The Secret Broker: Life in the very British Upstairs, Downstairs

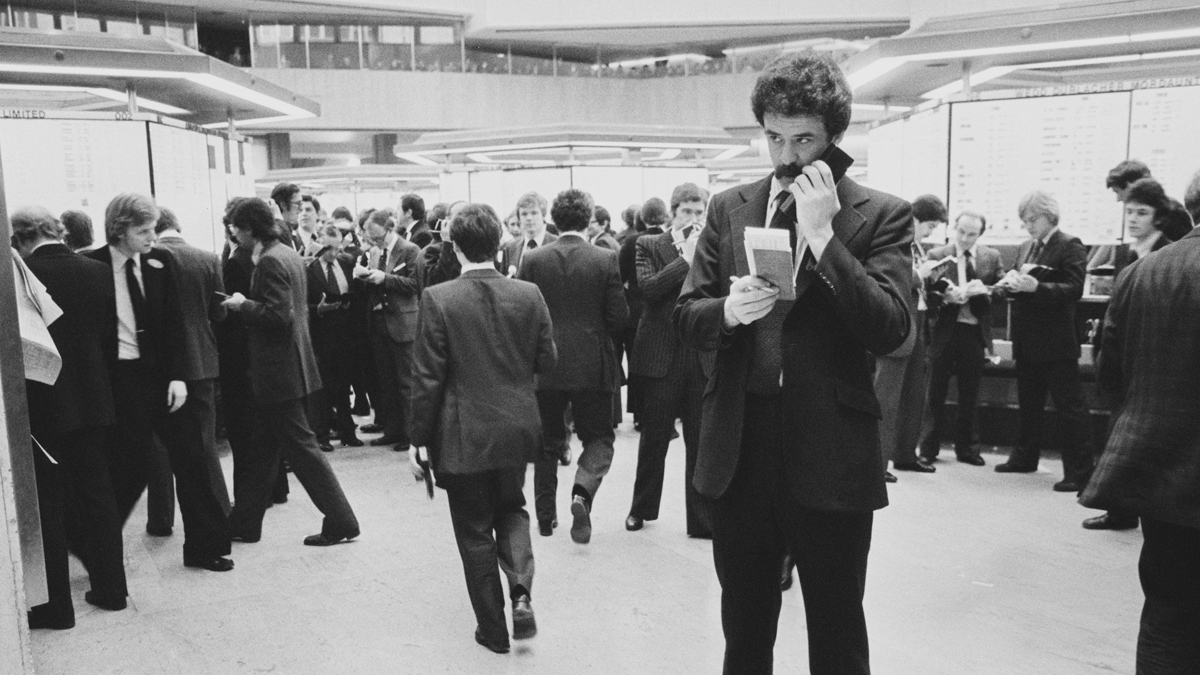

Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

I was watching a show the other day and they had one of those old fashioned ‘Clock on, Clock off’ machines that were used in the ‘50s and ‘60s as a way of tracking your staff.

They were especially useful in mining, as you had a record of who was down the mine and who had made it back to the surface at the end of the day.

We never had anything as ‘blue collar crass’ as like that in broking. Our office hours were 9.30am to 5.30pm and we would write our name in a book when arriving at work.

At 9.30am on the dot, the office manager would come out of his office and draw a red line across the page.

At 11.00am, anyone who signed in below the red line, would be summoned in to explain why they were late.

Anyone without a good excuse would be docked a day’s pay and one luncheon voucher, which back then were worth 15 pence each.

The luncheon vouchers were a tax-free perk, which dated back to the 1950s, when 15 pence or 3 shillings would get you a 3 course meal.

(Ed: Here we go again…)

By the time I joined the workforce, it would get you half a cheese roll, though it was still seen as a ‘must have’ perk.

If you see Lyon’s tea on the supermarket shelves, you may not know that Lyon’s used to own a string of cafes where one luncheon voucher (in 1950) could get you that three-course meal, tax free.

They were known as ‘Lyon’s Corner Houses’ and at one point, J. Lyons and Co were the largest food company in Europe.

Back in the ’80s there were no apartments in the City, so everyone commuted in by train and in the British winters, the railway tracks were prone to becoming frozen in the freezing rain and snow.

Even though every year the British winters were predictable, somehow the railway staff would never seem to remember this.

Every year you would be standing on a train platform, freezing cold and listening to an announcement, ‘that due to frozen points, expect a 30 minute delay’.

You would pray that when you did eventually get to work, that there would also be a mass of names under the red line. If you were the only one, the manager would not believe you.

The reason that our hours were different to the usual 9-5 was because all transactions had to be settled by 3.00pm that day, so when you did come in the next day, there would be no settlements outstanding.

Back then, the 3.00pm till 5.30pm time slot was set aside for anything that was causing us lot in the back office any settlement problems.

We were not allowed to leave the office until the office manager had left, which could be later than 5.30pm if there was a settlement problem, or his wife was angry at him.

As soon as he left, there would be a mass scramble for the door.

A proper rush hour

We had one stickler of a manager who had the nickname of ‘Adolf’ as he had a moustache and no empathy or personality.

One winter’s day he left and then had to come back as he had forgotten his hat.

He was knocked over by the mass of bodies rushing to get to the pub and had to be picked up and dusted off, whilst someone fetched his hat.

The next day we were all docked a luncheon voucher.

So, if you can imagine a very large open planned office with about 100 desks in 20 rows of 5 each, then that was the backoffice.

The office manager had his own private office overlooking all of us and with the – back then – steretypically tasty Veronica as his secretary.

We were given a weekly pay packet at 3.00pm every Friday afternoon and it would include our luncheon vouchers and our wages in cash. One of Veronica’s jobs was to remove our docked luncheon vouchers out of our weekly pay packets.

She would also hand-deliver our Friday pay packets, weaving her way around the desks. Any male advances were shut down with a ‘I have a boyfriend, you know’.

The floor to the office was wooden and down one end there was a vending machine that dispensed coffee, tea or soup into a plastic cup. They all cost 2 pence each, all were disgusting.

If the senior partner should ever enter our office, we all had to stand up until he left.

Only happened to me once, when after a large City lunch, he appeared round the door, muttered something and then disappeared again. He had got the wrong floor and the wrong door!

No wait, this is leading to something

Upstairs the partners had carpet on their floor and would have a butler deliver their tea or coffee in the finest bone china cups to their desks.

They would come and go as they pleased and all were educated at the elite schools of Eton or Harrow. Not normal schools, like everyone downstairs.

Their pay packets would be handled by the local bank manager and directly deposited by him personally into their accounts.

When it came to bonus time we would get a share of the spoils. Our bonuses were calculated by the amount of personal tax the partners had to pay and in a good year, it could be an eye-watering amount.

It worked like this.

If the partners had a very good year, they would pay themselves gross and then work out their tax liabilities on the gross amount.

They would then all pool it together and instead of paying this amount to the taxman, it was shared out to us office workers downstairs.

It was divided out as a percentage of your yearly salary and paid just before Christmas.

Veronica, donning a Santa hat, would appear pushing the trolley specially designed to handle the load of all heavy cash-stuffed paypackets.

Because it was the ’80s, we all had mistletoe at the ready, so no surprise Veronica would race the trolley around the room at a speed that would have made Michael Schumacher very proud, thus avoiding any potential kissing incidents.

It dawned on me that if we had a good bonus, imagine what the partners were taking home.

We had 20 partners to about 100 back office clerks and all we got, for a bonus, was the tax element of their pay.

After a few years of observing all of this I decided I wanted to work upstairs and not downstairs.

And that’s what I did.

Up the greasy pole

I went from being a messenger to an office clerk, and when one of the lads was sacked from the trading floor, my boss put my name forward and I spent 3 months as a ‘blue button’ on the floor of the London Stock Exchange.

Being a ‘blue button’ (I had to wear a square blue button pinned to my jacket with my firm’s name on it) meant that I could only get prices and never deal directly.

You needed a ‘silver button’ for the firm to allow you to become a dealer.

I worked the floor in ‘equities’ for a month, and then in ‘gilts’ (Government issued bonds) for a month. Finally, my last month was spent in ‘overseas equities’, which included getting quotes in dual-listed stocks like BHP and RIO.

Some people had been on the floor all their working life, but I was more ambitious than that. I wanted to be on the phone to the floor.

Luckily for my ambitions, being a blue button gave me direct access to the partners. They would phone down and ask for a price and I would have to call them back, with the best price and in what size they could deal in.

One partner took a shine to me. One day, after I had given them their prices, I pointed out a certain weekly trade that they should take advantage of.

The partner listened to me and started to take advantage of my observations – and that’s why I only lasted three months on the floor.

Soon I was their assistant and got my seat upstairs, with the carpet and the bone china. I was only 20 years old and four years out of school.

A few years later, I found out that my trading floor ‘observation’ had made this partner enough money to upgrade their Rolls Royce to a better model than the firm’s senior partner. It made their ‘City Profile’ very envious when parked outside of their Mayfair-based Members Club.

Farewell to Old England forever

After five years of working for a partnership, I moved over to funds management and got a job trading Japanese shares and Japanese warrants. This job took me all over the world, including of course, Australia.

I moved to a ‘Family Office’ operation, where we would trade in global equities, equity options, futures, bonds and also options on many future contracts.

It was a manic time for me as we were trading around the world, 24/7, to make the family’s money work a lot harder for them. It was a private hedge fund, if you like.

When the trading floor in Australia closed down and became screen-based, I could see the advantages of having direct access to all those stocks and slowing down a bit.

The opportunity to become your own market maker was too great to miss.

So we moved over to Australia, mainly for the lifestyle but also for the opportunities that live screen trading would offer me.

No more freezing winters, same language (well, almost), drive the same side of the road, beaches to walk to, direct market access (so no middleman), top quality seafood and meat.

For a boy like me, coming from a cold and wet suburb of England, I’m grateful for every day I spend here.

Australia truly is the lucky country!

(Except for the pubs, the over-smoked bacon, the mullets, the dole bludgers, the shopping malls, the Sheilas, the Bruces, the snakes, the spiders, the pokies and of course, all of those winging POMs. They are everywhere.)

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.