The Secret Broker: Jagshemash! It’s Taxi time!

Tax-time doesn't always have to be a snooze-fest, if you do it the Secret Broker way. (Pic: Getty)

As I pen this article, we have just five more days till the end of this tax year.

Doesn’t time fly when you are having fun!

I have learnt to turn around the mental burden of filing the year-end tax return into something which is a much more joyous and grateful task.

Instead of gritting my teeth when I see how much money is going to leave my coffers, I think about all the good my money will help do.

Build roads, fund hospitals, keep vital medication affordable, fund schooling and also help those on a pension.

The part that goes towards paying the politicians’ wages is suppressed, and all watching of parliamentary debating is permanently banned in case those joyous and grateful thoughts are overwhelmed with evil thoughts of ropes, trap doors and bullets.

As they say, the only two things that are certain in your lifetime are death…and taxes.

Just try not to let the ‘tax bit’ lead to your ‘death bit’. I have avoided this happening (so far), by learning to stick to some simple and personally-created rules.

Rule number 1: Don’t pay more than you have to

Over the years, I’ve learnt the hard way (by ending up with a tax bill).

And when the time came to pay it, was like watching a massive tidal wave coming straight towards me.

You know those waves, where the surfer is towed out and rides them back in and you don’t know if they make it till the very end.

It was like that. I was that surfer and the taxman was that wave.

You see, I once got caught in a ‘sure thing’ that subsequently got suspended from trading. It tied up all my tax capital, as I was unable to sell the shares on the ASX.

I basically thought it would be a smartarse thing to do and make some quick money out of the tax mans’ pending money-grab (should that now be tax ‘persons’ in our new PC world?), before I had to finally release the funds to him/her/it.

Wrong thing to do, and never again.

So, if you do create yourself a tax liability by day trading or punting crypto on the side, always have your liability in cash, ready for D-Day.

This is my very first rule.

Though funnily enough, when I was living in the UK, you could have a legitimate bet with the taxperson when having a flutter on the gee-gee’s.

In those days, regulatory requirements stipulated a tax of 10%; it was either added on to your bet, or you could choose to have the 10% tax taken from your winnings.

I loved the way that they were happy to join in the fun with you and be part of the punt with you on race day.

It was like having a little man/person on your shoulder looking over you, watching as you placed your bet (or now ‘our bet’) with a wide boy Arfur Daley look-alike bookmaker (or ‘turf accountant’ as the posh people would like to refer to them as.)

Rule number 2: Don’t forget rule number 1

The other simple rule that I discovered is that all crystallised losses (that’s why it has the word ‘cry’ in it) can be carried forward into another tax year.

I discovered that if you have a holding that you like but your in-cost is now underwater, you can always sell it and buy it back in another account, if you think your buy-in timing was wrong.

This allows you to crystallise your loss in one account (whilst in tears) and then establish a new in-cost in the other account.

The mother-in-law’s discretionary account came in very handy for me a few times over the years.

Although this also meant that for me, Christmas would either be a frosty affair or an abundance of socks and jocks, mince pies and brandy — all depending on how the penny dreadful market was behaving that year.

However, the fun police over at the ATO have since put a stop to this old trick. “Wash sale trading” I believe they call it.

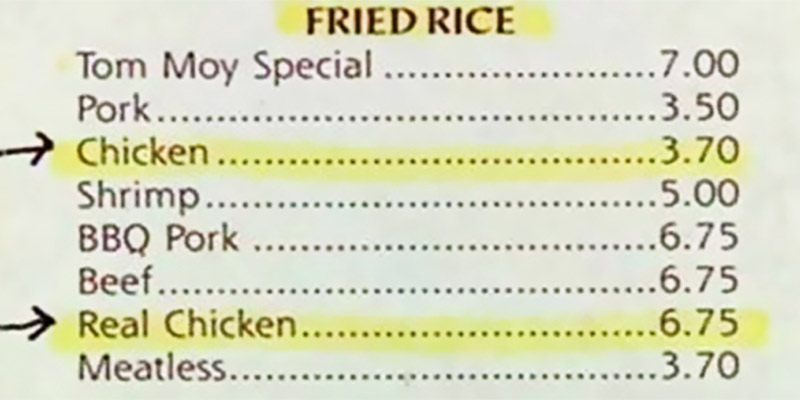

So if you do feel like a little year-end crystallisation is required on the old portfolio and you can’t stomach reading the 47 page ATO ruling, which is as close to plain English as a Chinese takeaway menu, then I suggest you dust off the black book and reach out to your accountant to ensure you haven’t fallen foul of the Commissioner.

So, just to recap:

Make sure you have cash ready and not equity holdings (ready to sell) to pay your liability, and don’t be afraid of crying and crystallising a position that is showing a loss, even if you would like to still hold it.

The Editor will now add a disclaimer to the end of this article because last year some busy-body emailed me and said he was sending my article to the ATO, as his accountant told him something to the contrary etc etc.

I told him that maybe he should change his accountant, and never heard another peep from him.

Over to you, Mr Editor.

(Ed: I’m on hols. You’re on your own.)

*Editor’s note. Oh, okay then. The Secret Broker is NOT a tax adviser and we recommend seeking advice from a professional tax advisor at all times prior to making any investment decisions.

The Secret Broker can be found on Twitter here or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.