The Secret Broker: Is this the card you picked?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

This week we saw a classic bit of masterly distraction 101 from the leader of the BNPL pack, AfterPay.

I have been sitting here all week, waiting for their half-year figures to come out, so I can study the market’s reaction to them. But alas, it was not to be – well, not immediately.

The stock, which had an IPO valuation of A$125m, is now worth A$32bn and the figures that were due out on Thursday, were an important part of their journey from humble valuation beginnings, to the growing kid that they are today.

When they did arrive on my screen, they were also attached with a request for a trading halt, as they wished to raise some capital and it may take a few days and that was that.

No share price reaction to analyse, so I spent all of Thursday bored, though mildly impressed with the market savviness of the board, which I would expect to see more from European listed companies, rather than an Australian one.

No trading price reaction to their half-year figures and now an exoctic convertible bond issue to raise A$1.25bn, which just so happens to be 10 times their original IPO valuation. What a trick!

Here is a slide from the presentation with some pretty % bar graphs:

See? Not too bad.

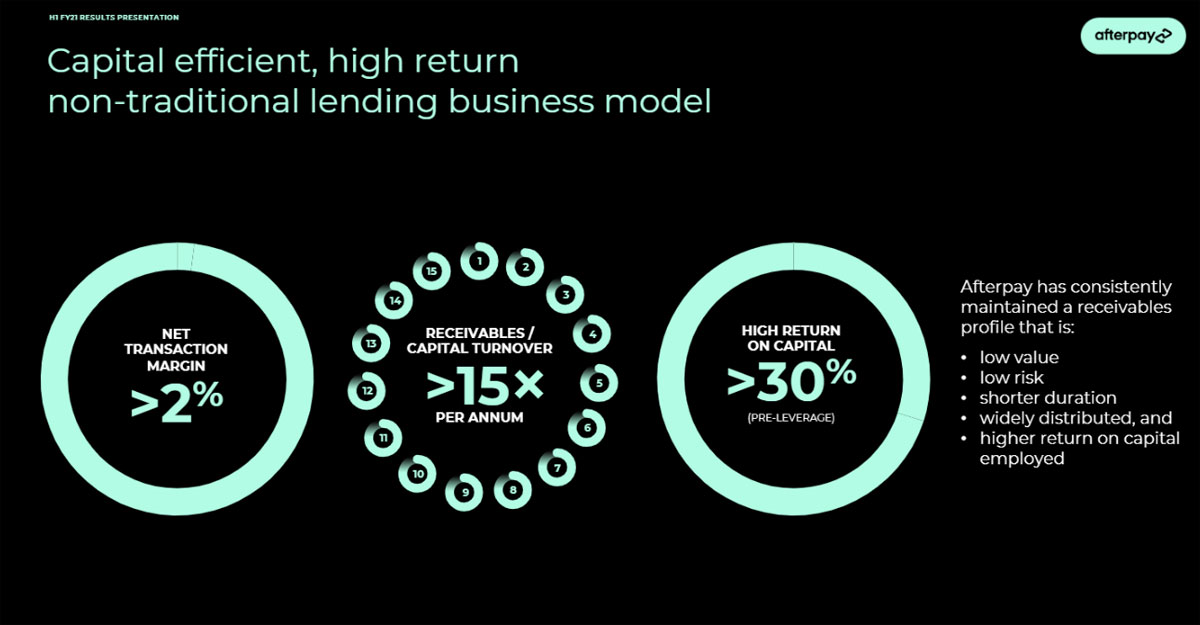

And then there is this slide:

This is the best slide from their presentation, as it captures the real jewel in their crown. It shows they get a 2% margin per transaction on an average turnover of 15 times a year, to give them a gross revenue on capital employed of 30%.

A casino makes the house 1.25% margins on turnover, which is why they used to have neat oxygen pumped into the air and no clocks allowed anywhere plus alcohol. They needed their customers to stay and keep playing and turning over their stake money.

All AfterPay have to do is attract the generation who are shunning credit cards but want everything now.

One of their tricks is to make out that you pay over four instalments, when in fact the first one is paid in the shop, so there are really only three instalments to go. This gives them that quicker turnover figure of 15 times. A casino would aim for 10 times.

When you take into account their turnover on a 2% margin and the fact that everything is transacted electronically, you can feel for the bankers and casino operators with their head in their hands saying “Why didn’t I think of this?”

Then, pre-market Friday. APT announced that the convertible note was so successful that it went to A$1.5bn and that the conversion price would be set the highest of the range, which comes in at a 45% premium to their last trade.

Dah-dah! Everyone is up on their feet applauding this bit of showmanship.

But there it was, sneaked into the end of the announcement – the fact the two founders were able to sell 450,000 shares each at that last price of A$134.36, “to help facilitate the Delta Placement”…

Bit of smoke, bit of twirling by the pretty assistant and in an instant they are able to sell A$121m worth of stock, which is just A$4m short of the original IPO valuation, whilst everyone was looking the other way.

None of this is mentioned in the presentation slides.

When we were advising companies on how to handle upcoming news, which they are legally obliged to announce to the world, a bit of magic circle distraction would not go astray, if they needed to distract the audience’s eyes away from centre stage.

So, when the stock does come back on, it falls from the level where the boys were able to sneak a few out, to A$120.48 or 11.2% down, which leaves the retail holders wondering where the belt holding up their trousers had disappeared to. Or why their wallet is missing and the headlines of a successful A$1.5bn raising and a 45% premium are everywhere.

This is a classic bit of smoke and mirrors (more David Copperfield, less Tommy Cooper) like a few other attempts that I have seen in my time, where they manage to stuff up the trick and lose the rabbit.

Spoon Spoon. Jar Jar.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.