The Secret Broker: Greek debt, Greek gods, bonds and crypto — what could possibly go wrong?

Enough to make a Greek statue shrivel. Picture: Getty Images

This has been a strange week in the land of finance, and most of the events taking place have left me reading articles opened-mouthed and in stunned silence.

Mrs Broker keeps popping her head around the study door, to make sure I am OK. She hasn’t seen me in such a state since I discovered that cousin Clive likes to wear women’s clothes…

Bond market banter

Firstly, we’ve seen Greek government debt trading at a lower yield than Italian government debt.

That’s right folks.

In the land where everyone’s surname rhymes with the word ‘Octopus’, they have managed to pull off a financial ‘Stephen Bradbury’ against the Italian bean-counters and skate straight past them into the sunset.

It was only back in May 2010, when the Greek government were bailed out by the IMF (International Monetary Fund) with a loan of €110bn at 5.5% for three years.

That caused the credit rating on Greek government bonds to fall to below ‘junk’ status due to the austerity measures attached to the loan, and there was social rioting in the streets.

Things got so bad over there the unemployment reached over 50%.

Everyone in Melbourne remembers being kept awake as their Greek neighbours wailed all night long over the amount of money their families back home were demanding, just to keep them on their all new (IMF-inspired) Mediterranean diet of a slice of bread and an olive a day.

And now, 11 years later, they are pumping!

So, what has caused the turnaround on Greek government debt, from junk-bond status to now returning a negative yield?

It’s the humble EFTPOS machine.

In an IMF post-mortem of the events that led to the Greece bail-out, they discovered that if the Greek government had collected all the taxes its citizens owed, then the loan would not have been needed.

This revelation led to the compulsory requirement that all businesses must install electronic devices for payments. No longer could proponents of the black (cash) economy get away with rorting the system and avoiding tax.

Initially, Greece had done what all governments do in a crisis and raised their tax rates. But this knee-jerk reaction always has the opposite effect, as it gives the avoiders a bigger incentive to keep avoiding.

Now, Greece collects taxes electronically, while the Italians still keep talking fast and waving their hands around.

Just ask the bond traders.

Crypto goes up…

Next up, we had the revelation that a managed fund that only invests in cryptocurrencies could top the Morningstar tables as the year’s best performing fund.

The aptly named ‘Apollo Capital Fund’ is up over 700% for the year and has assets under management of around A$100m.

As we all know, Apollo is a very important Greek god; the God of ‘oracles, healing, archery, music and arts, sunlight, knowledge, herds and flocks, and protection of the young’.

Where’s the fund based? Melbourne.

The biggest investor in the fund is the billionaire Alex Waislitz.

And where’s he based?

You guessed it. Melbourne.

This means that a fund that invests in crypto coins and blockchain platforms will outperform the other 9,000 funds that Morningstar monitors.

And it’s daylight to second place; the nearest fund behind Apollo has only returned 220% for the year.

Oh, and that’s a crypto fund as well but it’s based in Perth, so I can feel a call to the removalists coming on.

A move to Melbourne should add 100% or so to their returns, just by association.

The secret to Apollo’s success, according to them, is to have a spread of crypto stablecoins and investments in DeFi-related coins and platforms.

The largest stablecoin in the world is called Tether and it is pegged at one coin = one USD.

As Morningstar doesn’t close off the list till June 30, let’s hope that they have not invested in the next revelation that has stunned me and blown up some of those returns.

Brace yourselves.

…and crypto also goes down

The IRON Titanium Token Ticker: TITAN (yes, yet another Greek God) is the name of a complicated arrangement of crypto tokens and stablecoins. It’s controlled by an algorithm that took over a year of computer geeks (not Greeks) to create and make bullet-proof.

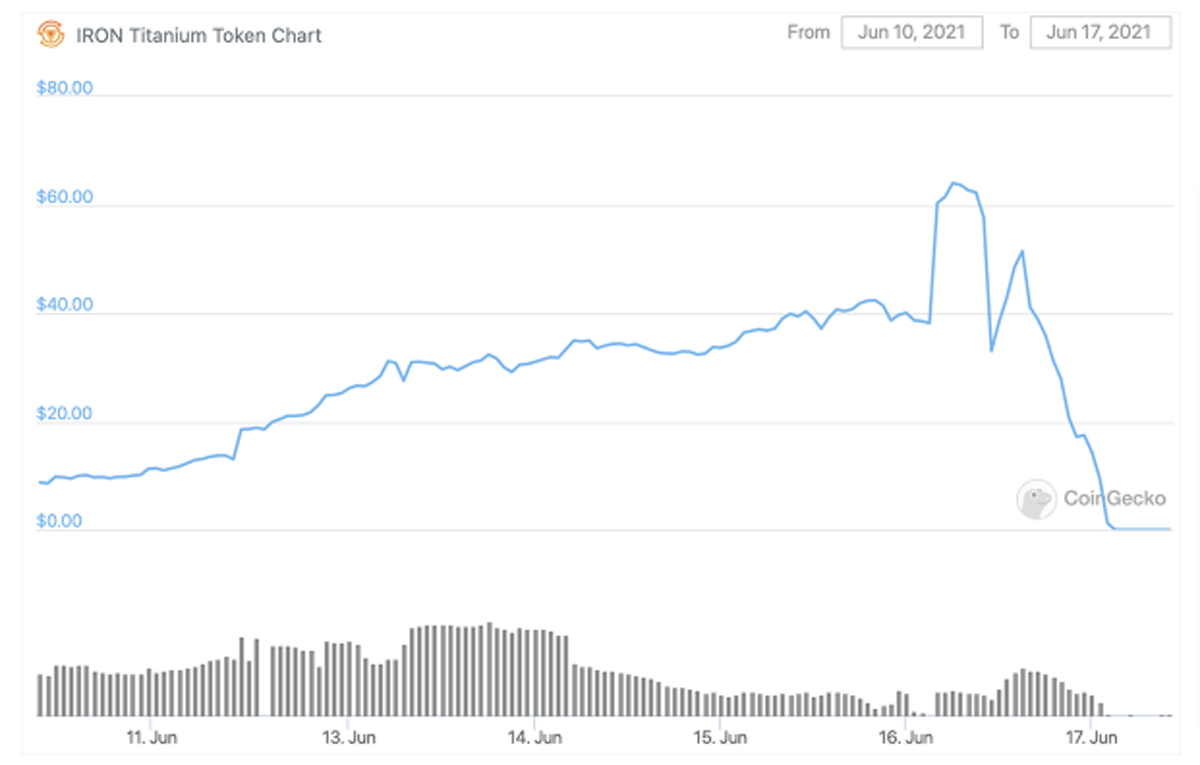

Well, it turns out that when you put geeks, Greeks and bullets together, the outcome is 100% opposite of what they intended to happen. Look:

In one day, the geeks managed to make US$2bn worth of stablecoins go from US$60 each to ZERO.

The guys behind the Titan stablecoin, Iron Finance, managed to shoot dead all their small-time holders by creating a stablecoin with an algorithmic flaw so big it’s valuation actually went to BELOW ZERO.

This is a monumental feat and as one of their backers stated:

“What happened is just the worst thing that could possibly happen considering their tokenomics.”

Tokenomics?

What the hell does that mean and why does that explain how they managed to destroy US$2bn worth of value in a mere 24 hours of trading?

Another billionaire goes belly-up

Tech entrepreneur and NBA basketball-team owner Mark Cuban was a big fan of Iron Finance and their Titan stablecoin.

So much so, that he let slip that he was their only major player. Or in crypto terms, he was their only genuine ‘whale’ involved in the financing part of their complicated lending/borrowing algorithm.

Whoops.

He tries to explain it here, on his blog. Read it before he gets it taken down, but know it will leave you so confused, there’s no wonder he just lost out big time — both financially and with his own reputation.

Via his own blog, Cuban let everyone know he was their only whale… and this led to some panic selling. When he tried to calm everyone down, the value of the coin collapsed to zero.

Here’s one of the worst explanations of what happened to Titan — caught on video — that I have ever seen. It will make you cringe.

Some of the reddit crowd were predicting this could happen two days ago and – yet again – they caught a so-called billionaire expert out with his own stupidity.

This is what Iron Finance released on Twitter after the event:

Iron Finance Post-Mortem 17 June 2021https://t.co/w084l7kzMK

— IRON Finance (@IronFinance) June 17, 2021

You couldn’t make this up if you tried.

Doff your six hats

Finally, I was saddened by the news that Edward de Bono had passed away.

He was Maltese (not Greek) and was known for the phrase ‘lateral thinking’, which was something I practised when I was broking by basically being a buyer when everyone was selling and selling when everyone was buying.

This does not work in crypto land, as Mark Cuban found out. My lateral thinking solution for him would be to drop the stablecoins and invest in stableshares, like CBA.

Since breaking through the $100 barrier on the June 2, they have added another 6% in value in 15 days, which is what he was boasting he could get in returns by just being a banker to Titan.

As for Mark Cuban — and on behalf of all your followers, Mark — all I can say is; I think I know where your cigar should go!

(Now that really is Lateral Thinking at its very best).

The Secret Broker can be found on Twitter here or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.