The Secret Broker: Given the options, I’ll take Bed Bath and Begone every time

Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

The kids introduced me to a new word this week, when I was asking one of them how their new relationship was going.

They told me that they were actually in a ‘situationship’ and not in a relationship.

When I asked them what they meant, they just rolled their eyes and said that I was too old to understand. So I just had to Google it, as I’m not too old to do that.

It would appear to be ‘a romantic or sexual relationship that is not considered to be formal or established’.

So one up from a ‘friend with benefits’ it would appear to me, though it got me thinking. Neither side wants to use that ‘C’ word.

Commitment.

No one wants to commit.

In my book you can come up with new words and terms but at the end of the day everyone wants the same result, whether you are alive this week or you were alive 200 years ago.

They want to find love and even with all these new dating sites and easier ways of communicating, they are finding it harder and harder to get the result they seek.

It’s the same in today’s markets. They all want to make money but aren’t committed enough to put in the hard yards

All these new investors can now get all the information they need on their phones via the latest apps, but very few are getting what they seek.

Hot Tinderhood

If you are new to investing and go to a stock market forum to get ideas, then you may as well as think of it as Tinder for Stocks. Swipe left for ones you are not attracted to or swipe right for the ones which you are.

“Mmm… lithium, mmm… only 20c. Oh they’ve been as high as $1.00, think I’ll swipe right for this little hottie.”

“Mmm… boring old bank, mmm… $90.00 a share and they were once $107.00 a share and they pay a dividend. Er yuck! Swipe left.”

Now, imagine if the guys running a popular stock market forum actually turned off the ‘most discussed’ button and just kept that knowledge to themselves.

Only they would be able to see which ones were being discussed the most and buy them on the way up. Then sell them as the discussion slipped down the ‘top 10 most discussed’ as everyone started to show a loss of interest, moving onto the next ‘hottie’ stock to start dating.

Well, that’s what broking used to be like in the old days. You needed a broker to get a quote from the floor and only that broker could see the order flows from their clients. Very handy when a few clients had the inside running and you could piggy off the back of them.

Then when the floors closed and everything went screen-based, you lost some of your unique knowledge as everyone now had the same level playing field.

Fast forward to today and you can now put your own orders on, directly into the queue and even see where you are in the queue.

No need to even speak to anyone. Just aim and fire.

All this knowledge is at everyone’s fingertips and yet they still lose money by only buying on the way up from fear of missing out (FOMO) and then panic selling at the bottom.

I shall now call this relationship between an investor and their investing apps as being in a ‘stockuationship’, with one side definitely not interested in showing any desire to commit.

There’s power in old farts

Why would a newbie investor want to commit to doing any homework, when they have everything at their fingertips?

Do these young kids today really think everyone tells the truth on a dating app or doesn’t show a highly touched up photo in their profile? Do they ever think that someone spruiking a stock on a forum is actually a seller and two timing them?

No, of course they don’t. They think they have the power over us older grey haired players, when in fact they don’t.

A prime example is in America, where the option trading volume has gone through the roof and billions (and I mean billions) of dollars have been shifting from the phone-app traders, to the old, grey-haired trading farts.

Millions of players all going one way and with only a concentrated handful of trading houses going the other way.

One side is using forums like Reddit to get their ‘trading edge’. The other side is just using good old-fashioned knowledge.

In February 2022, option trading on the main US equity derivatives market hit record levels on two consecutive days, exceeding 63 million contracts on both occasions. That’s the equivalent of trading 6.3 billion shares in just one day.

The average daily volume in January 2022 was 44.9m contracts, compared with 39.4m in 2021.

The other side thinks that buying 10 short-term US$225 call options at 12c is very cheap, when the stock is trading at US$200. Paying US$120 for the rights over US$225,000 worth of stock is to them, just like buying a lottery ticket.

I see an almost 100% guaranteed US$120 profit for me; all they see is the potential to make thousands over the next two weeks, which is certainly not guaranteed.

As 90% of all the options created over listed equity expire worthless, (whether in America or in Australia, the exact same stats apply), you clearly want to be on the side that creates and sells all of these options to the crowd.

Once you sell them, you stay short of them till they expire worthless and disappear (forever) and give you that US$120 to keep (forever).

The good old days – actually good

Unfortunately for me, I no longer have the energy to set everything up and take advantage of these non-committal newbie traders, though in the past I certainly did. I was committed with a capital ‘C’.

Before all of these newbie Robinhood traders arrived on the scene and way before Bitcoin ever appeared, currency markets were being spruiked as the way to make easy money.

Online courses were being sold to the masses and I was all set up to sell options to them and hold on until expiry.

Every night in America, I would offer out call options that had three weeks till they expired, collect the money and pay the margin and hold on till their death.

However, these were not ordinary options. These were options over the futures market price of the currency.

It would work like this.

- Spot market currency price 110 to 111

- Three-month forward futures price 112 to 113

- 115 call option price with three weeks till expiry 10c to 12c.

So I would put on some options to sell at 12c and the margin would cost me 30% of my account balance. The other 70% of my capital would be my margin buffer.

When they expired worthless three weeks later, I would get all of that margin back plus my 12c per option sold.

This is how crazy things became, with me on one side and 100,000 on the other side.

Once, on the very last day of their life, these options went from 1c to 12c and then back down to 1c and then expired at 0c and on very big volume.

Spot currency was 110, futures price was 112 which meant that the spot currency exchange rate needed to ‘pop’ to 115 in a day, for the person who paid me 12c for that option.

Seeing as this was the Euro to USD currency price, the odds of that happening would be like 10bn to 1.

Come in spinner! Come in spinners!

Bed Bath and Begone

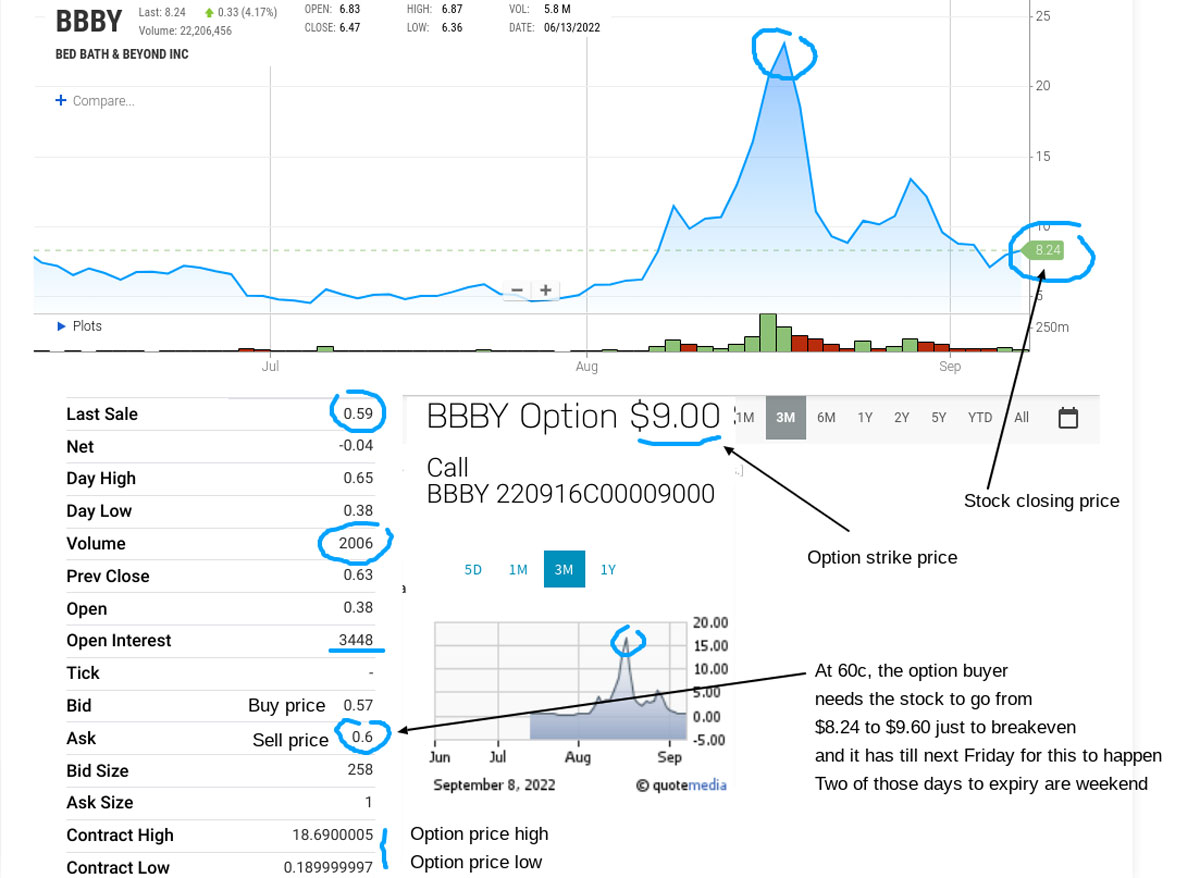

Currently, the big stock of interest option trading warriors is Bath Bed and Beyond (USA Ticker: BBBY) and one I would definitely be trading options in if I was a younger me.

Selling US$9.00 calls at 60c each with seven days till expiry of which two days are a weekend of no trading? These are the type of odds that really get my attention.

The buyer of those options needs the stock to go from its current price of US$8.24 to US$9.60 (US$9.00 call option plus 60c premium paid) just to break even.

Yesterday over 2000 option contracts changed hands between 35c and 65c and last, 60c. From memory each option gives the holder the right over 100 shares.

Have a look at this:

So, I would be fully committed to making sure everything was much more in my favour than the 100,000 other punters, as that is how I think.

Sink or swim? How about survive?

I send boat-owning mates mad, as the first thing I do when I get on their boat is not head to the back deck for champagne. No, I demand to see how many lifejackets they have on board.

If there are not enough life jackets to cover the amount of people on board I simply step back off the boat. This way, I have greatly hedged the odds of me dying at sea and I always note that none of the young people ever follow me and get off.

And that’s how I like it.

I zig when others zag and zag when others zig, especially when I’m trading options and shares. So should you.

Just remember – you don’t want to be fighting over lifejackets as the ship is going down.

You want to be sitting in a beach chair watching, in a ‘situationship’ with a bottle of Bolly. And with your head definitely above water!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.