The Secret Broker: Eat, sleep, buy cheap, repeat

Image: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

There is an art to buying and selling, whether it be shares, bonds or property.

There will be a million or so people who wished they had sold their house at the top of the market and there will be another half a million who wished they hadn’t bought at the top.

The same goes for shares, but with shares the timing has to be a lot sharper and a lot faster.

Bonds are a bit more scientific and houses have too much emotion attached to them for my liking.

We used to laugh at the clients who wouldn’t buy a falling share but would phone up and want to buy it after it recovered.

Why laughing? Because we would now be selling them just as they wanted to buy them.

There’s an art to buying into a falling share price, where the fundamentals have not changed, and it’s one that requires you to play a trick on your own mind.

You have to convince your brain that it is not buying into what the market says is a disaster of a company. You are buying it ‘at a cheaper valuation than the day before’.

If it’s a good company, at some point it will find a level to settle at and recover.

We’ve had situations where a very good small cap miner was falling even though its outlook was very promising.

I had one instance where my mate’s funds were buying as many as we could hoover up, even as they fell 20% over a matter of 10 days.

‘Why were they falling if it was such a good company?’ I hear you ask.

Well, their largest holder had got divorced (very messy – caught with her sister) and his scorned ex-wife was selling them down. The harder she sold them and the more they fell, the happier she felt.

Then one day she had no more stock to sell and over the next few days it settled down and then slowly recovered the 20% it had lost. The recovery took 30 days.

When I lunch with that mate I never ever have to put my hand in my pocket – and the lunches can get very messy.

Same company. Same fundamentals. Just an emotional seller knocking the price.

The art of buying and selling

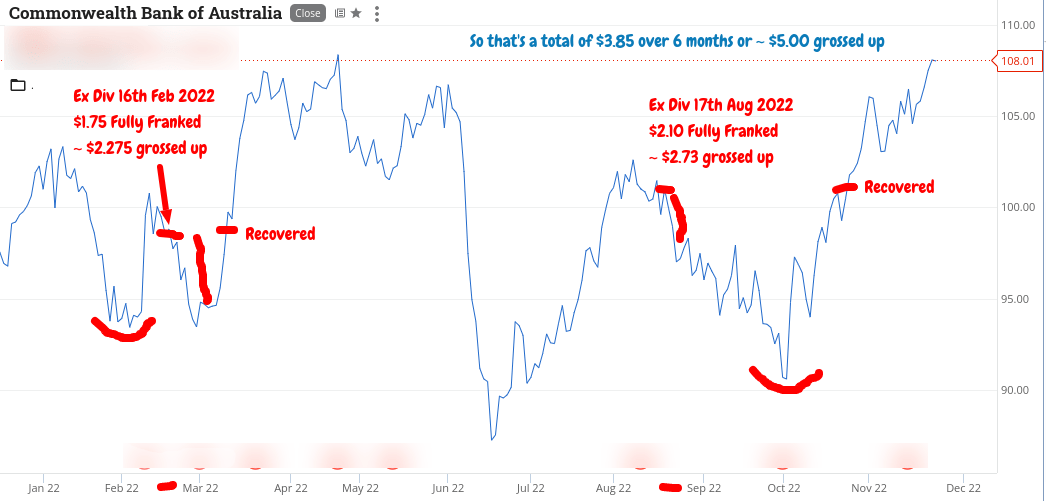

If you take one of the banks or major miners, when they go ex-dividend, their shares are marked down accordingly. No emotion. Just market anomalies.

Same company. Same fundamentals but now at a cheaper price.

They tend to recover from their mark down as they will deliver yet another dividend in six months time.

As you will see from the above chart, at some point the CBA’s dividend (ATM machine) spits out another dividend every six months. Just close out the emotional ups and downs in your mind and await your divvie cheque in the post.

Unlike houses, you don’t pay any stamp duty on shares, you don’t need to find a tenant, insure it against flooding, pay council rates or cut the lawn.

Are you hearing me? Nothing to do but just toodle down to your bank and cash in a cheque.

In case you were ever wondering why I and your Grandad love our shares so much!

Unbreakable bonds?

Now, with government bonds, their interest rate is calculated daily in their price. So if you buy some and sell them three months later, you get the selling price plus three months interest added on top.

This means that if you are holding a semi coupon bond (pays out every six months) you never get a price fall like when a share goes ex dividend.

If you hold them to maturity you get paid all your money back at par (100c in the dollar value held).

As at this morning, these are the rates that Australian government bonds are yielding.

If you look at the 30-year bond, they yield 3.9% till maturity at their price of $63.23.

This means that if you invested $63,230 in them, you are actually buying a bond face value of $100,000 on a yield of 1.75%. So that’s $1750 a year (on $63,230, don’t forget – not $100,000) and if held to maturity on the 21st June 2051 you will get the full $100,000 from the government paid out to you.

Total: $152,500. And in the UK, you can get bonds that pay out a fixed rate plus inflation.

Considering that this 30-year bond was issued at par and is now trading at 63.23c in the dollar you might be thinking ‘Who on earth would have paid par to get a 1.75% return fixed till 2051?’

The answer to that question is international insurance and pension companies. And that is why in the UK, their recent bond meltdown caused some bonds issued at par to fall sharply.

In one day, some fell to 35p in the £ and then recovered to 85p in the £ as the Bank of England stepped in to support them.

This is what caused all of that volatility, which should never, ever have happened in the pricing market of government bonds.

It truly was a ‘Black Swan’ event.

However, as these are long term government bonds that pay out at par, the manager who bought them at par will be long retired before they mature and in his mind he will never have lost any of his funds capital.

Now, if you take the 3-year bond, you need to invest $103,013 to get a face value of $100,000, which you will get back (only $100,000 that is) in 2026.

You get a coupon of 4.25% on the $100,000 but lose $3,013 in value over that period and that’s why they show a yield of 3.27%, as it includes that loss of $3,013 in capital.

The 3.27% yield shown is calculated till maturity and all-inclusive (how woke is that!).

Knowing when to invest in bonds obviously depends on the underlying official interest rate and it’s quite easy to pick the right time, as you just need to wait for the official interest rate to turn the corner.

Sh..ting bricks?

As for house prices, it all becomes too emotional.

Australians have an obsession over housing, however people are always getting divorced or dying so there is always a supply.

Auctions were originally meant for deceased estates as no one could ever argue over the valuation you get at auction.

If one of the estate’s beneficiaries complains about the sale price being too low, they always could have bid for it themself.

Now, auctions are just a show for an over-inflated real estate agent ego. They would never invest in shares, as they are too simple for that!

The question is, when is a right time to buy the property dip?

My gut tells me on a cold winter’s day in 2023, when everyone is weather depressed, as well as financially depressed. Just need to rug up and make sure your bidding hand is well gloved up, though it shouldn’t get too cold.

Who knows? 2023 could be the old CBA-to-property switch year. That is, if you have managed to get your mind reset.

Zig when others zag, as my wise old shareholding Grandad would say.

Otherwise you’ll be buying my CBA shares at the top, just as I’m buying your house at the bottom.

Ha!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.