The Secret Broker: Don’t worry about the elephant in the room, what about the panda!

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Just when you thought the Greensill/Gupta $10bn blow-up would be impossible to beat in 2021, along comes Bill Hwang, who managed to trigger the largest ever margin default in history.

Here is a picture of Bill, looking a bit like a smugh b..tard, I thought:

He has been convicted of insider trading and was, up until a few years ago, banned from being a client of all the major US broking firms because of his conviction.

All of this changed when his commission cheques to the brokers (the ones that still took him on regardless) became the size of a novelty lottery winner’s cheque, and compliance officer warnings were overridden by the greedy desk managers.

History is a bit vague on how Bill, having started with $100m, managed to amass $10bn in funds and then leverage it up by between five and seven times.

Registering himself as a ‘Family Office’ rather than a manager of funds gave him a bit of leeway, as the disclosure rules are different. He could accumulate 10% of a company and not have to declare to disclose.

This meant he could travel under the radar a bit, until he finally ran out of enough money to meet his leveraged up margin calls.

Now, being unable to meet a margin call can be one of the worst feelings that a financial oriented genius could ever endure. It’s up there with that gut-wrenching feeling you get when you’ve been wined and dined with a no-expense-spared $500 lunch for two and your entertainee’s credit card bounces. You not only have to pay for yourself but for him as well. Ain’t that right, David Burt?

It mentally scars you.

However, if you are able to see the funny side, it lightens up the atmosphere. So even after I was reading about the shocking betrayal that Bill has inflicted on Goldmans and Debit Suisse, Mrs Broker could hear me laughing from my study.

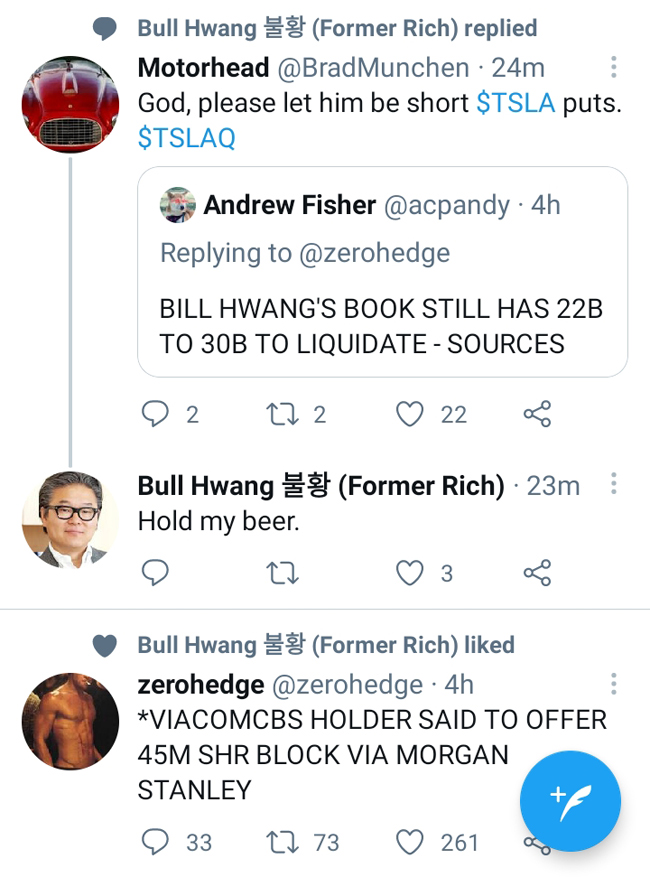

People began to pile on Bill big time. Someone set up a parody account on Twitter and the tweets were just brilliant. This was my favourite:

And then someone took a screenshot of Debit Suisses share price, which was down 16% because of their exposure, and added the Evergreen ship being dislodged.

Was the margin call ripple that helped do it, they asked.

The OG Hwang

I was sitting at my desk in London, in 1991, when rumors that Robert Maxwell had committed suicide were confirmed after he could not meet a margin call.

He was a very fat and grotesque human being, who stepped off the back of his luxury yacht after he was margined out.

The phone rang and it was Goldman Sachs ringing to tell me not to worry as the Japanese had launched a fleet of whalers to recover his body.

Death isn’t funny, apparently. But we all laughed at that, as he died with over 200 open litigation cases he was bringing against anyone he didn’t like. And he was famous for sacking one particular employee on the spot, out of sheer anger.

The story goes that his office lift was broken, so Maxwell had to waddle down the backstairs. He came across a young bloke, smoking and leaning against the bannisters, and this enraged him so much that he pulled out £1,000 in cash and sacked him on the spot.

It turned out that the guy was a courier waiting to pick up a parcel and never actually worked for Maxwell.

If you do use margin accounts for shares, then you need to use them sensibly. I have seen many a person get blown up very quickly, so I avoid them myself. If someone insisted on using one, we would set them up and wait for a major fall, before activating them.

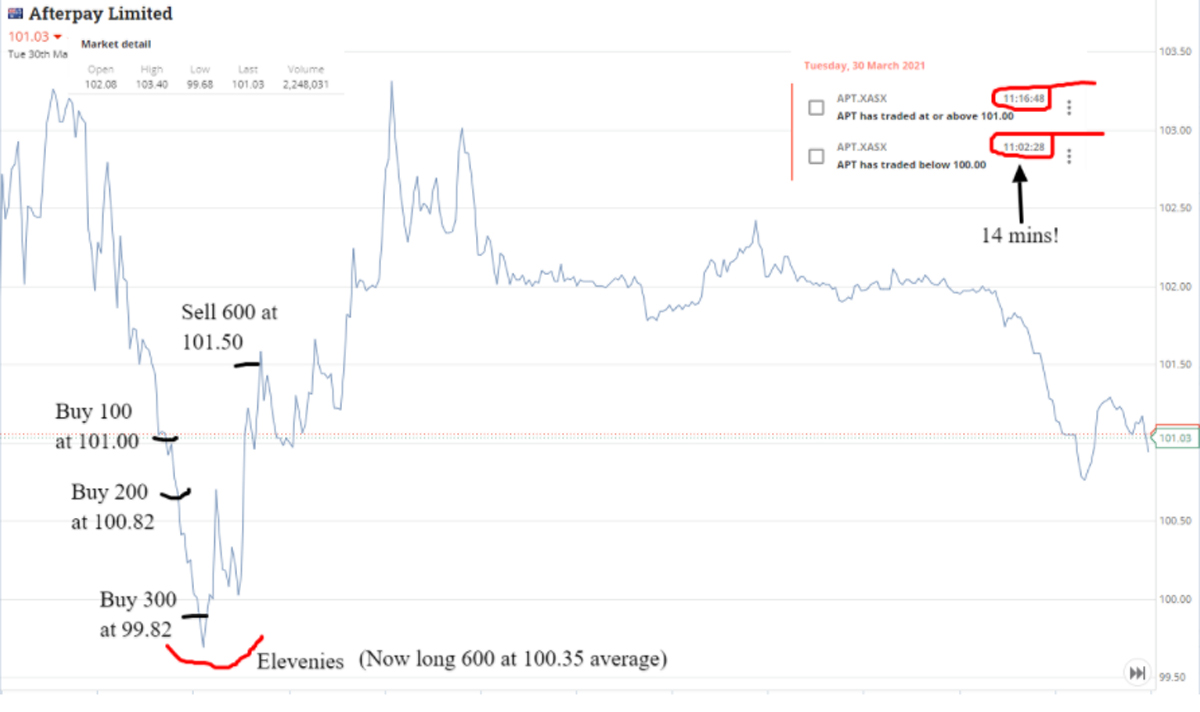

If you follow Bottom Picker, who writes a weekly column for Stockhead on daytrading, he points out that the Australian 11am margin cut-off point sometimes triggers a big rally intra-day:

Now imagine, if you could only ever margin Cadbury Creme eggs. Then you would only manage to blow up your waistline and not the bank account.

Happy hunting!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.