The Secret Broker: Did Robinhood ring a bell, or the market not give a Friar Tuck?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Well, overnight, the company Robinhood had its IPO.

It issued 55m shares at $38 each, to raise $2.09bn under the ticker of HOOD.

What’s so interesting with this IPO is it’s managed to break a few of the ‘Gentlemen’s Rules’ of Wall Street and hit some traditional broking houses directly below the belt.

Robinhood’s main punch, landing straight between their ‘Buys and Sells’, was to offer retail investors 35% of the allocation, instead of the traditional 10% to 20%.

That’s $70m in lost fees, which is enough to bring even the fittest broker to their knees on the canvas.

This also means that the institutions are left out on their usual allocations, leaving them in a bit of a quandary and slightly on the ropes.

Should they enter the ring on day one and buy or should they wait in the dressing room for a day or two before climbing into the ring?

To add more pain to this decision, the whole 35% is reserved for Robinhood’s retail clients only.

These are the collection of clients who have literally managed to steal from the rich (hedge funds) and give to the poor (young newbie investors); namely, themselves.

That’s why Robinhood is such a great name for this company.

Many a Maid Marian and a Friar Tuck have managed to steer some wealth away from the evil ‘Sheriffs of Nottingham’ hedge funds and back towards the people.

From a client base of 500,000 customers in 2015, it grew to 18m in 2020. Revenue also rose from $2.9m to $959m.

The average Robinhood account balance is $3,500, so that’s $70bn on which it pays zero interest.

These are truly spectacular figures and its valuation has risen to match those figures. It has gone from $12bn 12 months ago, to $35bn today, based on $38 a share.

The average age of an account holder was 26 years old in 2015 and is now 31 years old. So Robinhood’s client base is growing older with them.

By offering zero brokerage rates and no minimum purchase, they have maintained and grown a very loyal base of merry men and women.

If you are a client of Robinhood, you can go into the hat for IPO allocations and their own IPO was no exception.

It randomly choose clients for allocations and in this case they are free to sell their allocation on day one. But if they do, they are banned from receiving any new IPO stocks for two months.

If they hold for 30 days though, there is no punishment.

Take the shot

Waiting to see how the stock is going to perform on its first day of listing is like standing with an apple on your head with your back to the tree. Will Robin split the apple or split your forehead?

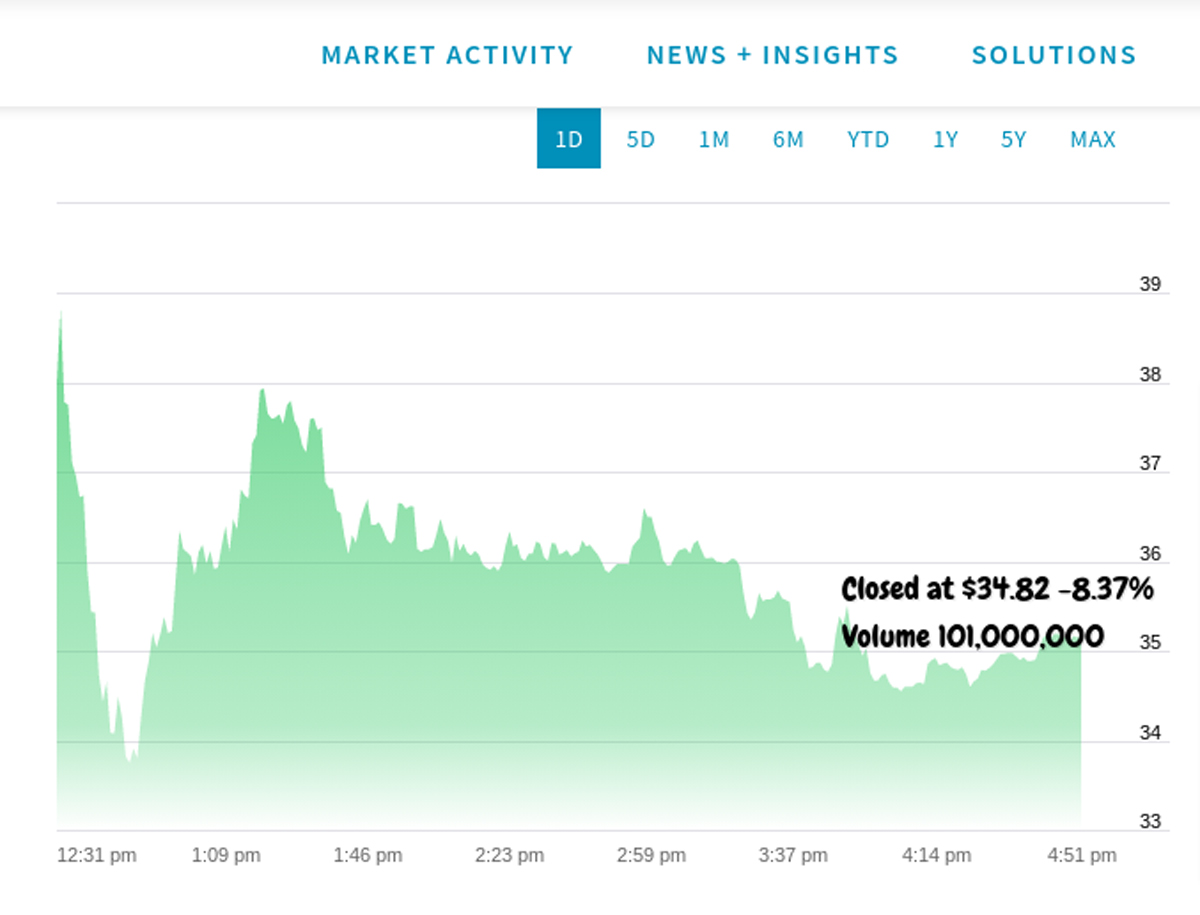

Well, the arrow started off straight enough on the opening, as the stock briefly touched $40… but then it got a bit blown off course.

So far off course in fact, that not only did it miss the apple and the forehead, it completely missed the tree and sailed off into the sunset.

And just like a drunken groom on his wedding night, the most anticipated night float of the year was a flop. The stock finished the night down $3.18 to $34.82 or an 8% droop.

Their volume was good at 101,000,000 considering the free float was only 55m shares, but the result was not.

Now, having seen the listing of a broker that is responsible for some of the market froth over the past few years and to watch it flop on the same day that Wall Street closed at an all time high, some would say that this has rung the bell on the market.

We shall have to wait and see, along with its 20m disappointed customers, to find out if this is the case or not.

At least the apple survived.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.