The Secret Broker: Cheats never prosper. Unless they don’t get caught. Or have a good lawyer, or…

Picture: Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

We had a real good laugh this week, me and Mrs B, when a snippet on TV showed two fishermen getting caught out cheating.

After they had won the weighing competition, their fish were cut open to reveal that they had stuffed their winning specimens with lead sinkers.

They had won the comp three years in a row and this year were set to pocket about US$30,000 when their not-so-cunning plan came unstuck.

Apparently cheating in competitive fishing is more common than many people think.

If only they had stuffed them with ice, thus adding heft during the weigh-in, then they may have escaped being caught out, as the ice would then melt and leave no trace of any cheating.

I suppose we were laughing more at their amateur effort, as getting caught doing that in redneck country probably means that they never made it home. It certainly felt that way:

Serious Controversy in Pro fishing tournament as multiple-time winners caught stuffing lead weights and other fish filets in their fish to have the heaviest catch to win hundreds of thousands in prizes. pic.twitter.com/Sxqeo2XC0K

— Billy 🏈 (@Billyhottakes) October 1, 2022

Bit like the time a bank robber handed over his demands, which he had thoughtfully written on the back of an envelope, which of course had his name and address on the other side.

When the police turned up at his place, he was having a cup of tea and counting out his ill-gotten money.

Then this week we also had a young chap, Hans Niemann, accused of cheating in professional chess competitions to get one over his more brainy competitors, such as the world No 1 Magnus Carlsen.

One theory goes he was wired with a device up his trouser leg, that vibrated what his next move should be, from a mate who was duplicating the game moves on a computer. A far more entertaining theory promoted by Elon Musk involves a form of “internal vibration”.

Niemann is the fastest rising top player in classical, over-the-board chess in modern recorded history. The rate of his rise is apparently ‘statistically extraordinary’ in the chess world.

My other observations I made to Mrs B, as we were watching all of this is that, in my financial world, they don’t call it cheating. They call it “insider trading”.

Insider trading is where someone acts on information that only a few have knowledge on. How you then go about cheating the person/s on the other side of your trading becomes a bit of a grey area to get policed.

Rene Rivkin got caught out by buying 50,000 QANTAS shares, after a man ‘in the know’ came around to buy his house. When Rivkin questioned him on how he could afford to buy his house, he revealed to Rivkin that he had just sold his rival airline to QANTAS, but this was not yet public knowledge.

He had made Rivkin an ‘insider’ and Rivkin should have never acted on this information but he couldn’t help himself. He cheated the sellers of those 50,000 QANTAS shares who, if also had been given the same information, may have pulled their selling.

A few were in the know but the general market players weren’t.

Even Martha Stewart got herself a seat on the ‘insider trading wagon’, in between opening and closing her oven door.

When she was caught out and was thrown in jail for insider trading (and not cheating), her ‘Steel-Cut Oat Porridge’ won the ‘Best In House Prison Porridge’ comp’ for five months in a row. Ha!

She didn’t even need to cheat anyone to win that trophy.

Another grey area of right and wrong is the fine line between tax minimisation and tax evasion.

These grey tax areas have made the partners at the Big Four accounting firms very wealthy by wedging themselves between their clients and the taxman.

A prime example of this came out this week when Chevron lost its defence of using interest payments to minimise its Australian tax bill.

Chevron Funding Corporation in Delaware borrowed around US$2.5 billion at interest rates of between 1 and 2 per cent in 2003.

They then lent that money to Chevron Australia, at a rate of between 10.5 per cent and 8.8 per cent and thus got a bigger interest rate tax deduction than if Chevron Australia had gone direct to the source.

Other examples are Starbucks, which uses offshore low tax operations buy its coffee before passing it on at a higher price to its franchisees.

The list goes on. Specsavers’ head office is in Guernsey, where it pays zero tax on its global earnings. However, its tax situation comes about as that is where its founders were actually born.

More an act of luck rather than the generous act of a global tax partner, though this gives Specsavers a huge advantage over their rivals.

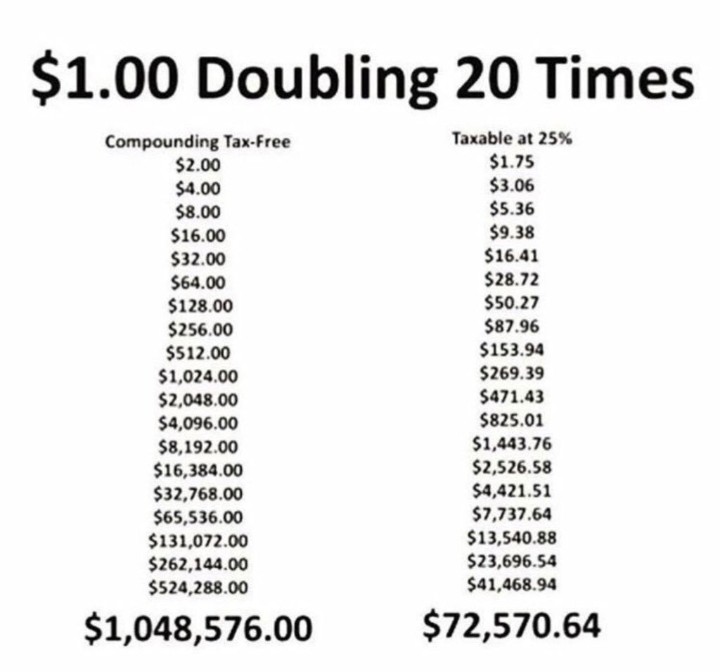

Here is a picture of $1.00 doubling 20 times, with one rate of zero tax and the other at a 25% tax rate.

Brace yourself!

Now I will leave you with this thought for the weekend.

Google, having managed to deal itself a leg-up on the “20 times, no tax paid” doubling ladder, now advertise on TV and sponsor sporting events, because it got pinged and has to pay tax on its Australia earnings.

These acts of kindness are, guess what?

Correct. Tax deductible items.

Have a great weekend,

TSB,

St.Andrews, Guernsey C.I.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.