The Secret Broker: Beer, Beatles and whole villages, all done the Aussie way

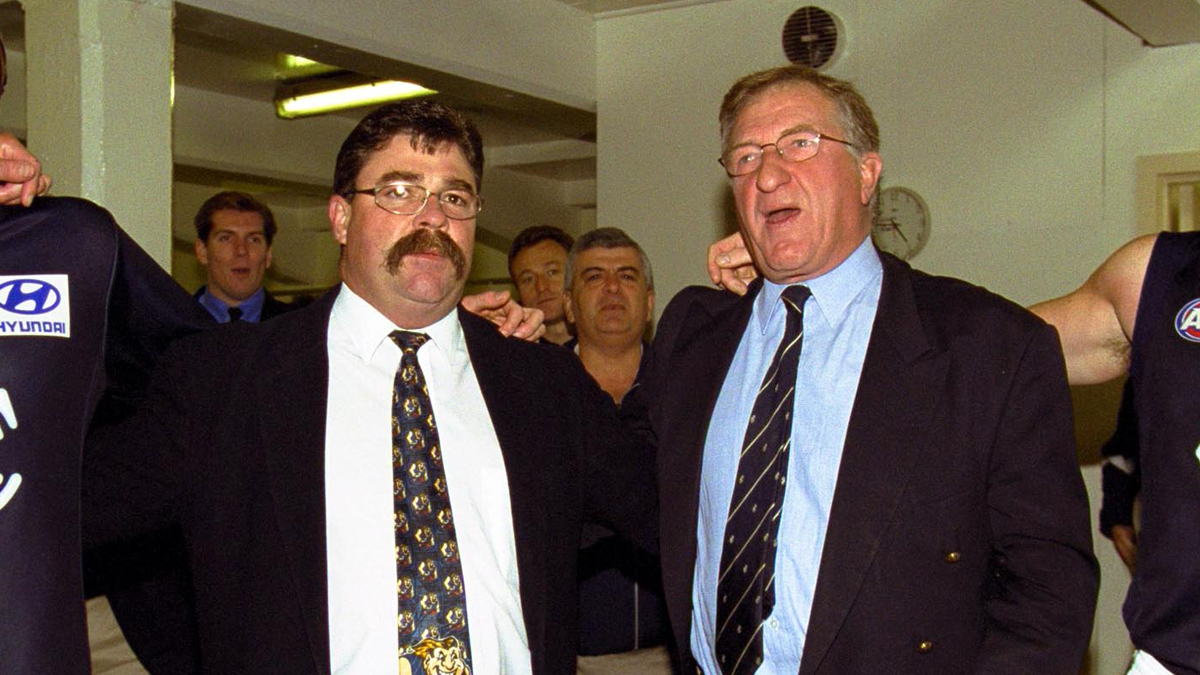

Now there's a couple to terrify any London pub. Picture: Getty Images.

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

I was reflecting on the passing of John Elliott last week and thinking he is probably the last of the Australian ‘larger than life’ characters to charm us UK ‘City Set’ before needing to retreat prompto back to Oz, when the corporate wheels on the Holden ute started to wobble.

The three main players who stood out for me were Michael Robert Hamilton Holmes à Court, John Dorman Elliott and of course, Alan Bond.

Just like the burning of the bra in the ’60s, in the ’80s we saw the burning of the Australian banking rules and regulations and the feeling of freedom of release from the previous ill fitting bank loan shackles.

This relaxation of credit inspired a flurry of Australian businessmen to follow in the footsteps of Barry McKenzie and drink Earls Court and the City of London pubs dry.

It used to be fun when they first arrived on the scene in London. They were paraded around by their Australian brokers and Fosters and XXXX beer would freely flow at lunchtime presentations, then spill over into the street and go long into the night.

They would Aussie charm everyone that they met, with their easygoing spirit and ‘she’ll be right mate’ attitude.

Everyone was called mate, which did not go down too well with the blue-blooded city gent set. But it was tolerated to a point, mainly because of the fees they would pay.

Well, that was until the crash of ‘87. All their empires started to crumble and the taps were turned off. The circus tent was packed up and sent home.

The stock market crash saw Wall Street fall by 25% in one day and take down with it the Australian business model of borrow and then borrow more.

Alan Bond went to jail, but not before yours truly shared his bathtub. John Elliott went bankrupt and Robert Holmes à Court died prematurely, after the stress brought on by Merrill Lynch.

He basically had managed to raise enough money to save himself via a bond issue that Merrills carried out for him.

However, after nine days of trading, they pulled the pin, cancelled the bond and gave all their clients their money back. This move financially ruined Holmes à Court’s empire and in turn, his health.

Hello, Goodbye

Even though they are mainly remembered for their falls, we should not forget some of their achievements, some of which were truly outstanding.

At one point Holmes à Court owned all the rights to the Beatles’ song catalogue. When he was once asked what his favourite song was, he said ‘Penny Lane’.

When asked why, he said: ‘Because I own the rights to it.”

He went on to sell those rights to Michael Jackson in 1985 for US$47.5m; today they are worth over US$1bn.

Bond managed to win the America’s Cup for Australia after 132 years of it being held by the Yanks.

In 1987, he purchased Vincent van Gogh’s renowned painting ‘Irises’ for $54 million, which at the time was the highest price ever paid for a single painting.

He also managed to buy a whole Cotswolds village in the UK, which also included 2000 acres of farming land. Though he never got the chance to do a ‘Clarkson’s Farm’ on it, he did end up with ‘Diddly Squat’, as he was forced to sell it for £8m in 1992. This year it changed hands for £120m.

And then we had Elliott arrive on the scene. He managed to ‘Fosterise’ the world, with the help of Paul Hogan.

In fact, Barry McKenzie, Dame Edna and Scott and Charlene’s marriage all pushed the Australian image along.

At one point Fosters Lager became the biggest Australian beer in the world and was sold in over 150 countries, though these days it’s rare to find it on tap in Oz.

Now, all the characters appear all gone, as the faceless hedge fund and private equity managers do all the bidding and asset stripping, whilst sipping Perrier water and eating organic tofu salads for lunch.

Even Chrispher Skase was a journalist who wrote about these characters before morphing into one, which I can’t ever see happening today Down Under.

He only blew up $1.5bn, before running away to Spain. Here is an article from 1994, which will warm the cockles of your heart and maybe bring a tear to your eye.

Now I’m off to rev up TSB Jnr and see if his craft home brewing venture can become global.

Who’s on for a pint of Crypto Moonshot IPA?

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.