The Secret Broker: Big Shot, or barrel full of nickel plated monkeys?

Pic: Getty

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

‘My old man’s drunker than a barrel full of monkeys and my old lady, she don’t care’ (Elton John) was the song that came into my head as I was reading about this week’s nickel market movements.

But instead of monkeys, it was a barrel full of traders. Nickel traders to be precise.

What with a war, COVID and floods this week has seen massive volatility, but nothing like how the price of nickel behaved and how the traders’ heads must have ended in a drunken night of open-mouthedness.

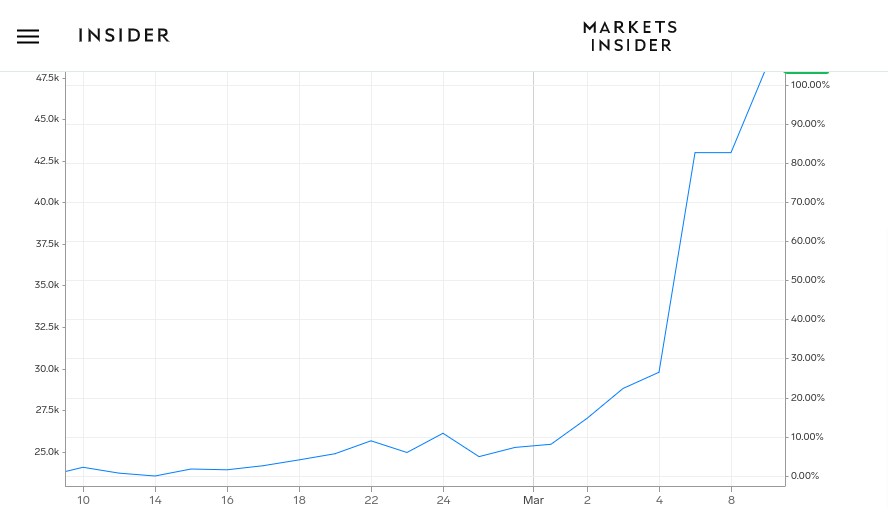

How is this for a chart of commodity madness?

Nickel surged to US$54,000 a tonne, which was way past its previous record price of US$51,800, which it reached way back in 2007.

That move equates to a 30 deviation point move in one day which has never been seen before (ie 30 times its average daily range for the past 20 years).

It ended the day at US$50,925, making it the largest single day gain for nickel in the London Metal Exchange’s (LME) history, at plus 76%.

It was one of the wildest sessions I have ever witnessed (at one point reaching US$100,000) and it all came about because of a massive short squeeze, as everyone tried to exit their positions, all at the same door at the same time.

Trading has actually been suspended by the LME as they have taken the unprecedented step of allowing a large shorter to put up a rumoured US$200m in margin.

The rumour is that they are short 100,000 tonnes of the stuff; however the shorter is actually a producer, so there is some comfort taken by this.

So how did it all end up like this?

Well, it’s normal for producers to sometimes sell forward and lock in prices, as they can then go about knowing what they are going to receive for their product.

If they are hedging their production and locking in an exchange rate by using the futures market, then they will have to put up some margin. Margin is normally in the form of cash and is calculated daily.

We have touched on the subject before and how the accountant and the bankers involved like to see a producer hedged if borrowings are involved, as it lessens any financial shocks.

However, it can also become a disaster and a death warrant if your production figures don’t match your future sales.

The Lalor brothers discovered this when their gold hedging strategy went from a profit of $74m to a loss of $1bn over a period of five years, when their production of gold failed because of technical problems.

It ended in a profitable gold mine being put into administration.

You had to be a Big Shot, didn’t you?

The late great Julian Baring, was the fund manager who never invested in gold companies that had hedged their production, as he wanted to be geared to their upside, whenever the gold price put in a rally.

For that reason, he was known around the City as Goldfinger.

However, the man on the wrong side of the nickel hedge is known as ‘Big Shot’.

Xiang Guangda or Big Shot, founded a company called Tsingshan (translation: ‘Green Mountain’) in China.

From humble beginnings he became a global player in the industrial sector across steel and nickel with production plants in India, Indonesia and Zimbabwe.

His paper losses are so far estimated to be US$8bn, so his Green Mountain has become a Brown Mountain and we are all now waiting to see what will happen next.

Trading is expected to start again next week, with a +/- 10% limit, so that margin calls can be deducted in an orderly manner.

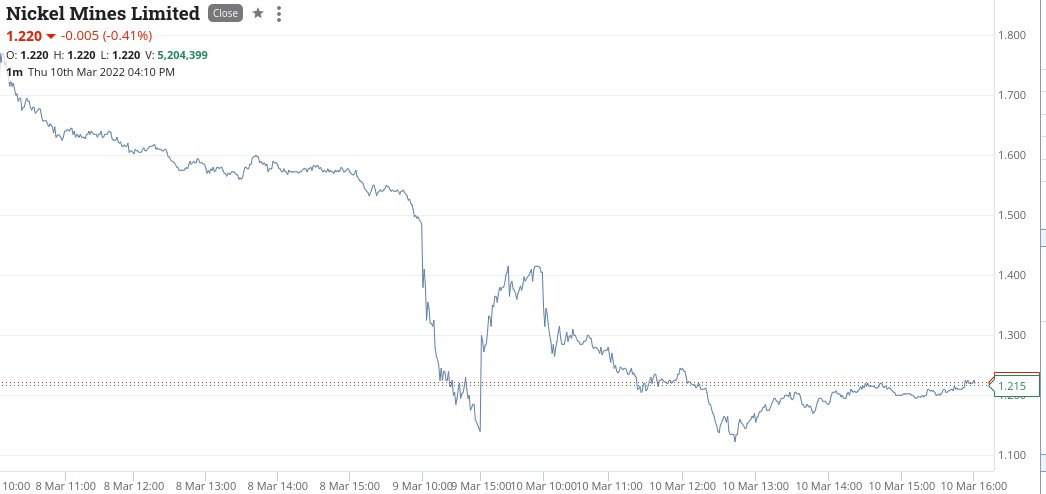

Now, you would think that if you were long of a nickel producer listed on the ASX, it would be champagne all round but in the case of Nickel Mines (ASX:NIC), it was tears all round.

As the nickel price went up, the shares went into freefall and had to be suspended by the ASX until NIC could tell the ASX why.

As it turns out, Big Shot is a very large holder of shares in the $3bn producer – and he may be a forced seller, which he has denied.

His holding is held via the aptly named Shanghai Decent Investment (Group) Co Ltd, which to me seems a very modest name when you are known as Big Shot.

And here is the current situation.

So, even if you picked the right commodity, found a well named listed producer and invested in their last fundraising at $1.37 per share, you still would have got it wrong.

Now, if you really want to go for the trifecta, then order a new Tesla, as on average it will contain 45kg of nickel.

Which all just goes to show that two three wrongs don’t make a right.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.