The Secret Broker: All good things must pass

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

I was very fond of Aunt Betty.

When the news of her passing popped up on my mobile phone, I thought the timing was rather ironic, as I was actually sitting on the throne at that time.

Everyone will be asking me in the next 20 years if I remember where I was when I heard the news of the Queen’s death and of course I will reply that “indeed one does”.

The one thing about the English class system is that everyone knows where they stand and royalty is right at the very top. Everything else just trickles down from there.

I definitely found this out in my broking career.

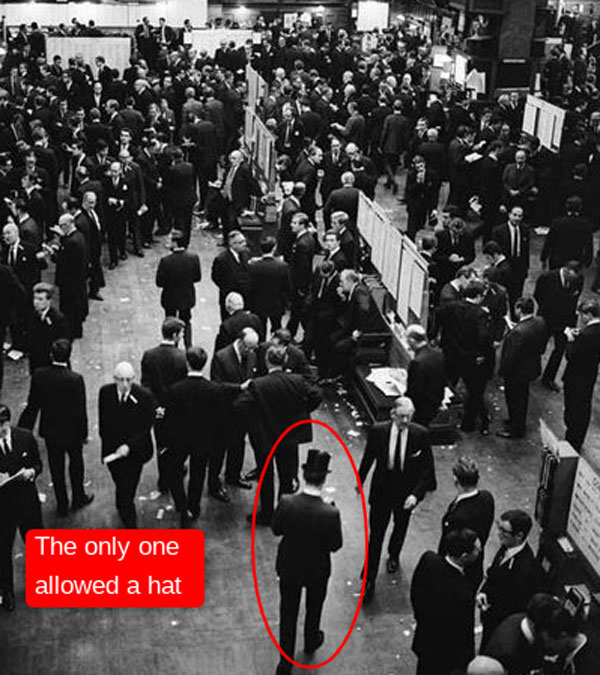

On the London floor of the exchange, the Eton-educated Broker to the Bank of England would be allowed to wear a big black top hat, so you could always spot him from any part of the floor:

No one else was allowed to wear a hat on the floor. Not even a bowler hat.

You really weren’t meant to approach him unless you were a senior partner of a broking house, though we did get into trouble once when Charlie Jenkins accidentally managed to knock it off his head with a wayward cricket shot.

This was definitely a moment that none of us will ever forget “where we were at the time”.

Hat-trick!

It was a quiet trading day and Christmas was just around the corner. One of the silver buttons (dealer) had been out to Hamleys Toy Store to buy some presents for his kids.

So, in traditional style, when he was not looking, we rummaged through all of his bags and there we discovered a shop assistant-wrapped, indoor cricket set, for ages of eight and upwards.

As we thought we qualified for that, the wrapping was torn off, the box was promptly opened and it was set up outside of our box. Teams were quickly chosen.

It was during this game that a leg break was bowled across the floor and good old Charlie thumped it for a six and knocked off the broker’s hat with his shot.

This, as we found out, was akin to committing treason.

We found ourselves summoned in front of the Stock Exchange committee to explain what happened, with us on one side and a very red faced and angry pompous broker holding his damaged big black top hat on his lap on the other side.

We were obviously staring at our shoes (and trying not to laugh), as we were made to apologise and then we all got fined a week’s wage, to pay for a new hat.

This, as it turns out, was a good thing, as in a whip round in the pub afterwards, we exaggerated our wages a little bit and all the staff covered us off. So we actually made money on the wayward shot.

The pompous broker worked for Mullens & Co and his actual title was ‘Broker to the Commissioners for the Reduction of the National Debt’. He was the old boy network link between the Bank of England and the market floor.

His firm was allowed to manage the issuing of long term government debt or ‘gilts’ and then buy back the shorter term one, so prices and books could be balanced and managed with a stiff upper lip.

He could be observed three times a day, leaving the floor and walking (on a non-windy day) to the Bank of England to get instructions.

On this day he appeared around the corner just at the wrong time.

Oiks like me and Fergie

When we went to pay our fines to the clerk, I whipped out my cheque book and the clerk almost fainted on the spot.

When he finally composed himself all he could mutter was ‘The Queen, The Queen’ as he shook his head and took my cheque into another room, never to be seen again.

You see, my cheque book was from Coutts & Co, famous for being ‘The Queen’s Bank’. Only noble people were ever allowed them.

Not oiks like me.

I had a girlfriend that worked for them and she opened up and approved an account for me and I would have my pay deposited there every week. “My money rubs shoulders with royalty,” I would tell everyone.

Later on Fergie (and not me) really would lower their tone when she ran up a huge overdraft and decided to become a pop star to pay them off. Or, as the Daily Mail put it:

‘Despite her willingness to support herself through a variety of business ventures, the Duchess’s money problems have been well documented. At one point, her overdraft at the Queen’s bank Coutts stood at £5 million.’

However, it is good to know that Fergie and Andrew will now be looking after the grieving royal corgis. I have it under good authority that Andrew particularly enjoys the grooming part.

Moving on

One of the other good things to come out of the ‘Top Hat for Six’ incident was that Charlie Jenkins had a rich and influential city type uncle who worked for Cazenove & Co, who were the Queen’s broker. Me and Charlie had become good friends.

Uncle couldn’t get us out of trouble with the Committee, but where he could help us out was in that he would like to use other brokers to disguise his orders. Probably how Charlie got his job, but we were not to ask.

Instructions would be given from uncle to nephew and we would discretely help out in the buying and selling of equities on behalf of their royal client.

I remember once after completing an order for Charlie, asking him whether his uncle had reported my order to the Queen himself. He just smiled and said I should buy him a pint, with a twinkle in his eye.

That definitely was another moment in my life where I could remember where I was. The Arbitrager, Throgmorton Street EC2!

And, as we have all found out this week, all good things must one day pass.

Coutts & Co were founded in 1692 and in 1990 they became part of Natwest Bank PLC, where their reputation slowly went down the Fergie path.

Mullens & Co were founded in 1786 and in April 1986 they were bought out by SG Warburg and ceased to operate, as Warburg only wanted their licence.

Cazenove & Co were founded in 1823 and in 2009, JPMorgan completely took them over for £1 billion and they are now called J.P. Morgan Cazenove.

So on Thursday, September 22 I will be raising a glass of ‘black velvet’ to the Queen and the other Charlie boy.

Bottoms up, not in (yet)

For those of you who may not know, a ‘black velvet’ was first introduced to the world in 1861 as a way to get pissed whilst mourning the death of Queen Victoria’s Prince Albert.

It was said at the time that ‘even champagne should be in mourning’.

I’ve always said that champagne should also be enjoyed in the morning, as it helps water down the bitterness of freshly squeezed orange juice.

Black velvet is made by filling a champagne flute halfway with champagne (or cider if you come from the Isle of 12 Fingers and Toes) and floating some Guinness on top.

The differing densities of the liquids cause them to remain largely in separate layers and this effect is best achieved by pouring the Guinness over a spoon turned upside down over the top of the glass.

To the Queen.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.