Zyber shares shoot up 40pc on acquisition and Blockchain rumours

Pic: Getty

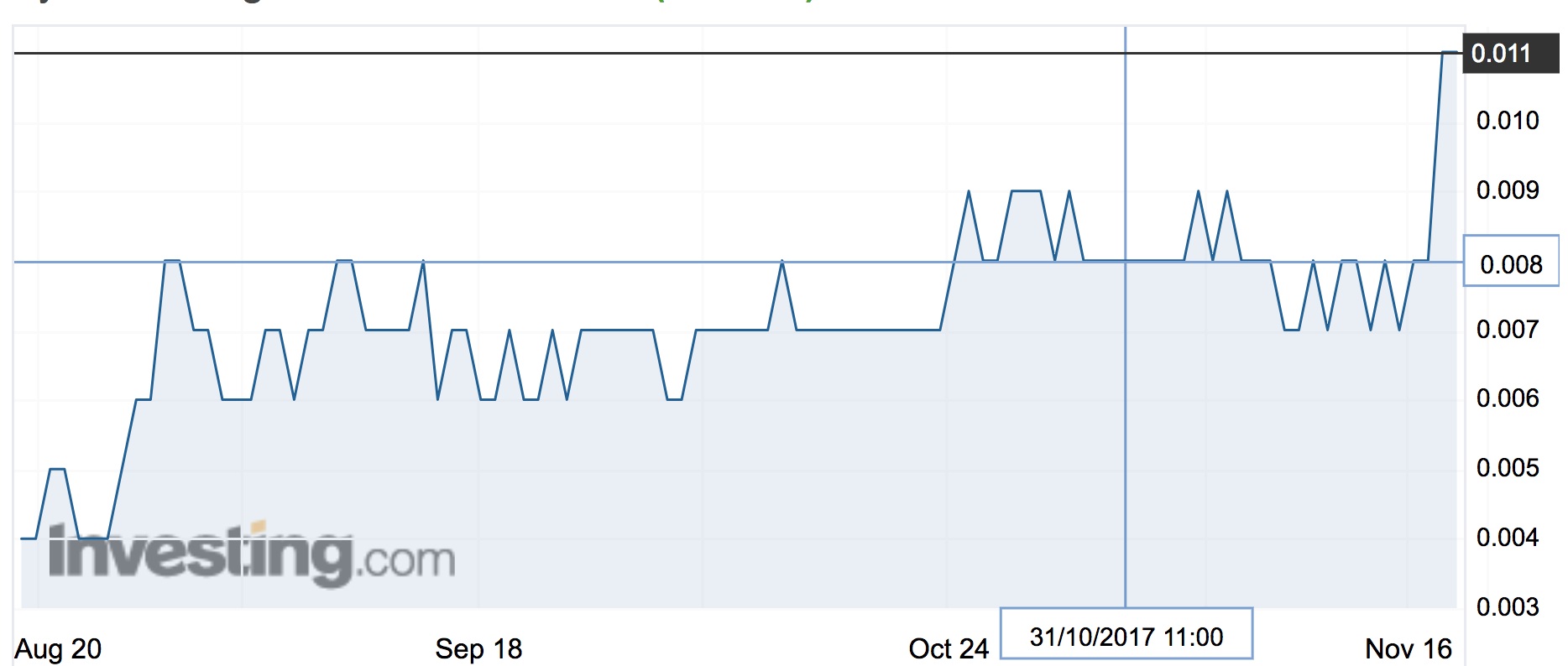

File sharing app Zyber shot up almost 40 per cent on Friday after heavy trading prompted a trading halt and ASX speeding ticket amid speculation in online forums that an acquisition or move into cryptocurrency was imminent.

Zyber (ASX:ZYB) went into a trading halt after its stock jumped from 0.7c to a six-month high of 1.3c.

Unlike with previous responses to ASX aware letters, Zyber pointed out to the ASX that it was indeed ruminating on a number of possible new paths.

“As outlined in the Quarterly Activities Report released to the market on 31 October 2017, the company continues to review new commercial opportunities both within the cyber security space and in other sectors, with a view to ensuring the best outcome possible for all shareholders.

“Discussions are ongoing in this respect, however nothing has been finalised or is announceable at this time. The company continues with the development of the Zyber technology.”

- Catch up with all the week’s ASX small cap news

- Follow us on Facebook or Twitter

- Discuss Stockhead small cap news in our Facebook group

Zyber has been knocked back several times in the last 12 months by the ASX for trying to change its business activity through a backdoor listing.

Previous share price spikes and subsequent ASX query letters in August and October were based on similar rumours, and gossip around a cannabis deal in October.

No one from the company was available to comment.

Indeed, Zyber’s new phone number is that of Kazakh-focused Jupiter Energy, the company from which it sourced a new chairman and company director.

Zyber says it’s still working on its file sharing tech — sold into the business by American Clay Epstein in 2016. But it has made slow progress, releasing a test version for the Apple iPhone and integration with the popular DropBox file-sharing platform.

According to its annual report, Zyber has spent $144,000 on research and development since January, compared to $504,000 on admin and corporate costs.

The stock finished last week at 1.1c, valuing the company at $7 million.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.