Seven West-backed CrowdSpark calls in administrators after ‘cash shortfall’

Pic: Morsa Images / DigitalVision via Getty Images

Digital content play CrowdSpark has called in the administrators and halted trading pending a possible sale or restructure.

CrowdSpark (ASX:CSK) — which is part-owned by Seven West Media — provided apps to let newsmakers source content from everyday punters.

It appointed Cassandra Mathews and Martin Madden of KordaMentha on Tuesday.

KordaMentha told Stockhead the business had about 20 employees globally. At the point administrators were called in, only one staff member was based in Australia.

KordaMentha cited factors including “cash shortfall, leaving the company unable to pay wages or debts when they fell due”.

Exactly what is owed to creditors is unknown at this stage. Administrators will investigate a possible sale or restructure, but if this cannot be achieved the company will be liquidated.

The company’s market cap had fallen to $1.4 million in recent months. Investors have been told to contact KordaMentha with any queries.

CrowdSpark was formerly known as Newzulu and rebranded in November 2017 after a restructure.

Its services include apps for data analytics as well as platforms for ingesting audio and video from across the internet, allowing news providers to draw content from across the internet.

In May, the company lost Seven West Media representative Clive Dickson after he resigned from the board.

Seven West Media owns about 22 per cent of the business. Seven had no comment when contacted by Stockhead.

The ASX had previously asked CrowdSpark about its finances. On May 21, the company answered questions from the ASX about its 2018 March quarterly results.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

The company had reported $340,000 in customer receipts, $1.1 million in negative cashflow and had $1.2 million in the bank.

The ASX queried whether it had “sufficient cash to continue funding its operations”.

CrowdSpark told the bourse it believed it was able to continue operating “subject to the reasonable achievement of its business plan, including the anticipated growth in sales and/or identification of new strategic opportunities and/or be able to raise sufficient capital if/and when needed”.

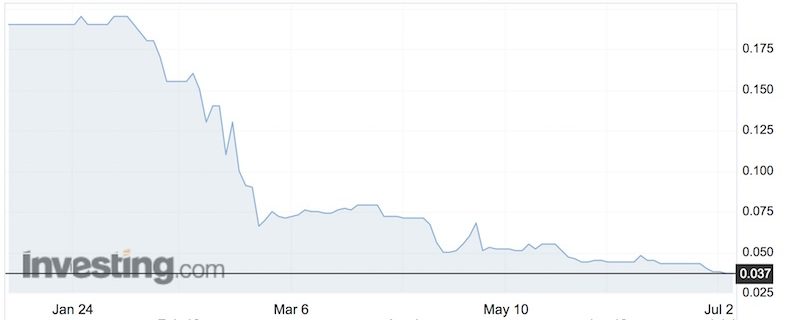

The company’s share price has dropped from 19c in January to 3.7c in July.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.