TSI leaves India behind to go deeper into the cloud, buys CloudTen

Pic: gorodenkoff / iStock / Getty Images Plus via Getty Images

Cybersecurity play Transaction Solution International is buying another software business, this time a company which migrates government services from old servers to the cloud.

TSI (ASX:TSN) is buying CloudTen for $8.6m in cash, and a cash and scrip earn-out payment later, according to a term sheet seen by Stockhead.

CloudTen comes with $1.6m in cash which effectively means TSI is only paying $7m for the company.

TSI will pay $3m upfront in cash for CloudTen and $5.6m over the next 12 months.

The last acquisition TSI made was cyber security company Decipher Works for $5.1m in August last year.

The new division rapidly paid for itself, with its $2.1m in half year revenue leading TSI to its first ever profit of $70,865 for the six months to September 2018. The prior half saw a loss of $507,566.

TSI is raising $2m to fund the acquisition, and has a committed cornerstone investor for half of that.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Before the Decipher Works acquisition TSI was in a tight spot.

It bought 25 per cent of an Indian ATM operator called TSI India — just before the country’s drastic demonetisation policy in December 2016 purged all 500 and 1000 rupee banknotes from circulation, and sent revenue and transaction numbers south.

TSI was originally supposed to buy the remaining 75 per cent of TSI India from private equity firm CX Partners.

The Decipher Works acquisition allowed it to stop wholly depending on TSI India for revenue.

That business is now valued at $15m, and Stockhead understands TSI is interested in selling it in order to become a pure-play cyber security company.

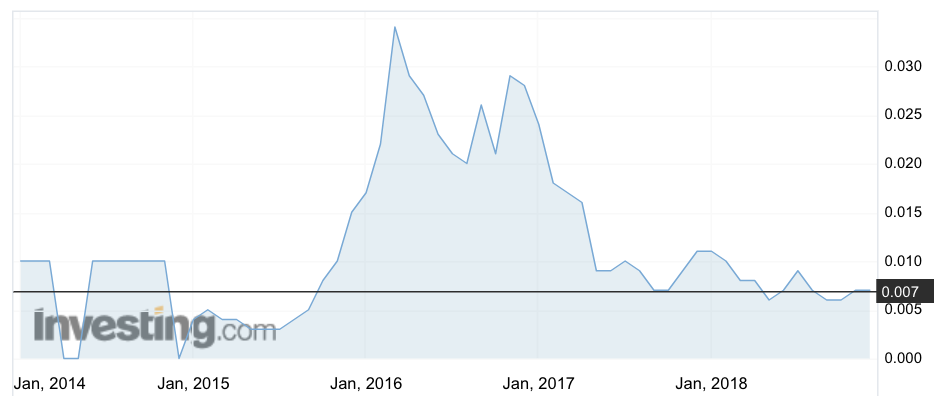

TSI is currently in a trading halt but last traded at 0.7c.

Stockhead is seeking comment from TSI.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.