Trustees Aus chairman plans to sell down because he’s worried about a surging share price

No party here Pic: Getty

Trustees Australia directors are in the unique position of worrying about a surging share price.

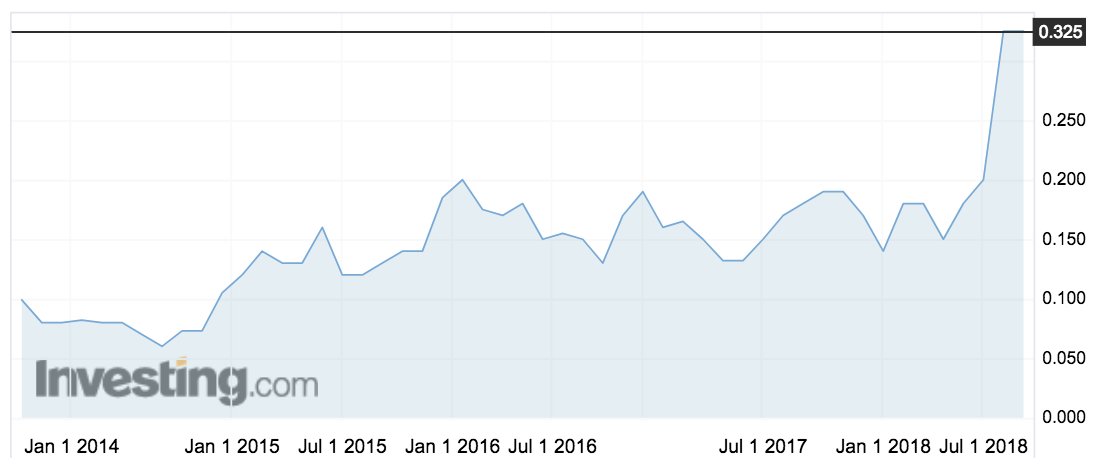

The fintech investor’s stock (ASX:TAU) has surged 62 per cent since the start of August — and the board says it’s because the stock is not liquid enough.

A big media splash to spruik their new online term deposit service Cashwerkz is creating new interest in the once-staid stock.

But there’s not enough stock to go around to satisfy demand — and that’s causing the price to skyrocket, the group says.

“All directors have expressed concern that the recent trading in the company’s securities may not be reflective of an orderly and liquid market, due to the significant recent price increases on very low turnover and low numbers of transactions,” the group told investors.

There are 86 million shares on issue and 81.3 million of those — 95 per cent — are held by the top 20 shareholders.

“While the increased share price is very encouraging … the Board is of the view that it is up to the directors to assist in liquidity in the available securities to maintain a balanced market so that investors seeking to become new shareholders have an opportunity to acquire shares in a market with adequate liquidity.”

Chairman and founding director Michael Hackett is going to sell tranches of 1 million shares at a time to cater to demand.

Trustees Australia went through some major changes last year, beginning a change from serious custodians to sexy fintech.

- Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

It spun out a range of businesses, including dairy farms and backpackers, into a new company called Jimmy Crow which is listed on the NSX.

At the same time it bought Cashwerkz, an online comparison site for term deposits that also does the heavy lifting of verifying identities and making the applications for the user.

Cashwerkz CEO Hector Ortiz told Stockhead they have 13 banks on the platform including two of the big four, NAB and ANZ although the latter just for financial advisors, with another lined up for this week.

They are looking to have a total of 35 banks on the platform.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.