Trading with Focus: Protecting your hard-earned gains in the BNPL sector

Pic: Justin Paget / DigitalVision via Getty Images

The most dangerous sentences ever uttered by a trader in speculative shares: “It’ll be different this time”. “I can’t sell, I’d get crushed by tax.” “This is a long-term hold.”

A long, long time ago there was a mining boom on the ASX (it was around the year 2004 – oof, so old). The Chinese demand for commodities seemed insatiable, and all around there were stories of the ‘fish that got away’.

So everyone started ‘fishing’ and before long all the proverbial ‘fishing holes’ were crowded.

It started with a nickel boom, then it became copper, iron ore, oil, zinc – anything that we could pull out of the ground that was in high demand was running hard and fortunes were made.

Once a commodity went too high, people would bid up a substitute metal; because, surely, the Chinese wouldn’t keep paying top dollar if there were options – so then even cobalt and molybdenum explorers started going nuts.

Around that time a little company looking for uranium called Paladin Energy (ASX:PDN) came across the desk.

Oil was getting pricey, and allegedly running out, so it made sense that uranium was the next best thing. (To this day, I am told that there is still no alternative better for baseload power generation than uranium.)

The stock went from a few cents to almost $11 a share. Let that sink in.

But the uranium pundits remained strong. “Doesn’t matter that it’s dangerous. Doesn’t matter that its abundant. Doesn’t matter that this company hasn’t made any money yet.”

History will repeat for BNPL

Valuations on everything remotely uranium related went out the window as the rush for a repeat of Paladin returns was on.

Now check out the price of Paladin today (it’s in the top left-hand corner of the chart).

So, there are a few points to note here. It is never different. Remember bitcoin went to $20,000 and everyone was quitting their jobs to become fulltime crypto-traders? Bahahaa! Oh, the tears…

The BNPL phenomenon will be no different (except that everyone was already at home).

For every Fortescue Metals (ASX:FMG) (that succeeded and justified their valuations and now pays dividends) there’s an Atlas Iron (ASX:AGO) (that went from a few cents to over $4 a share and back to a few cents).

Hype pushes all the share prices up, but it always comes back to profits — rather, how much profit that company makes.

So, a bit of advice. Never ever look back. Never ever. Don’t ever kick yourself for a proper, considered decision if the stock keeps running up and you’d already sold.

Kick yourself instead for your stupid emotion-driven trades — that should keep you busy enough!

If you sell out of a company and it keeps going, well, good luck to them. Don’t drive yourself mad by replaying what might have been a bigger win.

And when you find yourself patting yourself on the back and bragging about how good a trader you are, and looking at new boats and expensive watches – that is the biggest sell signal you will ever get!

You are not the best trader ever, stock markets are never easy and the Wolf of Wall Street was only rich because he stole people’s money and broke the law (sorry Jordy).

A few ideas to protect the base

- 1) Be John Wick. (aka: always know your exits before walking in)

A stop loss strategy can be as simple as choosing an amount that you are prepared to lose. I’m putting in X dollars, and if it goes down Y per cent I’m out.

Then, taking it one step further, make it a trailing stop loss to lock in your gains as the stock rises (if the stock rises!) Each day reset your alerts to a percentage below the last traded price.

Where to put that stop-loss

How tolerant you are for losing money?

What’s your timeframe?

Volatility of the market and volatility of the stock?

The quality of the stock?

Technical indicators such as gap theory, support/resistance, moving average crosses?

https://www.youtube.com/watch?v=3JUXMtIAMhc&feature=youtu.be

- 2) Just sell at the top – simple!

Feeling lucky? Sometimes you can just ‘get the vibe of the thing’. Sometimes it’s nice just to get a big win and being ‘up big’ can be enough reason to sell out.

Personally I love paying tax, so taking a profit is my favourite pastime, and I can’t stress this next point enough so pay attention: If I paid a lot of tax IT MEANS I MADE A LOT OF MONEY!!!

And you plan to make money again next year right? Best way not to pay tax is to not make money (this is not tax advice — this is math).

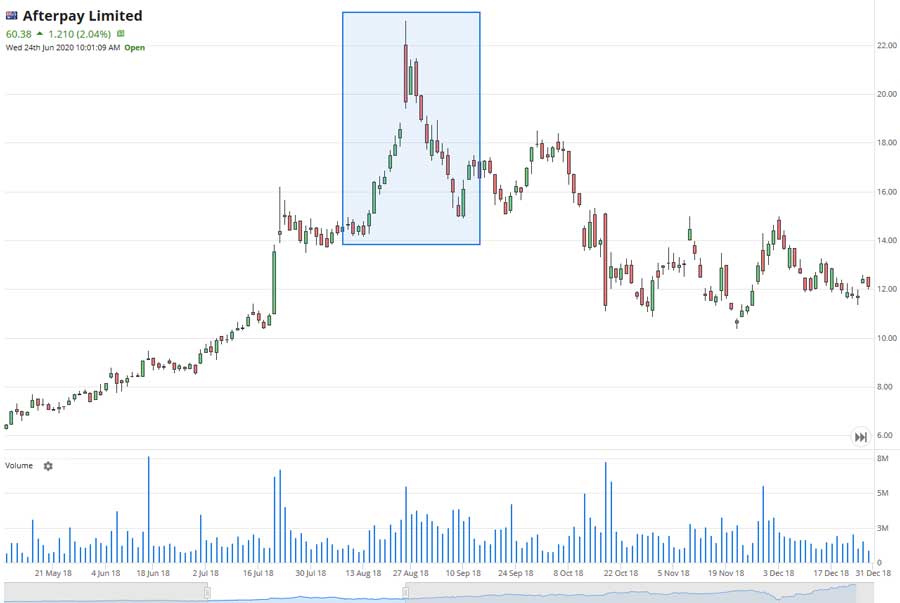

The chart below is from 2018, when shares in Afterpay (ASX:APT) rallied to new record highs (quite a while back now, when they were just ‘sort-of’ really expensive, unlike now), and then failed, and actually closed lower.

That’s a pattern to look for. These sort of sell-offs show that the herd is getting weary.

- 3) Other stuff about tops

Remember a few weeks ago when the world was ending? The markets were foretelling doom? Every newspaper was talking about the trillions of dollars lost on the market? Extreme bearishness = time to buy.

The opposite is true too. If everyone has bought and is holding firm, there’s no-one left to buy!

So when it starts to fade, everyone is already long and the stock can fall hard because everyone is already fully committed.

Like your favourite nag running out of legs on the final straight, if there is extreme bullishness and everyone is talking about a stock or a sector (or the market) go against the grain.

Has this ‘phenomenon’ been on network news yet – that’s almost reason to borrow stock for a short!

Also be wary of director sales, for any reason. To pay off a tax bill, to do shareholders a favour — oops I mean provide liquidity, to diversify. If directors are selling they had to get board approval.

They had to do it at a time where there was no information about the company that was not known by the market, so if they are selling, nothing is coming up (that they know of).

But don’t forget directors are humans too – they sell out when they think it’s the top too, they just have to have better excuses. (I love the fact they are called ‘Change of Director Interest Notices’. Yep, was interested in this, now I want to buy a walk-in humidor!)

Gaps. Get. Closed. I mentioned them briefly above. They are real. I don’t know if this is a thing that happens because people believe in them, but gaps get closed more often than not. Seriously, just watch a few. Its kinda freaky. Can I get a side bet on this one?

- 4) STAY INFORMED!!

If you’re punting around this end of the market, the speccy end — yeah I said it, BNPL stocks are speculative, fight me! — don’t watch the market sometimes. Watch it all the time!

Or at least put in some alerts. A news alert to tell you if something happens, and a price alert to tell you if your nominated stop-loss got hit.

When Marketech was designing Focus (our new high-function, low-cost easy to use trading platform designed for the good-looking intelligent person) we debated at length whether to automate stop-loss trading. The outcome was a resounding NO.

Remember when that car on autopilot crashed? Watch, or preferably read 2001: A Space Odyssey. Some stuff works on autopilot. Not everything though.

You, trading your highly speculative, constantly moving, constantly changing stocks should not be on autopilot.

Your Bunnings Warehouse Trust shares are probably ok to review every now and then, but not a whole sector that has just gone nuts and is mostly yet to even turn a profit (when most of you haven’t even used their services).

And even the directors are cashing some out six weeks after you all thought they were going to fail because there was a coming Great Depression!

Follow your stocks closely, have a plan and don’t be afraid to sell. Maybe BNPL will replace the credit cards and end up making huge changes to the financial landscape, but don’t just hold and hope.

Don’t be the guy that didn’t sell Paladin at $10, the trader that thought they were a crypto-guru at $20,000 per BTC, or the guy still holding tulips (Google it).

Making excuses for not selling into bubbles is the second oldest profession, and much less lucrative than the oldest one.

Trade Up to Marketech Focus — a high-function trading platform from $45 per month. Instant trading capability for both PC and mobile to keep you on the move.

As a subscriber you will have access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. Go to www.marketech.com.au to set up a free trial.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.