These two Christmas debuts have already gone platinum

Pic: Thinkhubstudio / iStock / Getty Images Plus via Getty Images

Two days after Christmas two companies joined the ASX: one saw its share price almost triple in three days, the other has gone stratospheric.

The two companies were Atomos (ASX:AMS) which makes and sells camera add-ons for amateur Instagrammers and professional photographers, and Jaxsta (ASX:JXT) which bought out its parent company Mobilarm.

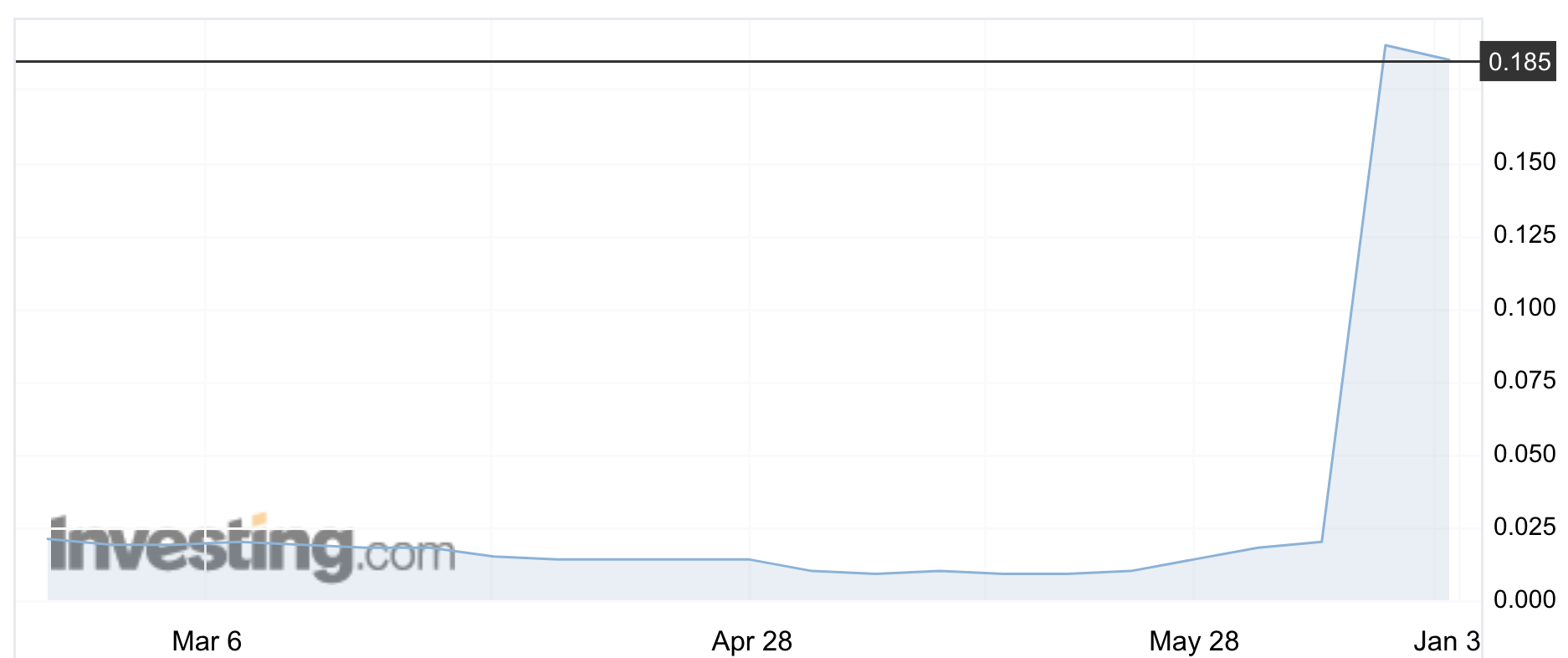

It was Jaxsta whose share price went mental, surging 750 per cent on debut before falling back as much as 15 per cent on Wednesday. The stock recovered to 18.5c that evening.

Sydney-based Jaxsta’s business revolves around a database of music credits (“from radio to roadies, artists to producers, photographers to video directors”) that it hopes will become the music industry’s official data record.

The music service raised $5.3m to buy out stuggling sea-goer Mobilarm, and is replacing the board with its own chief executive Jacqui Louez Schoorl and chairman Brett Cottle.

Existing Mobilarm board member Jorge Nigaglioni will stay on as the only reminder of what Jaxsta once was.

Jaxsta’s backdoor listing of Mobilarm was a long time in the making.

Mobilarm invested in Jaxsta way back in 2016 as a means of diversifying — to the bemusement of its shareholders.

In February last year they said their seafaring days were over and they were selling up to their investee.

Mobilarm’s main business, Marine Rescue Technologies, provided emergency beacons and safety equipment to help rescue those lost at sea.

In May, Marine Rescue Technologies was sold to to Secure2Go Group, a company which has been trying to list on the ASX since 2016.

Lights, camera, action

Atomos is another show pony rewarding investors since debuting on December 28.

The company convinced big-time investors such as James Packer-backed Ellerston Capital to give it $6m during the slow period before Christmas and its stock has been tearing ahead since then.

It issued stock at 41c, which on Wednesday had surged 43 per cent to an intra-day high of $1.15. It settled just above the day’s low, at 88c.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Atomos makes software and equipment which lets digital filmmakers record and edit in the field, but it’s priced so that the products are accessible to amateurs as well as professionals.

But it’s main drawcard are the partnerships with brands like Apple and Adobe to build add-ons for cameras made by Canon, Sony, Nikon, Panasonic and JVC.

And Atomos is already making money, which is the other part of its appeal.

Last year revenue hit $35.6m, almost half of which comes from the US, and it reckons it can get that up to $42m in fiscal 2019.

In 2018 losses fell from $4.7m the year before to $56,000, as the company slashed spending on marketing and R&D.

The extra $6m is going on investing in current staff, working capital and redeeming $2m worth of convertible notes issued in May 2017.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.