These Aussie companies want to make plastic that melts away into nothing

Pic: Getty

The concept of plastic that melts away into nothing is a holy grail in an era of grave environmental concern.

There are more than 5 trillion pieces of plastic pollution weighing more than 250,000 tonnes floating in our oceans, according to a 2014 study by the Public Library of Science.

The problem is petroleum-based plastics don’t decompose in the same way organic material does. Plastic never fully degrades — in sunlight it simply breaks down into tiny pieces that end up killing sea birds and fish.

Two Australian companies are hoping to change that with bioplastics — a scientific endeavour that aims to make biodegradeable plastic out of plant-based materials.

Leaf Resources (ASX:LER) is planning to produce renewable sugars that can be turned into almost any kind of plastic, while Secos Group (ASX:SES) supplies proprietary, compostable biodegradable resins and finished packaging products.

Bioplastics now makes up about 1 per cent of the 300 million tonnes of plastic produced every year, according to European Bioplastics — including non-biodegradable petroleum-based products with renewable additives.

Demand for hybrid products is rising rapidly. The European organisation predicts production to rise from 4.2 million tonnes in 2016 to 6.1 million tonnes in 2021.

Plastic made out of sugar

Leaf Resources plans to produce sugars from biomass such as banana leaves which could be used to replace petrochemicals of any kind, not just plastic, says managing director Ken Richards.

Last week Leaf signed a deal for the location of its first plant in Johor, Malaysia, and has supply agreements in place for raw materials to make biodegradable coatings for paper.

It is still pre-revenue. Those paper coatings, for landfill-killers like throwaway coffee cups, are one angle for initial revenue generation.

Leaf Resources shares hit a 52-week low of 7.5c last month and are now trading at about 10c, valuing the company at $20 million.

Biodegradable plastics maker Secos was formed from the merger of resin producer Cardia Bioplastics and film and laminate maker Stellar Films two years ago.

The larger, merged company has been focused on producing its plastic films (used in hygiene products such as nappies) and resins (for products such as plastic bags) at the right volume and price, Secos chairman Richard Tegoni told Stockhead.

“We’re extremely frustrated the market hasn’t recognised our size,” he said. “We’re doing over $22 million in sales now.

“Investors seem to love the story, the blue sky, rather than the substance.”

In November, Secos secured a $1.5 million contract to supply biodegradable plastic bags to Penrith Council in NSW and two deals to supply bioplastic resin to Malaysian bag makers.

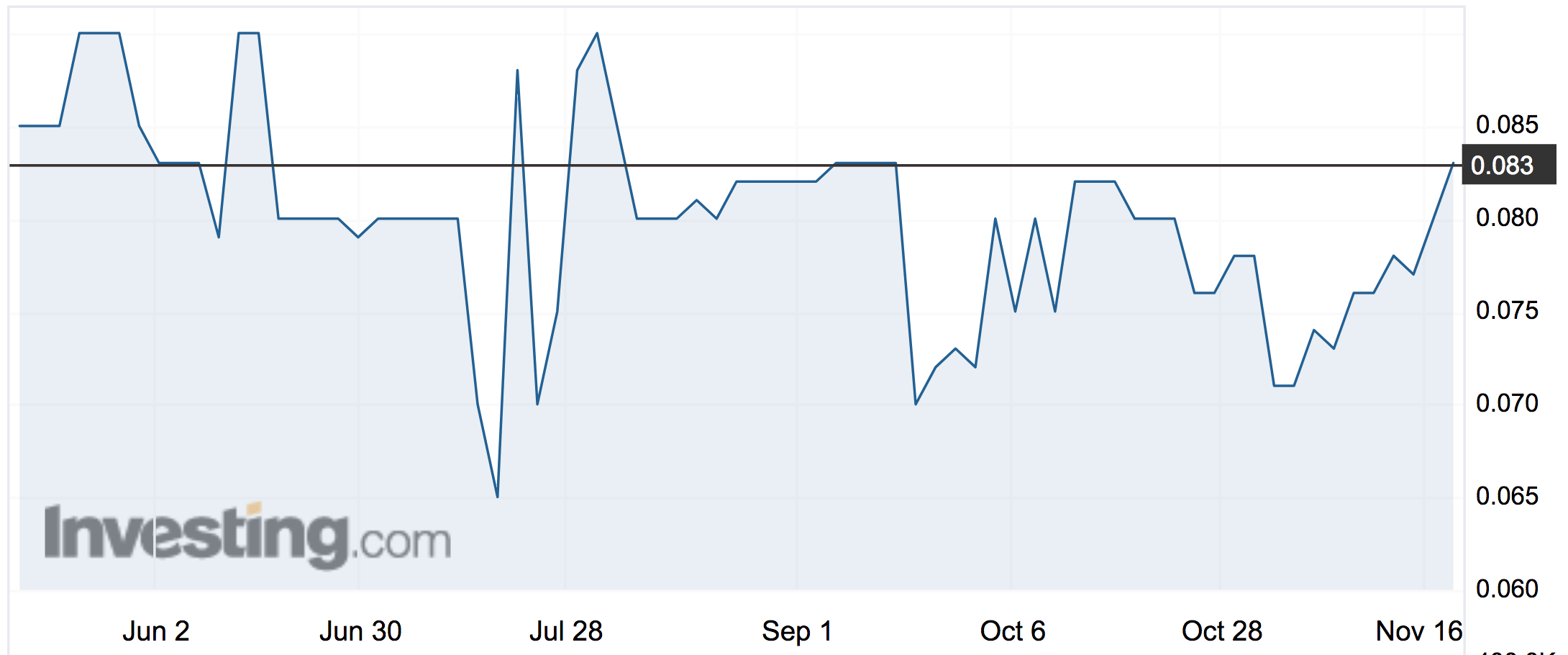

Secos shares trade around 8c — in the middle of its 52-week range of 6c to 11c over the past year. It has a market cap of $15 million.

The Malaysia factor

Leaf Resources is establishing a plant in Malaysia while Secos is also expanding there, adding to facilities in China and Melbourne.

Malaysia is a global hub for plastics — it’s one of the country’s top exports and the government is determined to attract clean plastic technologies to keep it that way.

“Malaysia one of biggest bioplastics places in the world,” says Mr Tegoni. “The government is very keen to support companies moving into the space and doing their best to attract companies.”

For example, Malaysia offers incentives under a program called ‘Bionexus status’ for international and local biotechs working on “value-added biotechnology and/or life sciences activities”.

Secos has the status and Leaf Resources is applying for it, bestowing tax-free status for a decade.

Investment before profits

Leaf Resources shareholders are still waiting for the company to make money, riding out a quarterly cash burn of about $1 million as it gets operations up and running.

Secos secured $6 million in payments from customers in the last quarter, although it’s still burning about $1.3 million a quarter as it invests in new plants to meet demand.

Secos has $433,000 left in the bank at the end of September, bolstered by a loan facility, and Leaf Resources had $860,000.

Secos halved its net loss this year, dropping it to $2.9 million, and Mr Tegoni expects they’ll be into “profit range” in the next 12 to 18 months.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.