The world’s top eight tech stocks are now worth a combined $US5 trillion

Amazon in Australia made $1 billion for the first time ever (Pic: Getty)

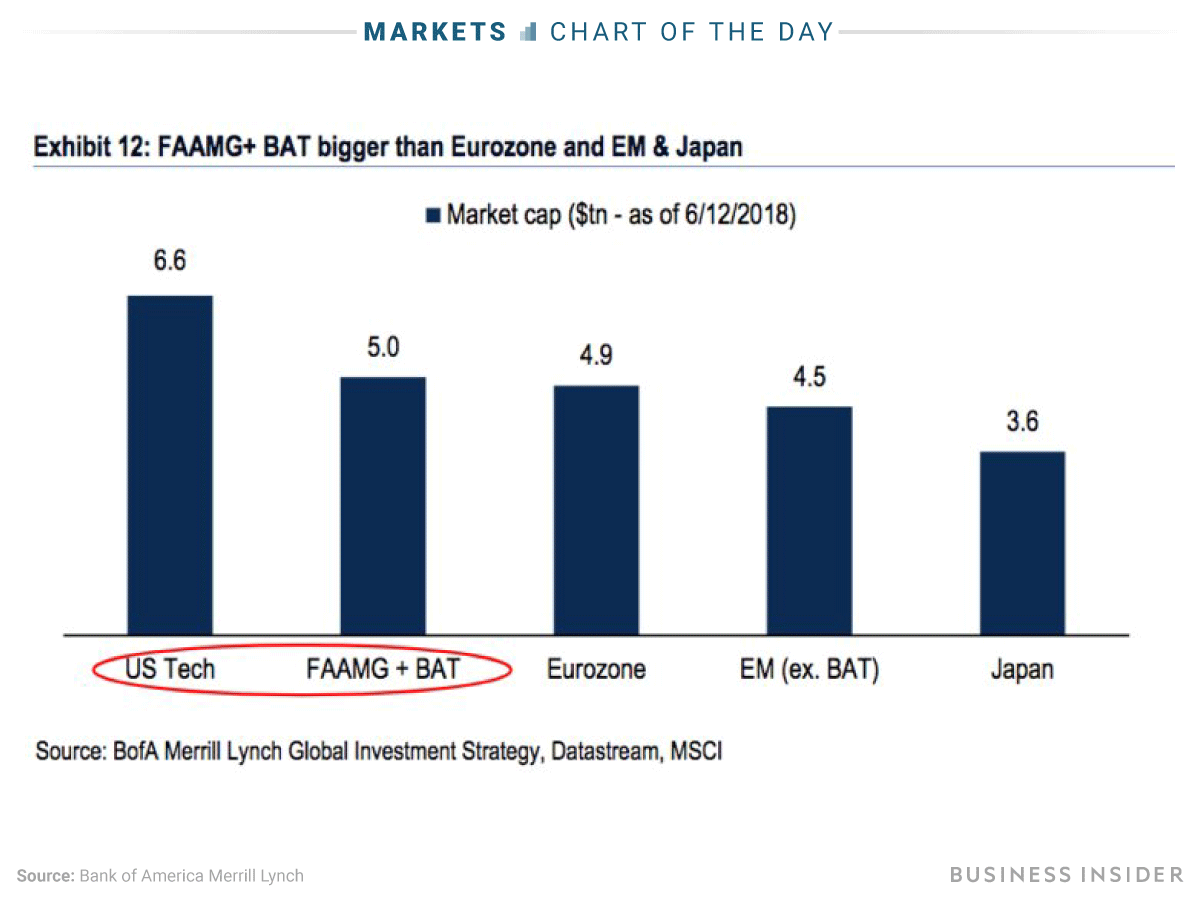

Here’s your stat of the day: eight tech companies are worth more than the stock markets of Japan and the entire eurozone.

The companies make up what Wall Street has abbreviated as “FAAMG + BAT”: Facebook, Amazon, Apple, Microsoft and Google (or Alphabet), plus the Chinese tech companies Baidu, Alibaba, and Tencent.

As of last Tuesday, they had a combined market capitalisation of $US5 trillion, according to data compiled by Bank of America Merrill Lynch.

US tech stocks were worth even more at $US6.6 trillion.

This ballooning in size has led to concern that investors are too optimistic about the future earnings power of big tech companies.

Merrill Lynch’s monthly survey of fund managers around the world shows that for most of the past year, the “most crowded trade” has been betting on tech stocks.

A recent survey found that it was thought to be “long FAANG + BAT,” while “long Nasdaq” became a concern in the second half of last year.

The most crowded trade was briefly “long bitcoin” just before the cryptocurrency peaked above $US19,000 in December.

Without declaring that we’re seeing another tech bubble, Michael Hartnett, the chief investment strategist at Merrill Lynch who published the chart above, recently listed this “fat” market cap stat as one of 10 reasons investors should be pulling money out of tech stocks.

Another reason, Hartnett said, was that tech and e-commerce companies accounted for nearly one-quarter of US earnings per share, a “level that is rarely exceeded, and often associated with bubble peaks.”

Indeed, no sector dominates global stock markets like tech does.

The MSCI USA Index of over 600 companies is driven by technology companies, which make up 27 per cent of it.

And on the top-10 list of the largest companies in the world, Berkshire Hathaway and Exxon are the only outliers, sector-wise.

Tech comes out on top in other ways you could slice the data, particularly in the US.

But it’s the near uniformity in opinions on big tech stocks that could continue to reap gains for investors – or catch them off guard.

Only five of 199 analyst ratings on FAAMG stocks say “sell,” according to Bloomberg data.

There are no “sell” recommendations for Apple or Alphabet.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.