The ad industry is expecting a big jump in spending and these ASX small caps could benefit

Pic: Justin Paget / DigitalVision via Getty Images

The ad industry has revised upwards its global spending forecasts — and ASX-listed advertising-related stocks could benefit.

The ASX’s advertising small caps have not fared as well as their big cap cousins over the past year (see our table below).

But recent industry forecasts could bring opportunities for value investors.

Global ad spend is expected to grow by 4.6 per cent this year to $US579 billion, according to research by one of the world’s big media agencies, Zenith.

That’s up from a 4.1 per cent growth rate forecast in December. The revision was “our biggest quarterly upgrade since March 2011”, said Zenith.

Growth in China (the world’s second biggest ad market after the US) plus events such as the Winter Olympics, next month’s FIFA World Cup and the US mid-term elections in November are key drivers.

Locally, Australian ad spend will hit $16 billion this year — a rise of about 2.6 per cent.

The growth is also due to “the wider process of digital transformation, as advertisers invest in technology, data and innovation to revolutionise their relationships with consumers,” trade magazine B&T notes.

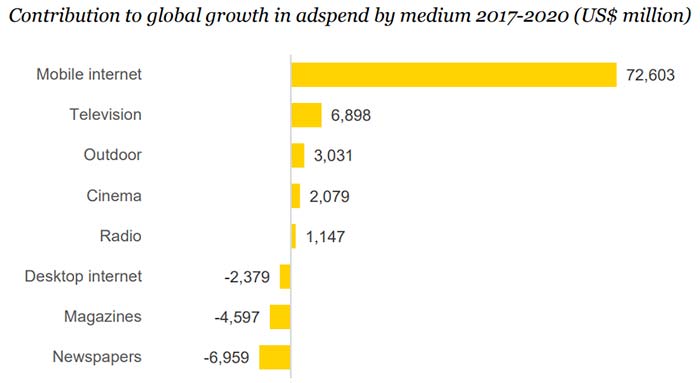

Internet advertising last year overtook TV to be the world’s biggest ad medium, accounting for 37 per cent of all ad expenditure. That will grow to 45 per cent by 2020.

In Australia, about 40 per cent of all advertising budgets will go into online ads this year — up from 38 per cent in 2017, reports Zenith.

Online video and social media are the driving forces of global internet ad spend growth. “We forecast both to grow by 17 per cent a year on average between 2017 and 2020,” Zenith says.

Aussie ad stocks driven by classified advertising

Although globally classifieds advertising lags behind video and social, it’s the biggest growth driver in Australia via ASX-listed businesses such as Seek, REA Group and Carsales.

Only last week ASX-listed classifieds business Mitula Group (ASX:MUA) soared after announcing a takeover offer from Tokyo-listed real estate data business LIFULL.

LIFULL wants to merge Mitula with its European Trovit classifieds sites to “create a significant global player in online classifieds operating in 63 countries with 170 million visits per month”.

Big guns Seek, REA and CarSales are performing strongly — though there are opportunities with smaller ASX-listed regional classies plays. See below.

The world’s two biggest advertising platforms, Google and Facebook, have faced criticism — largely from their traditional media rivals — over issues such as privacy and “brand safety” this year.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

But their ad tech is so effective — and so far ahead of traditional media publishers — that their advertising clients are unlikely to reduce spend.

“Among massive criticism over data privacy, Facebook showed the resiliency of its advertising machine, beating Wall Street’s $US11.4 billion revenue estimate in its Q1 2018 earnings report by raking in $12 billion in revenue,” reported TechCrunch last month.

You’ll have to head to the US markets to invest in ad giants like Facebook and Google.

The ASX has a number of other big cap ASX ad stocks besides the classies plays — such as outdoor advertisers APN Outdoor (ASX:APO), oOh!Media (ASX:OML) and QMS Media (ASX:QMS).

But what about value?

Below we’ve compiuled a list of ASX small caps with exposure to the advertising industry in segments such as technology, online classfiieds, ad tech and influencer marketing.

The majority of small cap ad stocks have not fared well over the past year. But with the market picking up, that could represent an opportunity.

Scroll down for our table of ASX-listed advertising small caps below.

Here are some notable ASX-listed small cap ad stocks:

Digital and programmatic advertising

Digital ad agency Engage:BDR (ASX:EN1) listed in December after raising $10 million at 20c apiece.

The shares are now at 16c — the price at which it just raised a further $2 million to buy a US app network called Adacel — which will provide more “inventory” where it can place ads.

Last month the Hollywood-based agency said it was expecting revenue of $24 million to $24.5 million this year — and EBITDA earnings of $1.25 million to $1.5 million.

Engage said at the time a new focus on video ads would significantly grow revenue and “also dramatically improve gross margins”.

A transition from older ad technology to high-tech programmatic advertising had contributed to a decline in revenue in 2017. But the programmatic business was “expected to be profitable and cash flow positive in the 2018 financial year”.

Programmatic advertising makes use of computer algorithms technology to automatically optimise ad campaigns for the best price and most effective targeting — often across many different publishers that auction off their inventory for the best price. The algorithms can analyse results and improve targeting in subsequent campaigns.

Marketing services outfit RXP Services (ASX:RXP) bought digital creative ad agency The Works for $33 million in August.

Similar to Engage:BDR, RXP cut its FY18 growth forecast from 10 per cent to 6 per cent in December while it transitioned from traditional “commodity” activities to higher value digital services.

But it said “integration of The Works continues to progress well across all fronts” in February. “It is delivering financial results in line with forecasts and has enhanced RXP’s overall client offering.”

Other digital ad stocks include Tech Mpire — a digital “performance-based” agency which means it focuses on tweaking digital ad campaigns to get the best cost per acquisition for clients.

Tech Mpire also offers nxus, a cloud-based software platform that provides real-time attribution tracking, analytics and reporting data for online advertisers.

Asia Pacific Digital (ASX:DIG) offers a range of services including digital strategy and creative, lead generation and performance marketing and customer engagement and retention.

The performance-based digital marketing service focuses on customer acquisition and lead generation, such as search engine optimisation, paid research and affiliate marketing services.

Video ads

There’s only one significant small cap focused on video ads — and perhaps the less said about it the better.

Big Un (ASX:BIG) was set up to create video ads and content marketing for small to medium businesses.

Its Big Review TV business was described as a “social media video review platform” and “innovative disruptor in the online video space”. But after a series of unfavourable media articles and scrutiny by the corporate watchdog and the ASX, BIG has been banished to the naughty corner.

The stock is now suspended from trade and has missed a deadline for posting its most recent half-yearly accounts.

“The company is currently working diligently towards completion of its reviewed half yearly accounts. At this stage, there remains uncertainty as to when these accounts can be lodged.”

The company is valued at about $380 million while its shares are stuck at $2.20.

Affiliate and influencer advertising

I Synergy Group offers “affiliate marketing” solutions — a type of performance-based marketing that allows a client to pay another business to send it website visitors or sales leads.

I Synergy’s marketing platform Affiliate Junction “provides a platform through which advertisers can connect with affiliates”, target prospects, tracking performance and process commission payments.

Crowd Mobile — co-founded by a 20-year veteran of Australia’s tech investment scene, Domenci Carosa — offers a variation known as “influencer marketing” through its Crowd Media division.

Crowd Media allows clients to pay “social influencers” — bloggers or anyone with a big social media following — to market their products.

Netccentric (ASX:NCL) also operates an influencer platform among other services such as a display ad network, social media gency and creative shop.

“The influencer platform enables advertisers to engage social media influencers to promote their products and services.”

AdTech and data

OpenDNA focuse on providing data analysis — using artificial intelligence and machine learning software — to publishers and advertisers.

“The company’s technology works by creating a detailed, holistic profile of an individual user’s likes, dislikes and interests based on that user’s interaction with platforms connected to OpenDNA.

XTD is an adtech business that caters to the “Out-Of-Home” advertising market — especially the installation of high-tech digital billboards in train stations.

XTD operates about 30 digital screens in underground rail stations in Melbourne.

XTD also operates an app called EMBARK which is designed to help commuters plan journeys while interacting with content on high-tech out Of Home screens.

Online Classifieds

This is the best-performing category in the Australian ad industry.

The three leaders in online classifieds in Australia — Seek, REA and Carsales — are all strong-performing large caps.

But there are opportunities among ASX-listed regional classies businesses.

Mitula looks set to be gobbled up, as mentioned above.

Frontier Digital Ventures invests in classies businesses in underdeveloped, emerging countries — especially in property and automotive. It’s got a range of brands South Asia, East Africa, West Africa, Central America, and Middle East North Africa.

iCar Asia develops automotive portals in South East Asian countries including Malaysia, Indonesia and Thailand. Brands such as Carlist.my and Thaicar.com offer car classifieds and content.

LatAm Autos offers similar car classifieds sites in Mexico, Argentina, Ecuador, Peru, Panama and Bolivia as well as a used car valuation tool.

B2B

Adslot takees a B2B approach, building software aimed at ad agencies to help them buy and sell online ads.

It provides a media trading technology called Adslot and a media agency workflow automation technology called, Symphony.

“The company’s adserving technology enables advertisers to deliver and measure the performance of display advertising, including impressions, clicks and online sales… Its Adslot Marketplace brings buyers and sellers together to create new market places and trading opportunities.”

Similarly, Adcorp offers a range of ad agency services from human resources to website design.

But the business is going through a rough patch with a court case against media agency Dentsu after it terminated a deal. Adcorp has a poor-performing traditional agency business that “has been impacted by soft trading conditions and poor new business conversion rates”.

Traditional marketing services

Enero Group offers a broad array of services including PR and communicaitons — but one of its three pillars is Creative — the part of advertising where innovative idseas are dreamed up.

“The overlap between creative agencies and PR/Communications agencies is blurring,” Enero CEO Matthew Melhuish said last year.

Energo just acquired a creative and technology agency Orchard Marketing to strengthen its digital capabilities.

“The acquisition of Orchard Marketing significantly strengthens our digital capabilities in Australia and the USA with Orchard not only operating as the Enero digital pillar brand but also enhancing the digital capabilities across our other sectors – Research & Strategy, Creative Agencies and PR/Communications.

Marketing services business Salmat — which started as a letterbox distribution business almost 40 years ago, has been undertaking a strategic review amid a 4 per cent fall in revenue last half.

It’s dropped some “non-core” busiess recently including the sale of its call centre division.

It’s been refocusing on its core catalog business which runs largely through national letterbox distribution as well as digital catalogues.

| ASX code | Company | Price change Jan-May | Price May 14 | Market Cap |

|---|---|---|---|---|

| BIG | BIG UN | Suspended | 2.22 | 388.9M |

| SLM | SALMAT | 0.288461538462 | 0.67 | 132.8M |

| ICQ | ICAR ASIA | 0.25 | 0.25 | 90.7M |

| MUA | MITULA GROUP | 0.220338983051 | 0.72 | 155.1M |

| FDV | FRONTIER DIGITAL | 0 | 0.71 | 155.1M |

| LAA | LATAM AUTOS | 0 | 0.135 | 47.3M |

| IS3 | I SYNERGY GROUP | 0 | 0.15 | 27.8M |

| AAU | ADCORP AUSTRALIA | 0 | 0.008 | 1.5M |

| EGG | ENERO GROUP | -0.0294117647059 | 0.99 | 85.6M |

| XTD | XTD | -0.268292682927 | 0.03 | 4.7M |

| EN1 | ENGAGE:BDR | -0.304347826087 | 0.16 | 40.1M |

| ADJ | ADSLOT | -0.4 | 0.024 | 30.9M |

| NCL | NETCCENTRIC | -0.4 | 0.012 | 3.2M |

| OPN | OPENDNA | -0.469230769231 | 0.069 | 7.0M |

| CM8 | CROWD MOBILE | -0.484615384615 | 0.067 | 14.5M |

| DIG | ASIA PACIFIC DIG | -0.508333333333 | 0.059 | 9.3M |

| TMP | TECH MPIRE | -0.733333333333 | 0.056 | 4.8M |

| RXP | RXP SERVICES | -15% | 0.57 | 93.5M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.