Tech: Ye of little faith – here’s an idea of how many millions roll in off US collection plates

Pic: Yuichiro Chino / Moment via Getty Images

Pushpay (ASX:PPH), a company that helps churches ditch the Sunday collection plate in favour of a mobile phone transfer, is rolling in money from its donation management service.

The company released its annual report today and said it’s swung from a full year loss of $US23.2m to a $US18.8m profit in the year ended March 31, 2019.

- Scroll down for more ASX tech news >>>

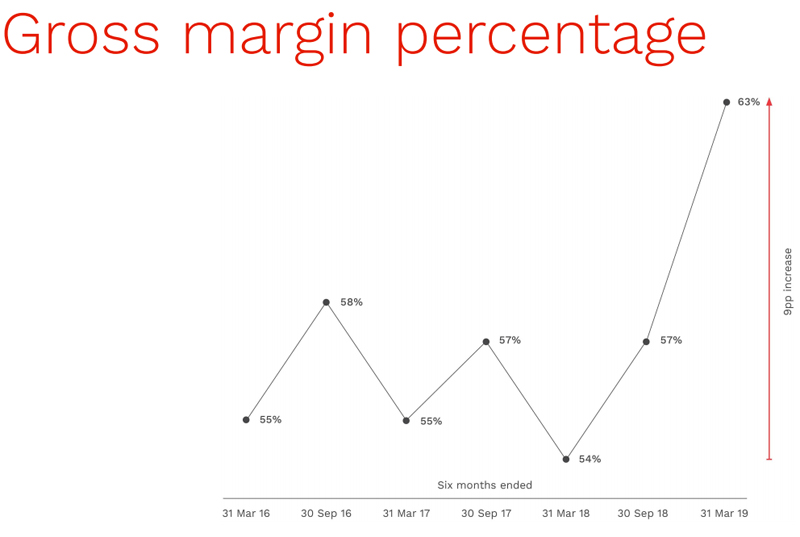

Revenue hit $US98.4m, up 40 per cent on the year before. The company is forecasting that to lift next year to between $US122.5m to $125.5m driven by market share gains in the US faith sector.

Customer numbers however only lifted 5 per cent to 7,649. Yet:

The positive revenue news was coupled with a statement that CEO and founder Chris Heaslip is resigning. The company did not say why, but did say he will remain on the board.

He will be replaced by banking executive and current chair Bruce Gordon.

Pushpay listed in 2014. It began with the idea of how to donate more easily during church services, given the decline in check books and cash.

At its most recent Summit One Day in the US, 627 leaders from 228 churches attended a two-day sold out event.

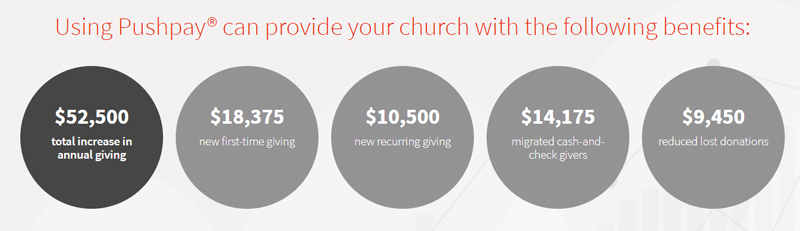

Pushpay’s online calculator says a 500-strong congregation can tip in as much as $US750,000 a year. And:

It now also services not-for-profits and the education sector in New Zealand, Australia, the US and Canada, but 55.7pc of their customers are medium-large churches.

In more ASX tech news today:

DigitalX (ASX:DCC) has settled a $2.5m lawsuit in which a group of investors alleged the company engaged in misleading or deceptive conduct during an initial coin offer (ICO) for German company Shivom. The crypto advisor will pay a total of $750,000 worth of cash and shares from existing cash reserves without admission of liability, and the investors will return all of the tokens they received in the ICO.

DigitalX held cash of $3.4m at the end of March.

The chairman of bike dashcam maker Cycliq (ASX:CYQ) Chris Singleton has resigned, citing time commitments at his various other companies. Singleton has two other chairmanships, three directorships (one at Parazero — PZO), an executive director gig at a Singaporean company, is the managing director of an investment house, and is the marketing director of Perth tech company hoppr.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Online lottery business Jumbo Interactive (ASX:JIN) is making so much money they’ve just paid out an 8c special dividend. Investors have to own shares by May 14 to get this.

Recruitment platform LiveHire (ASX:LVH) says it has 1m “talent community connections” on its platform. A single user can make multiple connections, as each time they sign up to a company’s Livehire-run online recruitment pool that counts as one connection.

Flexigroup (ASX:FXL), which claims the title of “inventor of buy now pay later” (BNPL), is trying to be more consumer focused a la Afterpay (ASX:APT) and Zip (ASX:Z1P). A spokesman for the company says it started a white labelled BNPL service about 20 years ago (what we’d know as layby), and consumer-oriented, albeit sold via retailers, services since 2000.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.