Tech: Titomic lands itself a NASA engineer; sets sights on $US360 billion global space market

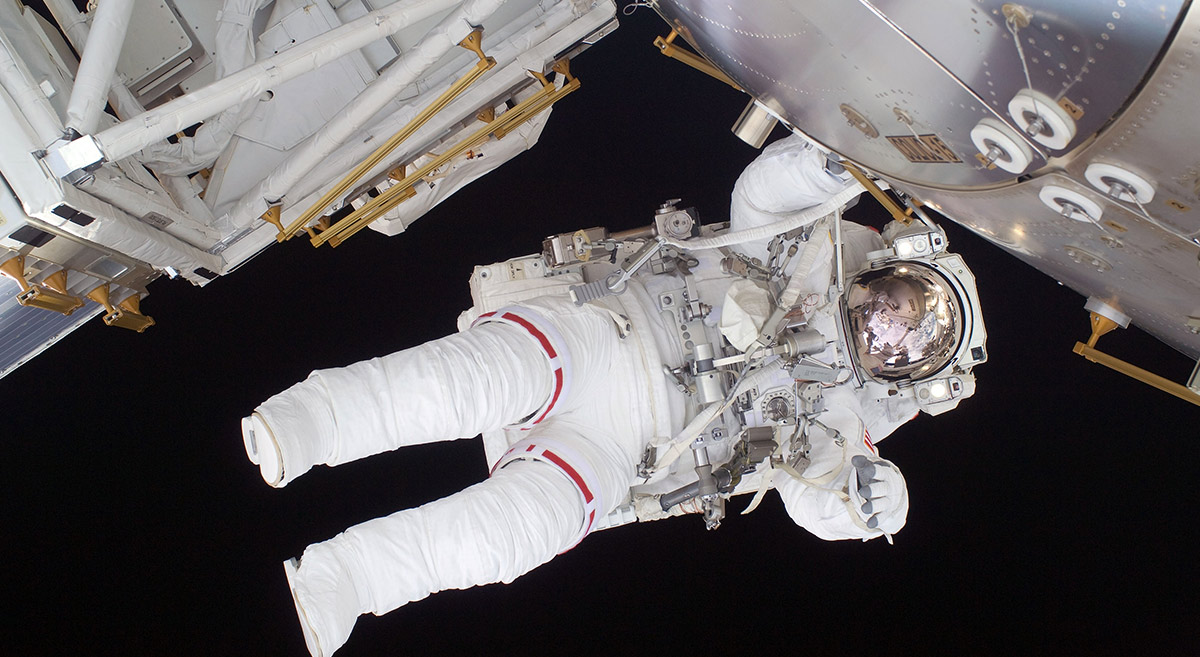

(Getty Images)

Shares in 3D metal printing company Titomic (ASX:TTT) got a bump this morning after the announcement of a key hire.

The company revealed that Nathanael Miller will join as chief technology officer, following a 13-year stint as an engineer at NASA.

- Scroll down for more ASX energy news >>>

Titomic said Miller’s experience would be important as it leveraged its patented technology to pursue commercial opportunities in the space sector.

After falling more than 20 percent in May, shares in Titomic were up more than 4 per cent in morning, climbing back above $2.

Space race

In announcing Miller’s hire, Titomic highlighted the potential growth of the global space industry — and there are some big numbers involved.

The sector’s value rose to around $US360 billion ($521 billion) in 2018, and that figure is expected to climb to $US3 trillion by 2040.

Locally, investment by the Australian Defence Force in space-related projects “is anticipated to be nearly $10 billion over the next 20 years”, Titomic said.

And Titomic reckons its titanium printing technology — which can 3D print a metal bike in 25 minutes — is well suited to benefit from that growth.

The company said its additive manufacturing techniques “allow for the automated production of large-scale future space vehicles and satellites,

which are challenging to produce using traditional metal manufacturing techniques”.

In that capacity, Titomic hopes Miller’s experience — most recently as an Aerospace Technologist at NASA’s research headquarters — will help give it a competitive advantage.

Miller said his experiences with robotic automation and software engineering left him confident that Titomic could compete in the global space market.

He said the company’s kinetic fusion process was “the most practical, large-scale metal technology manufacturing in the additive manufacturing technology space available”.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In other ASX tech news today

Defence tech company Electro Optic Systems (ASX:EOS) had a positive update for the market yesterday afternoon. The company said new orders for its anti-drone weapons system were strong enough to underpin a compound rate of core earnings growth of 45 per cent through to 2020. Shares in the company were up 2 per cent to $4.08 this morning — a gain of almost 80 per cent from its February low of $2.32.

Also late yesterday, struggling IT company LandMark White Limited (ASX:LMW) provided an update on the crippling data breach that saw its shares suspended from trade for almost three months. The company said it had identified a site called SCRIBD where a number of PDF documents had been published online.

“These documents do not appear to have been taken from LMW through an IT related security breach, but may be the deliberate work of an individual known to the LMW business,” the company said. Shares in LMW fell 7 per cent to 26c in morning trade.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.