Tech: Online rental platform rent.com.au edges out of COVID-crisis with steady user growth

(Getty Images)

Real estate tech company rent.com.au (ASX:RNT) provided a trading update this morning where it said overall user numbers continued to track positively.

The company said more than 800,000 users had now created renter resumes on its platform, up from around 550,000 at the same time last year.

While the resume portal itself isn’t revenue generating, rent.com.au said it accounts for almost three quarters (72 per cent) of the company’s product sales such as RentCheck, its automated tenancy verification process.

The company said it felt the impact of COVID-19, as strong growth in renter resumes during January and February came to an abrupt halt in mid-March.

But as the economy creeps back to life more people are planning their next move, and “resume creation rates are improving towards where we expect”, rent.com.au said.

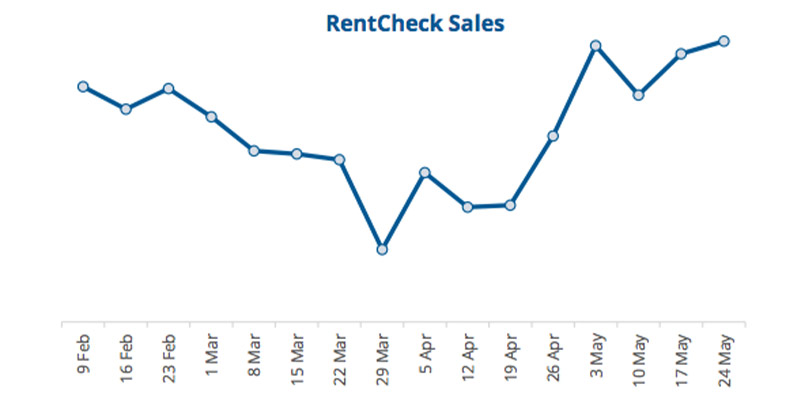

As a sign of the pickup in activity, the company said over the past four weeks it had “some of our best RentCheck sales weeks ever as renters start looking for a new place to rent”.

rent.com.au showed a chart illustrating the shift, however it didn’t include data on the Y-axis to indicate growth on a per-unit basis:

rent.com.au said it hadn’t seen a commensurate pickup in its other product channels, RentBond and RentConnect, although it noted those sales typically lagged because they were only used once renters had found a place.

The company said it had also had some advertising channels recommence after going on pause at the height of the crisis, while increasing its focus on costs.

”While we don’t expect to post revenue growth for the June quarter, our current forecast is much more positive than it was a month ago,” CEO Greg Bader said.

In other ASX tech news today:

Accounting software company Reckon Ltd (ASX:RKN) provided a market update, where the company said it had navigated the peak of the COVID-19 crisis with minimal disruption to its operations.

“Amidst the uncertainty that many businesses must have felt, we are pleased to report that overall we have noticed no material changes to our performance as measured against prior corresponding periods”, Reckon said.

The company said group revenue was up 9 per cent through the first four months of the year, compared to the same time last year. Shares in Reckon were up 8.5 per cent to 64c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.