Tech: MyFiziq can measure waistlines (and other body circumferences) as good as 3D scanners

3D body scanners do a fair job at measuring body circumstances — including (but not limited to) the waistline. But now recent validation tests have shown the technology of MyFiziq (ASX:MYQ) is just as good.

The company engaged external consultant Dr Jonathan Staynor, a former academic at UWA and current employee of Body Composition Technologies, to test the technology. Results showed MyFiziq’s technology performs just as well, if not better, than 3D scanners.

- Scroll down for more ASX tech news >>>

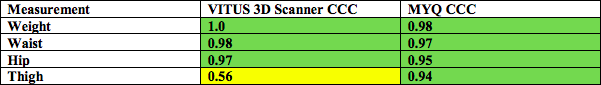

The test compared the accuracy of MyFiziq with a 2016 study on the accuracy of 3D scanners when reproducing circumference measurements.

In thigh measurements, the one area where the 3D scanner came up short, MyFiziq scored a rating of 0.94 — meaning excellent. Although the 3D scanner was excellent in measuring hip and waistlines, MyFiziq performed just as strongly.

“In my opinion, the MyFiziq technology performed as good, or better, when compared to the 3D laser scanner; which I would imagine is expensive and relatively difficult to assess outside of a clinical or research environment when compared to a smart phone application,” Staynor said.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

MyFiziq CEO Vlado Bosanac said the technology had now been validated in three different institutions. However this one was “the gold standard” because it was directly compared to a 3D laser scanning machine.

“I am equally pleased with this result as it defends our technology’s position as the leader in our field and clarifies further for stakeholders the unique and effective solution we are providing to multiple business vertices,” he said.

“When looking at the competitive landscape, we are the standout technology as we are capable of sitting in the palm of every consumer via their smart phone.”

In other ASX tech news today:

The latest growth figures out for software stock Vault Intelligence (ASX:VLT) have sent it up over 30 per cent this morning. It confirmed achievement of its $6m contracted annualised recurring revenue target — $1.3m of this came in the last quarter, representing growth 2.4 times higher than the quarter before.

Fellow software play RightCrowd (ASX:RCW) also announced strong revenue results with its unaudited full year revenue at $8.85m. A strong last quarter boosted its growth rate from 40 per cent to 60 per cent. Managing director Peter Hill said he was “very pleased” with the results and anticipated further growth in the coming year. The stock is unchanged this morning.

Fintech Raiz Invest (ASX:RZI) has announced its most recent customer and funds under management figures. Currently it has $347m funds under management — a 5 per cent increase in a month and 74 per cent increase in 12 months. Its customer numbers today totalled 193,327. “Raiz begins the 2019-20 financial year well positioned,” said CEO George Lucas. The company listed a year ago at $1.80 and closed at 46c on Friday.

While the market has had a strong year, Scout Security (ASX:SCT) has gone the other way and fallen over 50 per cent in 2019. Co-founder and CEO Dan Roberts wrote a letter to shareholders this morning saying he and co-founder Dave Shapiro “understand the disappointment around the share price” and said improving it, “is top of mind for us all”. He reminded shareholders of its achievements in 2019 including increased sales.

At Stockhead we tell it like it is. While MyFiziq is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.