Tech-focused fund Bailador claims edge over renowned Bessemer index

BTI says its portfolio is beating the Bessemer Index on key performance measures. Pic via Getty.

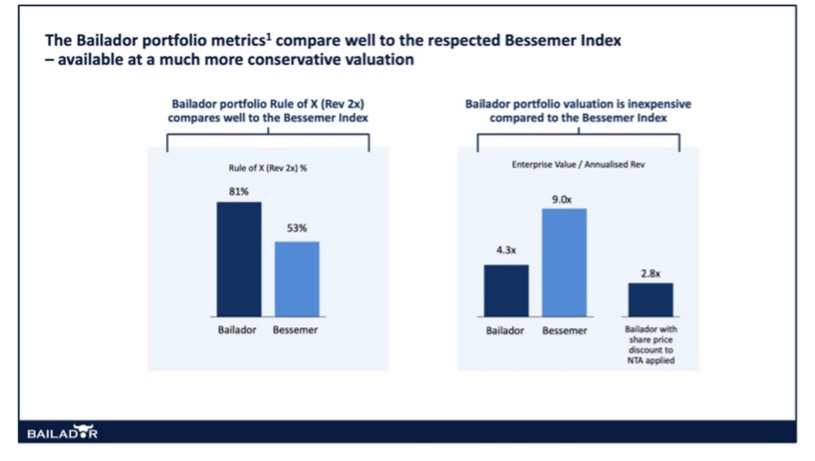

- Bailador says its portfolio is outperforming the renowned Bessemer Index on key measures

- Bessemer Index tracks performance of emerging public companies primarily providing cloud software solutions

- Bailador says investors can access its portfolio at more attractive valuations than companies comprising Bessemer Index

Special Report: Capital fund Bailador Technology Investments says its portfolio is demonstrating outstanding performance metrics and outperforming the renowned Bessemer Index on key measures.

Bailador Technology Investments (ASX:BTI) co-founder Paul Wilson said investors could gain access to the portfolio at valuation levels that were substantially more attractive than those of the companies comprising the Bessemer Index.

The Bessemer Cloud Index, which is often referred to simply as the Bessemer Index, was created in 2013 by Bessemer Venture Partners to track the performance of emerging public companies primarily involved in providing cloud software to their customers.

Long regarded as thought leader in technology investment, Bessemer is a venture capital and private equity firm headquartered in San Francisco, with offices in India, Israel, Hong Kong and the UK.

Wilson said the index became the benchmark for the rapidly expanding universe of emerging public technology companies.

Bailador embraces Rule of X as modern adaption of Rule of 40

Wilson said the Rule of X – developed by Bessemer – was emerging as a modern adaptation of the widely recognised Rule of 40 for high-growth technology businesses, offering an updated approach to assess performance.

The Rule of 40 has long been a go-to benchmark for assessing high-growth SaaS and software businesses, where the combined total of a company’s revenue growth rate and profit margin should equal or exceed 40%.

He said Bessemer’s Rule of X reflected a shift in how public markets are valuing growth and noted it puts greater emphasis on revenue momentum, particularly through what’s known as “Rev 2x”. That’s where revenue growth is counted twice in the performance equation, recognising its outsized impact on valuation.

“The Rule of X adopts a more nuanced evaluation, emphasising revenue growth (Rev 2x) over profitability, attempting to more closely align with metrics that correlate with valuation in public markets,” Wilson explained.

BTI portfolio compares favourably

BTI has an established track record of disclosing performance metrics for its investee companies on a whole of portfolio basis.

“We do this to provide investors with insight into the quality of financial performance across Bailador’s investments, while respecting the confidentiality of individual company performance where, as a minority shareholder, we are often bound by confidentiality provisions,” Wilson said.

BTI has compared the underlying performance measures of its portfolio to equivalent metrics produced by companies in the Bessemer Index.

“We then go a step further by examining the valuation of the Bailador portfolio, as implied by the published Net Tangible Asset Value and, indeed, the BTI share price,” Wilson continued.

“As demonstrated in the graphic [pictured below], the Bailador portfolio performance compares favourably with the Bessemer Index, while giving investors access at a fraction of the valuation multiple.”

Source: BTI

Wilson said BTI would continue to publish whole of portfolio metrics to provide investors with information on portfolio performance.

“This is the first time we have performed this particular comparative analysis, and we are pleased that not only does the Bailador portfolio stack up well in performance, but that investors can access this portfolio at a valuation that also compares favourably.”

This article was developed in collaboration with Bailador Technology Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.