Tariffs, trade wars and tax cuts: Saxo on Trump 2.0’s global market impact

Trump 2.0 will likely have highly nuanced effects on global markets. Pic: Getty Images.

- Saxo believes Donald Trump’s re-election could have complex impacts on global markets

- Trump’s victory and Republican control of Congress could reshape US and global economies

- Tariffs and trade wars could impact inflation, global economic growth and markets

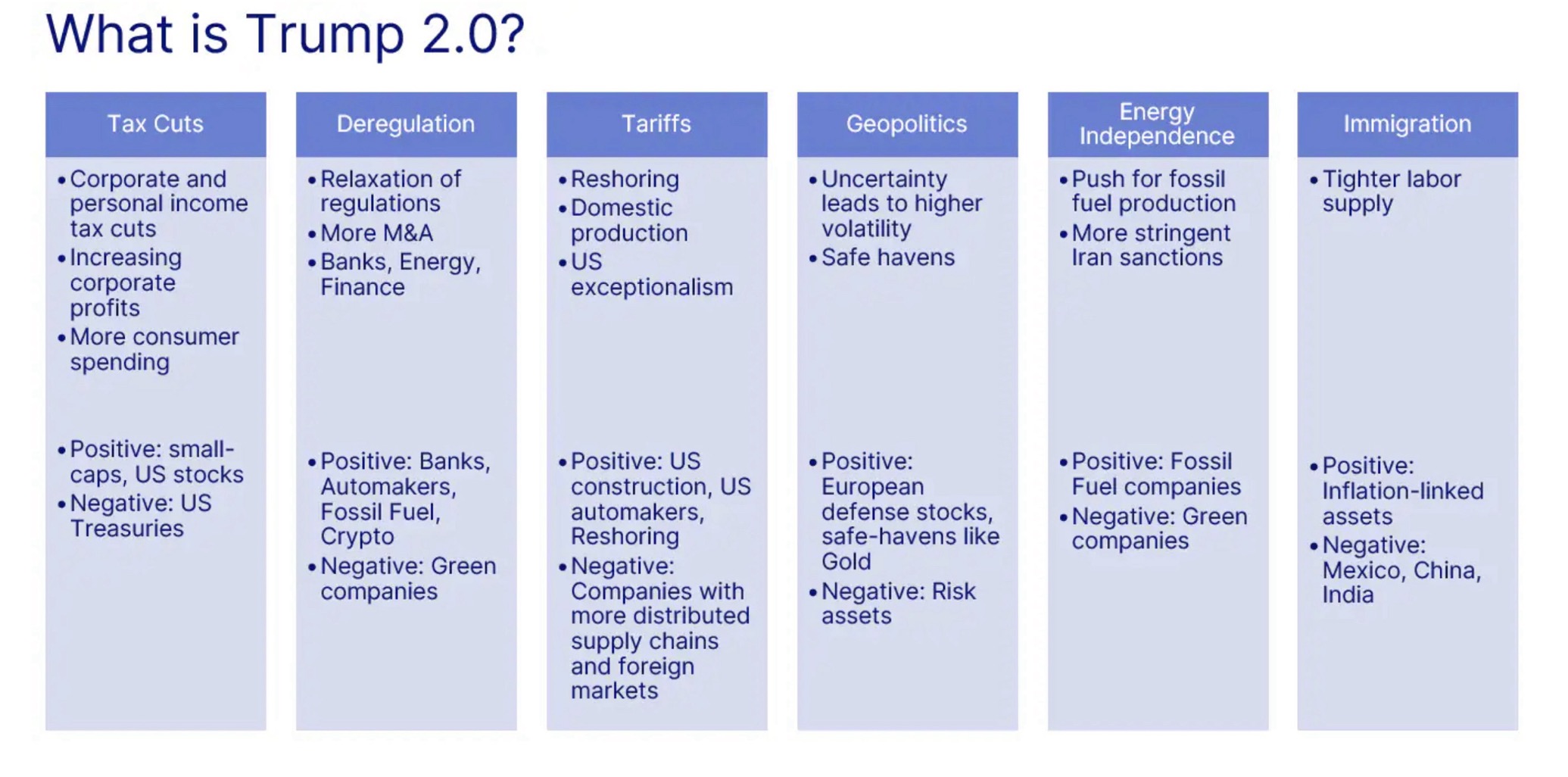

Special Report: As the post-election Donald Trump rally fades, the initial perception of what the president-elect’s second term could mean for global markets is emerging as more complex than first anticipated.

That’s the view of online trading platform Saxo Markets, which said initial news of Trump 2.0 saw equities perform stronger, the US dollar rise sharply and US treasury yields quite high, all on the assumption of a rip-roaring US economy under the pro-business president.

However, chief macro strategist John J Hardy questions what the results of some of Trump’s proposed policies could be – including higher tariffs and tax cuts.

“The historic 2024 US election gave Donald Trump a resounding victory and the Republicans full control of Congress, which will mean enormous changes and possibly even a wholesale reshaping of the US and global economies,” Hardy said.

“What the second election of Trump might bring is not fully clear, but an overwhelming victory for a totally anti-establishment party means that Trump has the mandate, should his team prove skilful enough in using it, to completely transform US government.

“This means everything from slashing spending and reducing taxes to enacting new widespread deregulation measures and, of course, imposing massive tariffs that disrupt the globalised economy.”

He said there were many dynamics at work that could move markets in both directions and investors should take a careful approach when not knowing what the famed first 100 days of a new presidency will – and won’t – bring.

Image: supplied

Trump policies to be felt far and wide

Hardy said that as the US was the world’s largest economy, shifts in demand from American consumers would be felt far and wide, and so too any moves in its stock and bond markets – both by far the world’s largest.

He said Trump’s proposed tariffs have the potential to impact global inflation – higher for the US, possibly lower elsewhere – and global economic growth.

“If Trump policies continue to send US treasury yields and the US dollar spiking higher, that will tighten global financial conditions as well,” he said.

Hardy said, furthermore, Trump’s decisions on the war in Ukraine and the Middle East would also have huge impact, along with the potential of China being singled out for especially large tariffs.

“Would China retaliate or try to convince Trump to make some kind of deal that somehow makes him look good but avoids the worst of the feared impacts?” he asked.

Tariffs to hit growth stocks

Saxo’s chief investment strategist Charu Chanana said Trump’s recent cabinet appointments, including key China hawks, signalled a stronger immediate focus on trade and tariffs over tax reforms.

“The emphasis on tariffs introduces uncertainty and market volatility, particularly for sectors heavily reliant on global supply chains,” she said.

Chanana said high-beta stocks, including small-cap and cyclical sectors, were especially vulnerable to trade disruptions.

“Defensive sectors such as consumer staples, healthcare, utilities and select retailers with less exposure to offshore production could be relatively more resilient,” she said.

Chanana said global markets, particularly China/Hong Kong, would feel the impact if trade tensions escalated.

“Expect outsized impacts on China/HK equities, given the direct trade exposure, along with broader weakness in Asia and other China proxies such as Europe and Australia,” she said.

Chanana said while tariffs may create some inflationary pressures, the impact on growth could offset this, supporting bonds with a possible flattening yield curve.

The US dollar may also benefit as a safe haven currency, while high-beta and cyclical currencies like EUR, CNH, AUD and MXN could weaken under trade pressure.

Tax cuts pro-growth and inflationary

Chanana said tax policy can often take longer to take shape as it needs a congressional approval and there were likely to be some members who could be concerned about the record-high debt and deficits.

However, she said when implemented, tax cuts could boost domestic growth, benefiting US-centric sectors over globally exposed ones.

“The likely beneficiaries are small-cap and cyclically sensitive companies that stand to gain from a tax burden reduction,” she said.

Chanana said Trump 2.0 signalling a renewed focus on deregulation could act as a pro-business catalyst across various sectors and was expected to streamline operations and reduce costs for industries like energy, finance and manufacturing.

She said the US dollar stood to benefit from multiple supporting factors, including Trump’s tariff policies, fiscal measures, Fed actions and geopolitical risks.

This article was developed in collaboration with Saxo Markets, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.