Tap set to transform American ad landscape

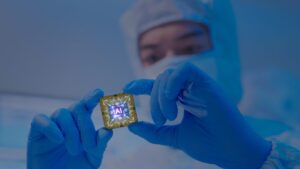

Pic via Getty Images

- Ad-tech startup Tap secures $1M backing to disrupt US media landscape

- Tap targets $5M seed funding to scale its AI-driven ad platform

- Media veteran Chris Edis leads Tap’s push to streamline multi-channel advertising

Special Report: Aussie tech start-up bites into big market with its AI-based platform, industry savvy and major league backing.

Ad-tech startup Tap is getting set to shake up the US advertising sector with its proprietary AI-driven media-buying platform backed by deep knowledge of today’s market and industry heavy hitters.

Founded by media sales veteran Chris Edis, Tap aims to streamline ad buying in the fragmented media market with a solution that manages the entire process, from creation to targeted placement and execution.

The new company has already attracted $1 million backing from prominent industry figures including oOh!media founder Brendon Cook and advertising veteran Andrew Baxter (formerly of Ogilvy, Publicis and KPMG) as it targets $5 million in seed funding. Tap has also won a grant from Austrade which has helped accelerate its marketing initiatives and expand its presence across the lucrative North American market.

Harnessing opportunities

With his extensive media sales experience in Australia and the US, Edis understands the challenges businesses face as they aim to make the most of diverse advertising opportunities.

While digital advertising on platforms such as Google and Facebook has become ubiquitous, traditional media channels including TV, radio, billboards, and retail advertising have remained siloed. This makes potentially highly effective multi-channel campaigns difficult to implement.

Tap’s AI technology utilises algorithms and predictive analytics to provide advertisers with advanced targeting capabilities. The platform analyses vast amounts of data to identify optimal ad placements across various media channels, enabling advertisers to reach specific demographics with unprecedented accuracy.

“What sets Tap apart is our holistic approach,” Edis said. “We’re not just offering a targeting tool; we’re providing an end-to-end solution that manages the entire advertising process, from media buying to ad creation and execution, all powered by our AI.”

Cook said Tap’s approach to integrating AI into media buying was a significant advancement.

“It’s not just about technology, but about creating value for advertisers and media companies. The Tap platform can potentially reshape the industry.”

Expanding into lucrative markets

Tap is not only transforming traditional media advertising but also tapping into the lucrative retail sector. With major organisations seeking to monetise their audiences through advertising, Tap offers a seamless solution. For instance, the Tap platform will enable advertisers to reach the large and high-value US college football audience across multiple channels.

Tap is already collaborating with 50 US media companies and rapidly expanding across North America. Early results are promising, with advertisers reporting a cut in the campaign creation and buying process from weeks to minutes.

Looking ahead

Tap aims to expand its platform to include additional media channels and markets. The company plans to launch in the Canadian and Australian markets by Q2 2025 and is exploring partnerships with major media conglomerates to further enhance its offering.

“In an era where digital giants dominate the advertising landscape, Tap provides a vital solution to unify and simplify the media buying process,” Edis said.

“The platform empowers businesses to reach their target audiences precisely and efficiently while driving revenue back to media companies.

“Our vision is to create a truly global, AI-driven advertising ecosystem that benefits both advertisers and media companies. We’re just getting started, and the potential for growth and innovation is enormous.”

This article was developed in collaboration with Tap, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.