Struggling IoT seller Quantify has made no money since it listed

Pic: Thinkhubstudio / iStock / Getty Images Plus via Getty Images

Since it listed in March 2017, Quantify has never made any sales revenue in spite of signing a series of agreements.

The Internet of Things (IoT) company today unveiled another quarter of zero sales receipts.

Quantify’s (ASX:QFY) income to date has been from government grants, tax rebates and an unspecified ‘other’.

The business had $178,000 left in the bank at the end of September, but has resolved that particular problem with another equity raising of $4m to continue marketing its household Internet-connected devices management system.

It’s raised $14m from shareholders to date including the pre-backdoor listing raise.

Many deals few purchases

Quantify has signed a range of agreements but few have been for purchases.

A Quantify spokesperson told Stockhead the reason they’ve been unable to secure only one purchase agreement in the 18 months since listing is “the development has taken longer to work through the various levels of approval than originally anticipated”.

One of the first deals was in July last year with a South Australia property development project. This year, late in September, Quantify said the developer confirmed a first purchase of $736,000 to cover 100 houses.

The company says it could potentially sell more if the developer decides to extend the technology over the rest of the development. They even put a $2m revenue target on that potential, although they gave no indication as to whether a second contract would be forthcoming.

The spokesperson said a development timeline hadn’t yet been finalised but they hope to see the money in 12-18 months.

The company said in a statement that installation won’t start until sometime before June next year.

In October last year Harvey Norman’s commercial arm started selling the devices to property developers.

At the time future revenue from this arrangement was pegged to arrive in three to five years.

The company has since announced a range of collaborations, distribution arrangements, and MoUs, but no new commercial deals until mid-October this year.

It did a reseller deal with a Perth company called Powerhouse Home Automation Group.

Quantify initially said it expected sales of over $2m in five years, but later said it had no reasonable basis for the figure. It also said that if no contracts are made within 12 months, the deal was off.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Quantify has struggled to keep directors this year.

Chairman Aidan Montague resigned in May. His successor Lee Christensen and another board member who was appointed in May both resigned in September.

The company made a full year loss in 2018 of $6.8m, but still paid its board $1.1m.

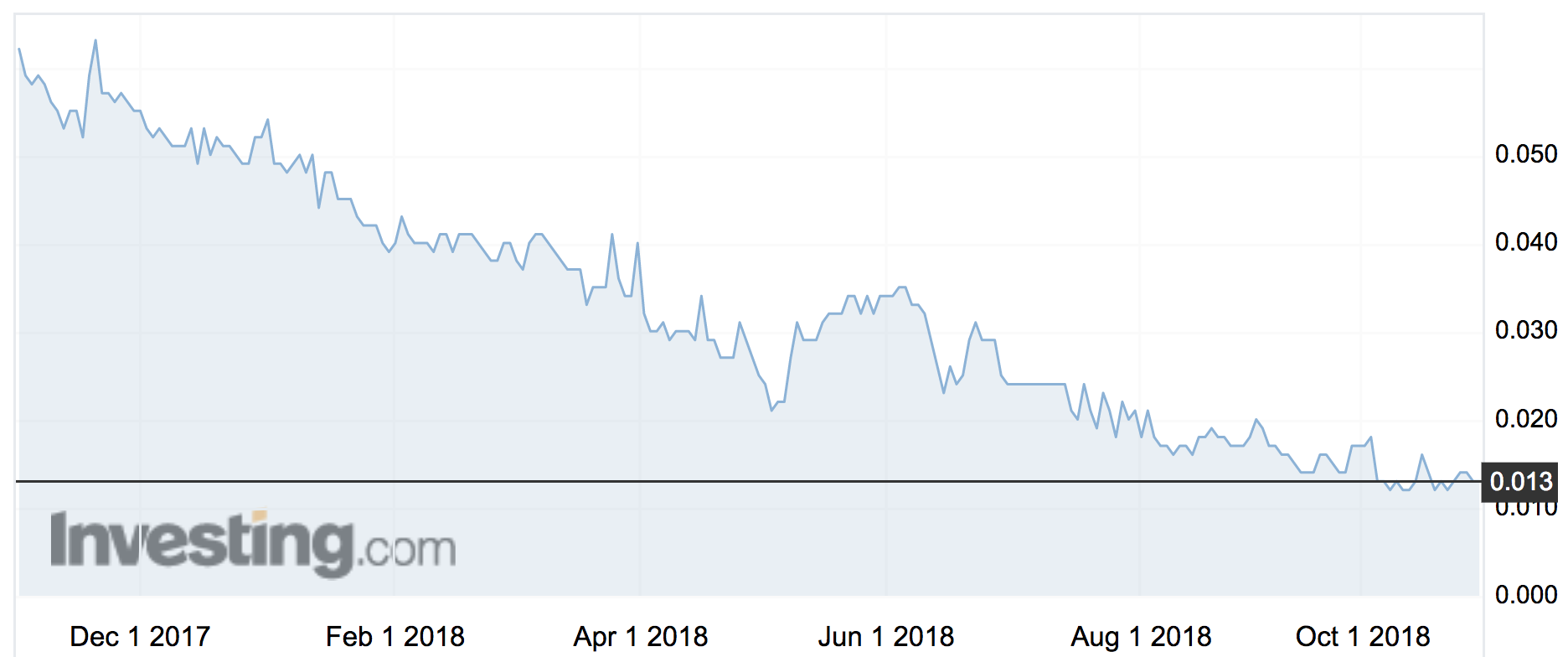

Quantify’s share price has been on a downward run for the last 12 months, currently just off annual lows at 1.3c.

The 52-week low is 1.1c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.