‘Stop relying on handouts’: Tech boss fires warning as Aussie innovation slips

Tech

Tech

Companies need to start funding their own research and development and stop relying on government handouts, the boss of one of Australia’s biggest tech companies warns, as innovation spending dives against global rankings.

Ed Chung, the chief executive of TechnologyOne – a Brisbane-based software giant with a market value of $10.25bn, more than Ansell and Lendlease combined – says businesses “should open minds, not palms”.

He said TechnologyOne spent 25 per cent of its annual revenue – which totalled $506.5m last year – on R&D, performed in-house by its team of about 400 developers and engineers.

“Australia’s worsening R&D crisis paints a grim picture – a 15-year slide in R&D expenditure from 2.7 to 1.6 per cent of GDP, which is 60 per cent below the OECD average,” he said.

“These bleak results should be a wake-up call across every boardroom in Australia, yet the first reaction from key parts of the business community was to once again call for government to solve the problem, as though government were the only answer to the challenge.”

Neither Labor nor the Coalition have proposed lowering the company tax rate, despite US President Donald Trump vowing to cut it to 15 per cent in the US, prompting the Business Council of Australia to call on the government to immediately raise the cap on R&D incentives from $150m to at least $250m “so private companies, not government, can invest more in Australia”.

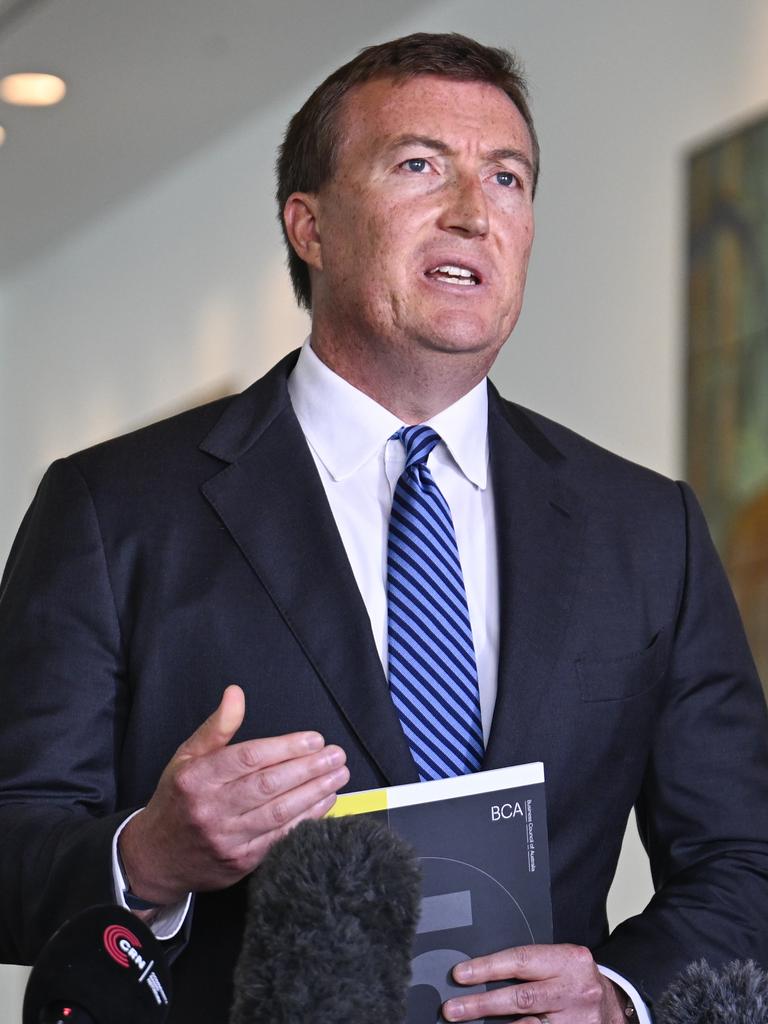

BCA chief executive Bran Black said Australian jobs and investment could be lost overseas unless there were immediate changes to R&D rules, with the goal of growing innovation spending from 1.7 to 3 per cent of GDP.

“We need to create market incentives for non-taxpayer-funded research, so businesses aren’t actively disincentivised from doing more R&D in Australia,” Mr Black said. “Abolishing the R&D expenditure threshold would create a better incentive for investment and help Australia catch up to the rest of the world.”

Tech Council of Australia chief executive Damian Kassabgi is also calling for changes in the way superannuation funds invest, as well as policy changes that offer tax incentives to not only start-ups but companies that are scaling up.

He said if Australia could lift R&D spending to 4.6 per cent of GDP, it would inject an extra $38bn worth of productivity gains into the national economy by 2035. That number would rise to $167bn if tech investment rose to 6.9 per cent of GDP.

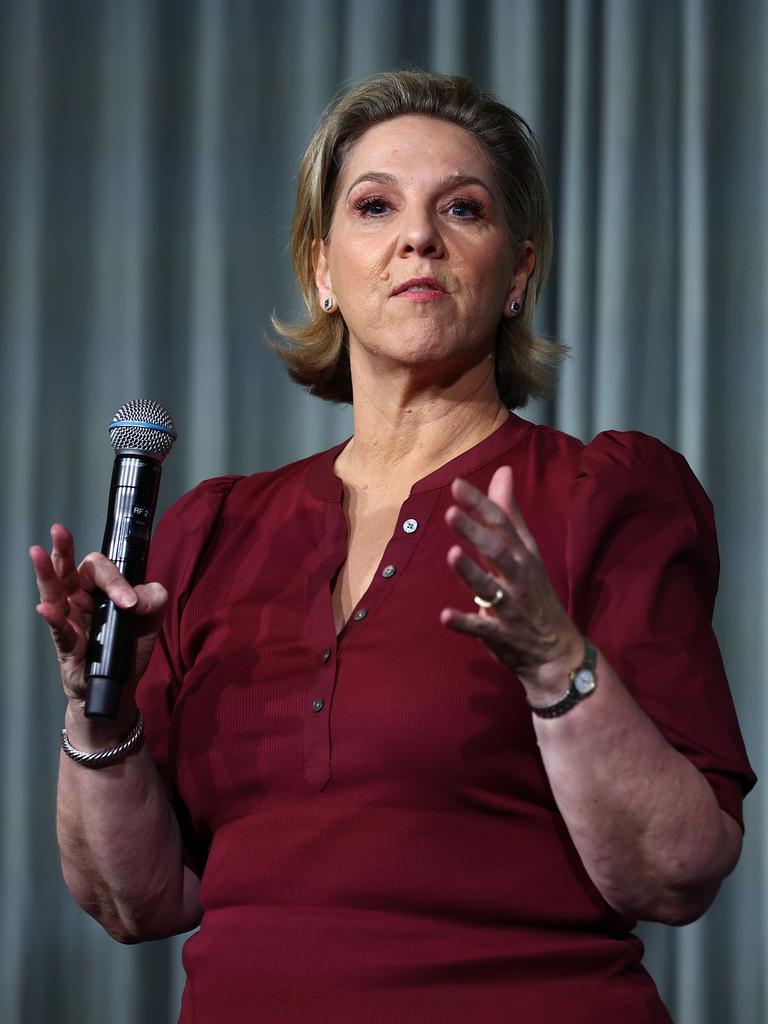

But Industry and Science Minister Ed Husic has rejected calls to ramp up tax breaks that encourage businesses to undertake R&D, saying: “I don’t need a tax incentive to brush my teeth.

“I don’t think they should just say: ‘We’re not investing in R&D unless we have a tax incentive’.”

Mr Chung said the “elephant in the room is why more Australian businesses do not value R&D as the foundation for their ongoing success and growth.

“We do not choose to invest because we are chasing a government handout, but because innovation is our greatest competitive advantage,” he said.

“Our R&D investment focus has a clarity and risk appetite that those in the public sector cannot be expected to have, namely, what can we do to improve our software to save our customers time and money.

“That is the practical, result-focused mindset we need across the business and research community if we are going to get back on the pace, and even potentially lead the world.”

TechnologyOne shares have soared more than 90 per cent in the past year and almost quadrupled in the past five years. It has delivered consistent profit growth of about 10-15 per cent each year.

Mr Chung said too many Australian companies have become reliant on government incentives and grants.

“In the absence of more handouts, we’ve seen a decline in business R&D investment, leaving the research community to bear the brunt of the blame when it comes to Australia’s diminishing global standing as R&D innovators.

“We have a multicultural and diverse society which supports the generation of challenging ideas. We have strong and established world-class higher education institutions. And we have had a series of programs over time to encourage business engagement in research, from the Co-operative Research Centres program to the R&D Tax Incentive.

“What we don’t seem to have cracked is how to create a mindset across the business community so hungry for innovation as a competitive edge that most businesses will take the risk and invest heavily in it.”

Mr Chung said Australia needed to “move beyond an incentive-led culture” and the government’s review was an “opportunity for the business community to demonstrate its ability to open minds, not palms”.

“Many in the business community vocally opposed attempts by the previous government to reform the RDTI (R&D tax incentive) to get better value for taxpayers. The cost of the scheme has grown from about $3bn in 2021-22 to about $4.5bn, while Australia has slid down the global R&D ranks. That does not look like value for money.”

Mr Chung said the government’s review can’t “fall into the same trap” of blaming researchers for not understanding what businesses and consumers want.

“It is our job as industry leaders to work with the researcher, and to anticipate and respond to the business opportunity. This is what a true ‘Made in Australia’ looks like, which will help to reverse Australia’s fortunes as R&D leaders, and ensure we become creators and not just adopters of information technologies.”

This article first appeared in The Australian.