STAR Water plans to tap growing ESG sentiment with its stormwater recycling tech

Pic: Yuichiro Chino / Moment via Getty Images

With increasing pressure on governments globally to address climate related issues, investor appetite for ‘green’ stocks has well and truly gained momentum.

One company aiming to tap into the growing market sentiment towards environmental, social, and corporate governance (ESG) factors, and ethical investing more broadly is Sydney based company STAR Water, which plans to list on the Sydney Stock Exchange under the ticker SWG.

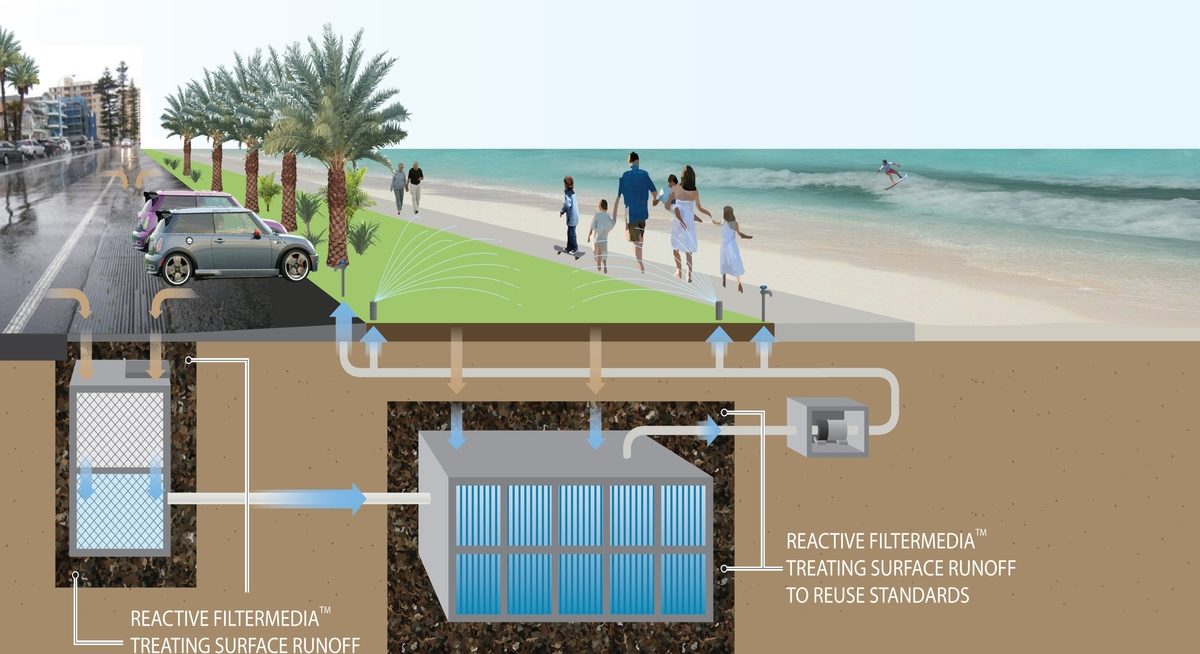

STAR Water has developed a process by which recycled materials are examined through the company’s patented Kalkulus computer modelling tool to solve community issues such as waste management, water scarcity and water contamination.

By using advanced bio-filtration technologies and systems, these recyclable products work to remove pollutants such as heavy metals, toxic compounds, and micro plastics from stormwater to protect water ways and capture run off from urban, industrial, agricultural and mining environments.

Listing on the SSX at the perfect time

Speaking with Stockhead, chief executive officer Chris Rochfort said that while the technology has been developed over a 20-year period in collaboration with multiple universities and research centres, STAR Water has positioned itself to list at what it believes is the perfect time.

“There has been a major shift in the financial markets over the last two years to recognise green technologies and ESG requirements,” Rochfort said.

“It has been very sudden in the scheme of things, but we’ve noted that shift and we’ve thought the right time is now.

“Plus, also the Sydney Stock Exchange is aligned with the UN Sustainable Stock Exchanges program, which entices investors to invest in green stocks and that has been a major driver.

“If we listed too early the market wouldn’t have been ready, the regulatory settings wouldn’t have been in place, but now the timing is right, and we’ve got the perfect story.

“We solve multiple community issues starting with waste and water security where our systems can capture water, clean it up and make it available for reuse as supplemented water supply in cities around the world.”

Springboard to the ASX

Ultimately, STAR Water sees listing on the SSX as a springboard to the ASX with multiple raises anticipated as the company scales up.

With clients around the world spanning Australia, South-East Asia and the US, the company aims to list in late October through the issue of 5 million shares at 0.20 cents per share to raise $1 million.

Funds will be used to hire marketing, project management, and fulfilment staff to secure more large-scale projects, which will allow STAR Water to sell the technology to more clients.

The company is already working with key developers, cities and utilities in the green infrastructure and the blue economy space to get these projects off the ground.

ASX water-tech stocks

| CODE | COMPANY | PRICE | 1 MONTH RETURN | 6 MONTH RETURN | 1 WEEK RETURN | 1 YEAR RETURN | MARKET CAP |

| DEM | De.Mem Ltd | 0.29 | 12 | 7 | 7 | 21 | $ 62,828,665.88 |

| FLC | Fluence Corporation | 0.19 | 1 | -18 | -1 | -15 | $ 115,597,996.29 |

| PO3 | Purifloh Ltd | 1.6 | 39 | 55 | 7 | 25 | $ 50,437,596.80 |

| RWL | Rubicon Water | 1.66 | -7 | $ 293,064,102.32 | |||

| SDV | Scidev Ltd | 0.8 | -11 | 13 | -7 | 20 | $ 130,489,258.44 |

| SRL | Sunrise | 1.61 | -5 | -33 | -2 | -38 | $ 146,794,342.77 |

| D2O | Duxton Water Ltd | 1.43 | 1 | 6 | 3 | 10 | $ 170,772,066.98 |

With an increasing global population, demand for water should continue remain strong well into the future.

Here are a few ASX water stocks making waves in the marketplace.

Purifloh has gained 39% over the last month and at the time of writing the share price was $1.65.

The company is developing its Free Radical Generator (FRG) technology for a range of applications across three segments: water sanitation, indoor air purification, and medical sterilisation.

Back in June the company claimed its Free Radical Generator (FRG) technology could “deliver the assurance of best-in-class air and conditioning surface disinfection, capable of destroying 99.99% of viral and bacterial contaminants”.

As a result, its share price gained almost 7pc on the day of the release, where it continued to surge $1.99 before the plug was pulled.

DEM, short for Decentralised Membranes, is an Australian-Singaporean water and waste-water treatment business that designs, builds, owns, and operates turn-key water and wastewater treatment systems for its clients.

Its IP-protected technology essentially filters and blocks unwanted constituents from water by using nano-sized pores in the membranes’ structures.

Earlier this month it launched a new proprietary graphene oxide-enhanced membrane technology with the potential to disrupt the existing global market for hollow-fibre membranes, which is expected to grow from US$9.4 billion to US$16 billion by 2026.

Other notable stocks include Duxton Water (ASX:D20), who owns and manages a portfolio of water rights in Australia, providing the irrigation community with a broad range of water supply solutions.

At the time of writing D20 shares were trading at $1.43.

And Fluence Corp (ASX:FLC), a water tech company involved in the decentralised water, wastewater and reuse treatment markets, with its Smart Products Solutions, including Aspiral, NIROBOX and SUBRE.

The cleantech has seen major progresses in China, Southeast Asia, and the Middle East for its water solutions over the past year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.