Some businesses are now facing an annual $130m cybersecurity bill. These ASX stocks could benefit

Pic: Yuichiro Chino / Moment via Getty Images

Almost 75% of Australian businesses experienced as many as 10 cyber incidents or breaches over the last year, according to a survey of 600 global executives by Deloitte.

The Future of Cyber report found that 40% of respondents experienced an increase in threats to their organisations during the COVID-19 pandemic.

Statistics echoed by the Australian Cyber Security Centre (ACSC), which received more than 67,000 cybercrime reports during the 2020-21 financial year, an increase of nearly 13% from the previous year

And self-reported losses from cybercrime totalled more than $33 billion.

But despite the increased risk of cyber-attack, 93% of Australian respondents were still committed to investment in digital transformation – including moving their financial systems or Enterprise Resource Planning (ERP) to the cloud.

Remote and hybrid working increases risk

The report flagged that the shift to remote and hybrid working by Australian business has intensified the cybersecurity risk.

More than 40% of Chief Information Officers (CIOs) and Chief Information Security Officers (CISOs) surveyed acknowledged the challenge of balancing investments in digital transformations to remain competitive while protecting their systems from potential breaches.

“Businesses across Australia – whether in financial services, health care, or the public sector – are on a fast-tracked path of digital transformation and cloud migration,” Deloitte Australia cyber lead Ian Blatchford said.

“Now more than ever, responsibility needs to shift upwards.

“Organisations that don’t incorporate cybersecurity into every aspect of their business risk increases to their vulnerability to attack, so it’s critical to have visibility to manage that risk, balance proactive and reactive responses, and to fully empower the CISO.”

Organisations increasing their cyber defence budgets

Deloitte said that as the sophistication of cyber criminals grows, organisations are more inclined to increase their cyber defence budgets.

Almost 75% of leaders with more than $40 billion in revenue reported they will spend more than $130 million on cybersecurity protections this year.

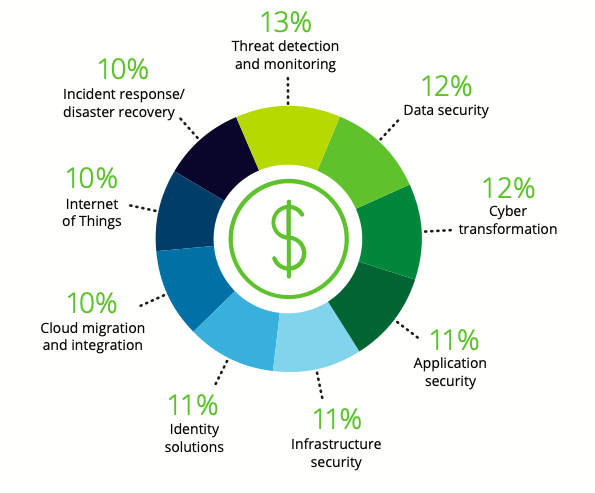

And CIOs and CISOs flagged that they would be paying particular attention to threat intelligence, detection, and monitoring, cyber transformation and data security.

Respondents ranked security capabilities (64%), enhancing privacy capabilities (59%), demonstrating compliance capabilities (50%), and improving business efficiency and intelligence (45%) as the drivers for their adoption of emerging technologies.

Here are some of the cyber security players who could be set to benefit:

| Code | Name | Last | %SixMth | %Mth | %Wk | Market Cap |

|---|---|---|---|---|---|---|

| CPT | Cipherpoint Limited | 0.042 | 83 | 56 | 31 | $ 13,975,773.73 |

| FZO | Family Zone Cyber | 0.63 | 29 | -9 | 6 | $ 446,553,679.32 |

| SOV | Sovereign Cloud Hldg | 0.635 | -16 | -3 | 4 | $ 32,540,296.38 |

| HWH | Houston We Have Ltd | 0.14 | 49 | -15 | 0 | $ 51,263,252.69 |

| FCT | Firstwave Cloud Tech | 0.091 | 11 | 30 | -2 | $ 68,476,360.41 |

| ELS | Elsight Ltd | 0.375 | -5 | -14 | -3 | $ 50,003,093.25 |

| TNT | Tesserent Limited | 0.185 | -8 | -18 | -3 | $ 230,081,761.79 |

| WHK | Whitehawk Limited | 0.14 | -28 | -22 | -3 | $ 31,790,435.88 |

| SEN | Senetas Corporation | 0.042 | -11 | -13 | -5 | $ 47,614,563.88 |

| FFT | Future First Tech | 0.04 | -42 | -9 | -5 | $ 18,349,378.56 |

| VOR | Vortiv Ltd | 0.04 | 0 | -17 | -7 | $ 5,902,023.25 |

| PRO | Prophecy Internation | 1.15 | 117 | 28 | -9 | $ 86,837,302.12 |

| SPA | Spacetalk Ltd | 0.2 | 29 | -2 | -11 | $ 37,118,769.55 |

| AR9 | Archtis Limited | 0.235 | -2 | -23 | -15 | $ 54,912,534.37 |

Last week the company’s cyber security subsidiary Brace138 secured a three-year contract with software and technology services company Sandstone Technology Pty Ltd whose products are aimed at digital lending, digital customer acquisition and digital banking.

Brace138 also signed a two-year $720,000 contract with Ingenia Communities Group (ASX:INA) to provide a Managed Detection and Response (MDR) solution.

And last month the subsidiary entered a three-year Master Services Agreement (MSA) with Vocus worth $772,000 to build a sophisticated detection capability and integrating with the security team at Vocus to deliver best-in-class incident response service.

Family Zone Cyber Saftey (ASX:FZO)

The school cyber safety provider grew annual recurring revenue by $2.5 million to $46 million in the September quarter – and said it now services 9.78 million students and 19,278 schools across the group.

That works out to more than 9.5% of US school districts and 38% of the UK schools.

FZO aims to integrate products and cross-sell Smoothwall and Linewize products into each customer base.

Plus, it’s planning to launch Monitor in the US with a pipeline exceeding $1 million and expects to launch Linewize’s Classwize offering into the UK in March quarter 2022.

Soverign Cloud Holdings (ASX:SOV)

The company (trading as AUCloud) generated over a million dollars in revenue for the first time in the September quarter of $1.06 million.

It also nabbed certification as a “Certified Strategic” Cloud Services Provider under the DTA’s Hosting Certification Framework (HCF), as well as Assessment and Authorisation Framework (CAAF) Authority to Operate – with no data leaving Australian shores or being subject to other nation’s legal jurisdiction.

“No other Cloud Services Provider that we are aware of has yet to secure both the HCF Certified Strategic and CAAF Phase 2 Authority to Operate,” managing director Phillip Dawson said.

“We expect these standards to be increasingly formalised within Commonwealth Government procurement requirements.”

The AI company has rebranded to ECHO IQ to reflect its strategic focus on prioritising the med tech, health analytics and defence sectors, subject to shareholder approval at the upcoming AGM.

ECHO IQ will remain focussed on the design and implementation of disruptive new cardiac-diagnostic technologies powered by big data and artificial intelligence.

The Prometheus business stream will focus on predictive analytics in customer, provider and business-operating decision making.

Plus, its augmented intelligence software Intelfuze will be deployed to maximise the predictive capability and power of ECHO IQ and Prometheus – as well as defence and intelligence organisations already well suited to use of the software’s core capabilities.

Firstwave Cloud Technology (ASX:FCT)

Late last month the company launched CyberCision, which it says is the most transformational technology upgrade, to provide world-first cyber protection for vulnerable small-to-medium businesses (SMBs).

“Until now, cybersecurity for the SMB market has been a tangled web of services from different providers, involving significant up-front investment and complexity that SMBs simply cannot afford,” FirstWave executive chairman John Grant said.

“The launch of FirstWave’s upgraded CyberCision platform changes all of that, by enabling service providers to deliver world-class cybersecurity protection at scale, behind one pane of glass, at low cost.

“We have listened to our partners and developed CyberCision to make frictionless cybersecurity protection simple and affordable for SMBs and profitable for service providers for the first time globally.”

The AI powered drone connectivity solutions company partnered with US Tech Data Corporation last quarter as a lead distributor for Elsight sales in North America.

Elsight has been added to the Tech Data catalogue and ordering system with sales personnel approaching Tech Data’s main broadband solution resellers to drive Halo drone connectivity product awareness and first sales through the channel.

Plus, Tech Data has merged with Synnex, to form TD SYNNEX (NYSE:SNX), and Elsight expects similar activities to be initiated with Synnex personnel in the short to medium term.

Cybersecurity firm Tesserent reported turnover of $26.9 million and year-on-year growth of 78% in its September quarterly and has eyes on the #1 cybersecurity provider spot in Australia.

The company is focused on exploring international expansion opportunities with Australia’s key Five Eyes allies, which consists of the USA, UK, NZ and Canada.

Tesserent is also aiming to capture further market share in three key markets: Government (including defence), critical infrastructure and industry and financial services.

Last quarter Whitehawk secured a 2nd year contract extension from the US Department of Homeland Security (DHS) CISA QSMO Cybersecurity Marketplace, as a sub-contractor to Guidehouse for US$1.5-$1.8 million.

The company also executed option Year 1 of 4 as prime contractor on US Federal Government CISO Cyber Risk Radar for up to US$1.18 million annually.

Active government opportunities include NAVINTEL, US Dept of Navy, Open-Source Cybersecurity Small Business Sources, US Dept of Treasury Small Business Cyber Security Assessment RFI, and Cyber Risk Radar Proof of Concept for a US State Government CISO.

Senetas provides high-performance network encryption to secure file-sharing collaboration and anti-malware applications, with its solutions distributed and supported internationally by Thales – the world’s largest security company.

The company’s encrypted file-sharing and collaboration application, SureDrop, provides the information security and data sovereignty control essential in today’s world of rapidly growing remote work.

And Secure File Gateway by subsidiary Votiro prevents crippling malware and zero-day attacks such as ransomware and viruses.

Last month the company secured its first contract win in Western Australia with Main Roads where it will work with Venture Smart on the Statewide Electrical Infrastructure Services Contract.

Venture Smart is a joint venture between Ventia and Johnson Controls – who are listed on the NYSE with a market capitalisation >US$50 billion with more than 100,000 employees worldwide.

As a JV partner in Venture Smart, this contract will see Future First’s Asset Vision Platform being used by a number of Johnson Controls’ workforce in Australia, expanding the global reach of organisations being exposed to Asset Vision.

Late last year the company sold Decipher Works, a cyber security specialist, and Cloudten Industries, a cloud and cloud security specialist.

The company sold the shares for $25 million, with profit on the sale of $9.7 million providing Vortiv the capacity to return $7.8 million to shareholders as a fully franked dividend and $14.1 million as capital.

The company still holds a 24.89% investment interest in Transaction Solutions International (India) and is seeking acquisition opportunities.

Prophecy International (ASX:PRO)

The company raised $7.7 million last month to build on current sales momentum with the company’s eMite and Snare products.

CX Intelligence by eMite provides a SaaS-based real-time and historical analytics platform, dashboards, wallboards, KPI and orchestration products for customer experience, contact centre environments.

The Snare product suite is a highly scalable platform of centralised log management and security analytics products designed to enable customers to detect and manage cyber threats in real time and maintain regulatory compliance.

Earlier this month, the company announced Big W will be stocking its Spacetalk Adventurer smartwatches across 50 Australia stores and online.

The smartphone GPS watch for children is built with tailored features, design qualities and “best practice data encryption, security and privacy technologies, for families to stay confidently connected,” the company says.

Big W is targeting to launch in store in November, 2021.

In October archTIS nabbed a $449,000 contract with an Australian national intelligence and law enforcement agency for the deployment of technology from partner Okera’s universal data authorisation platform.

Through the partnership, the company can now resell and provide the Okera Dynamic Access Platform (ODAP) to support enterprise, government and defence clients in Australia with the ability to securely access sensitive structured data such as records or transactions in a database.

“Combined, we can provide an end-to-end solution for granular, zero-trust data access control to ensure all of our joint customers’ data – from structured to unstructured – is protected,” archTIS MD Daniel Lai said.

In early November, archTIS also began trading on the OTCQB Market in the United States and on the 12th of November announced a placement and SPP to raise up to $8 million.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.