Shares up 240pc. That’s the kind of thing Microsoft can do for a small cap

Pic: Getty

Microsoft New Zealand will start selling 9Spokes’ (ASX:9SP) software-for-SMEs to banks around the world, and the company’s stock has gone wild.

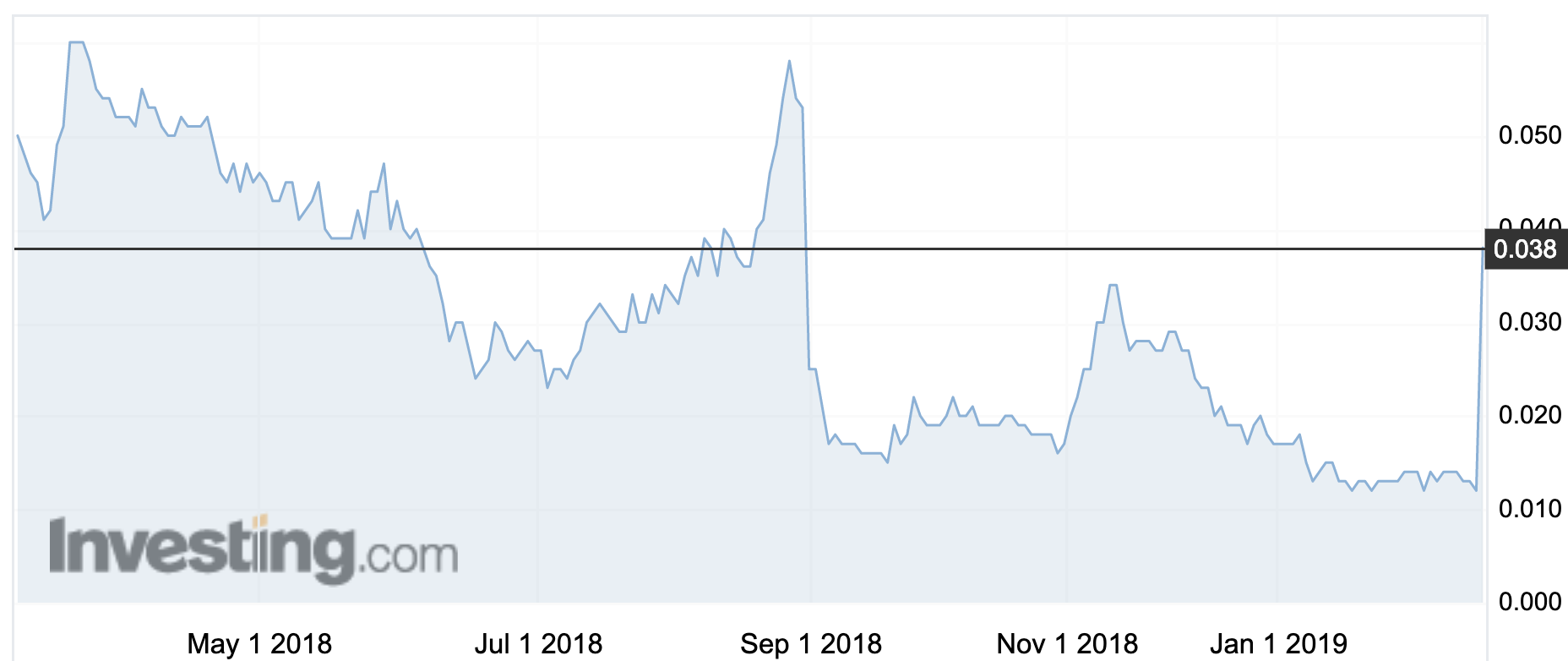

9Spokes started from a low base — it closed at 1.2c on Thursday — and rose 241 per cent to a high of 4.1c on Friday.

The company, which is still only worth about $19m even after that jump, has been approved as a ‘One Commercial’ partner by Microsoft and as a listing on the multinational’s app marketplace.

But unlike most app approvals, which often just see a company added as one of many into a giant global marketplace, Microsoft will co-sell, co-build and co-market the software to clients.

9Spokes’ software aggregates apps used by small businesses, such as payroll and accounting, so users can see all of the data on one platform. It sells to small businesses and a white label version to banks.

It already has several banking customers, including Barclays and Bank of New Zealand, and the Microsoft deal will allow it to sell into tier 2 banks.

The arrangement is through Microsoft’s co-selling programme which was set up in 2017, the idea being to cherry-pick good products and companies, boost their reach and ultimately make a pile of money for the leviathan and the small fry.

The stock fell back slightly by midday to 3.8c. The stock plunged in August when the company said a deal with Royal Bank of Canada (RBC) had fallen over, after the bank decided it wanted a change in “strategic direction”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.