September Tech Winners: ASX tech sector up 7.42pc, still top YTD

Pic: Getty Images

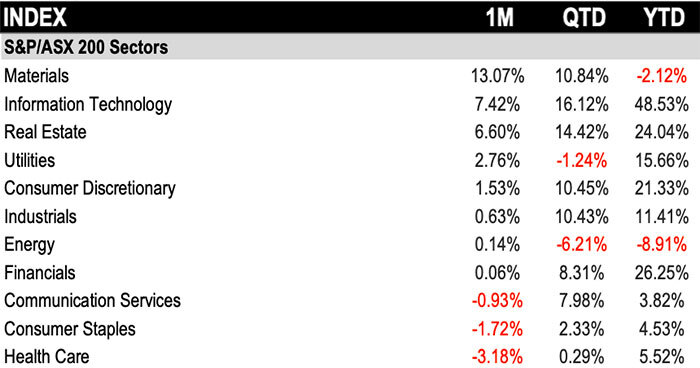

- The S&P/ASX 200 Information Technology sector rose 7.42% in September and leads ASX sectors YTD, up 48.53%

- Global X said there was a clear shift to lagging software sub-sector as investors look beyond outperforming hardware names

- Envirosuite tops winners board in September up 84% after Hitachi Construction Machinery invests $10m to be largest shareholder

The S&P/ASX 200 Information Technology sector rose ~7.42% in September in what was a strong month for global markets and is up 48.53% YTD to remain the top-performing sector of 2024.

The US Nasdaq Composite index – the bellwether for the global tech sector – was the best performer of the major US indices in September but trailed the Aussie sector to rise 2.7%.

The Nasdaq had a rough start to September in what is historically the weakest month for the stock market, however, rebounded when the US Federal Reserve cut interest rates by 50bps.

Global X investment strategist Billy Leung told Stockhead software carried the weight in September up 3%, while hardware remained flat.

“This follows a similar pattern from August, particularly after [an] August 5 volatility event, which reset the market’s expectations,” he said.

Leung said the market continues to maintain a positive sentiment towards innovation but there was clear shift as the trade broadens into lagging sub-sectors like software, which had shown resilience in the face of ongoing tech momentum.

“This rotation reflects a renewed interest in areas that had previously underperformed, as investors look for opportunities beyond the outperforming hardware names,” he said.

The top ASX tech winners in September

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| EVS | Envirosuite Ltd | 0.079 | 84% | $108,434,687 |

| RKT | Rocketdna Ltd | 0.015 | 67% | $9,185,608 |

| YOJ | Yojee Limited | 0.083 | 66% | $22,006,811 |

| NOV | Novatti Group Ltd | 0.078 | 56% | $29,527,287 |

| FCT | Firstwave Cloud Tech | 0.028 | 47% | $47,880,542 |

| FBR | FBR Ltd | 0.05 | 47% | $241,219,867 |

| NXL | Nuix Limited | 6.56 | 42% | $2,086,157,080 |

| EIQ | Echoiq Ltd | 0.225 | 41% | $126,532,024 |

| ASV | Asset Vision Co | 0.028 | 40% | $21,354,485 |

| BRN | Brainchip Ltd | 0.235 | 38% | $382,681,255 |

| AJX | Alexium Int Group | 0.011 | 38% | $17,312,666 |

| 8CO | 8Common Limited | 0.041 | 37% | $9,187,891 |

| SEN | Senetas Corporation | 0.023 | 35% | $40,853,367 |

| JCS | Jcurve Solutions | 0.031 | 35% | $9,910,303 |

| PHX | Pharmx Technologies | 0.047 | 34% | $28,129,819 |

| BTH | Bigtincan Hldgs Ltd | 0.16 | 33% | $131,468,149 |

| CT1 | Constellation Tech | 0.002 | 33% | $2,949,467 |

| SIS | Simble Solutions | 0.004 | 33% | $2,260,352 |

| SNS | Sensen Networks Ltd | 0.051 | 31% | $41,237,949 |

| BEO | Beonic Ltd | 0.03 | 30% | $18,906,910 |

| ELS | Elsight Ltd | 0.425 | 29% | $66,592,605 |

| ACE | Acusensus Limited | 0.83 | 28% | $101,871,708 |

| RUL | Rpm Global Hldgs Ltd | 3 | 26% | $677,586,929 |

| SPX | Spenda Limited | 0.01 | 25% | $50,639,555 |

| ASB | Austal Limited | 2.91 | 25% | $1,025,844,328 |

Envirosuite (ASX:EVS) topped the tech winners board in September, up 84% with the company announcing Hitachi Construction Machinery was investing $10m, buying about 12% of its shares and becoming its largest shareholder.

EVS said Hitachi – a major construction machinery firm – would use its global presence and industry knowledge to boost the company’s market opportunities.

RocketDNA (ASX:RKT) rose 67% in September with the company announcing it had signed two significant contracts for its xBot surveillance model (PatrolBot) with SSG Security Solutions.

The contracts involve the deployment of PatrolBot units across several mining sites for the monitoring and reporting of defined areas using drone or unmanned technology for the purpose of security overwatch and intelligence gathering.

Fintech Novatti (ASX:NOV) was up 56% in September and got hit with a please explain from the ASX. NOV responded it was unaware of any specific reason for the recent trading in its securities other than “continued successful execution of the company’s strategy to simplify its business and lift financial performance, demonstrated through recent announcements to ASX.

The company said this included release on August 30 of the unaudited FY24 results, which highlighted significant year-on-year improvements, including a 10% increase to revenue, a 19% decrease in operating expenses and a 16% improvement in underlying EBITDA.

Leung said Nuix (ASX:NXL) had its investor day on September 3, where it outlined its growth strategy, including the goal to increase annual contract value by 15%.

“Additionally, the company saw growing demand for their Nuix Neo platform, which addresses unstructured data challenges,” he said.

“These developments drove investor confidence, along with an initiation report by Jefferies with a buy rating with a target price of $6.10 and ongoing positive broker sentiment with upwards earnings revision.”

BrainChip Holdings (ASX:BRN) rose 38% in September after announcing a strategic partnership with a leading automotive manufacturer to integrate its Akida neuromorphic processor into advanced driver-assistance systems.

Leung said it highlights BRN’s expansion into the auto sector and growing demand for energy-efficient AI solutions in edge computing.

Austal (ASX:ASB) rose 25% received a significant submarine contract worth US$450m on September 16 to expand its submarine module production capacity, which strengthens its position in the US defence sector.

The top ASX tech losers in September

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | $611,622 |

| VR1 | Vection Technologies | 0.008 | -38% | $10,612,712 |

| IXU | Ixup Limited | 0.015 | -35% | $23,216,289 |

| FGL | Frugl Group Limited | 0.015 | -35% | $1,573,629 |

| 3DP | Pointerra Limited | 0.049 | -27% | $39,448,763 |

| LNU | Linius Tech Limited | 0.0015 | -25% | $11,730,481 |

| PIL | Peppermint Inv Ltd | 0.006 | -25% | $14,849,508 |

| NVU | Nanoveu Limited | 0.018 | -25% | $10,603,376 |

| TZL | TZ Limited | 0.019 | -24% | $4,361,913 |

| W2V | Way2Vatltd | 0.01 | -23% | $8,122,541 |

| DUG | DUG Tech | 2.53 | -21% | $289,402,296 |

| ZMM | Zimi Ltd | 0.009 | -21% | $1,139,982 |

| XPN | Xpon Technologies | 0.008 | -20% | $2,899,532 |

| SMP | Smartpay Holdings | 0.935 | -19% | $227,426,856 |

| XF1 | Xref Limited | 0.15 | -19% | $28,362,490 |

| MP1 | Megaport Limited | 7.32 | -19% | $1,200,839,093 |

| LIS | Lisenergylimited | 0.115 | -18% | $73,623,026 |

| BCC | Beam Communications | 0.14 | -18% | $12,099,069 |

| IS3 | I Synergy Group Ltd | 0.005 | -17% | $1,781,089 |

| SMN | Structural Monitor | 0.58 | -17% | $79,668,250 |

| EML | EML Payments Ltd | 0.65 | -16% | $247,030,375 |

| OPL | Opyl Limited | 0.017 | -15% | $2,902,149 |

| HTG | Harvest Tech Grp Ltd | 0.018 | -14% | $13,884,625 |

| ID8 | Identitii Limited | 0.012 | -14% | $7,156,683 |

| FLX | Felix Group | 0.16 | -14% | $32,719,954 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.