Secos is still chasing its bio-plastic dream, but the transition is taking time

Pic: nespix / iStock / Getty Images Plus via Getty Images

Biodegradable plastics maker Secos is up and running with a brand new Malaysian factory — but the cash is not yet flowing in.

Secos (ASX:SES) saw quarterly customer receipts drop from $7 million in the June quarter to $5.7m in the three months to September.

Secos is shifting to become a maker of biodegradable resin — the stuff bio-plastic bags are made from.

Under a 2015 merger Secos combined its traditional plastic film business (which still makes up the bulk of customers) with a bioplastics business.

But Secos is still working on the transition.

The traditional business of making films for sanitary products has flatlined, while the smaller bio-resin business is booming. Bio-resin sales are expected to grow 90 per cent in the coming year to make up 40 per cent of sales.

An existing factory in China has been running at full-tilt all year and a new one in Malaysia started up in August to cater to a rapid rise in demand for resins. The Australian film-making business is under review and plans are afoot to shut it down entirely.

Chairman Richard Tegoni is seeing bioplastics demand in waste diversion and expects the next stage in demand will be films for sanitary products.

But there is still work to do.

Secos had a cash burn of $734,000 in the September quarter, largely due to manufacturing and staff costs.

They only had $522,000 left in the kitty at the end of last month and they’d used $5.5m worth of five different loans and convertible notes.

The company said it expects the sale of land in Malaysia to settle in November, leaving them with $1.3m less debt and $2m in cash.

It raised $941,135 of a $1.2m placement to sophisticated investors and hopes to raise $2.7m from retail investors.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Chairman Richard Tegoni says the result was reflective of the traditional plastics business, as most of their customers are based in Japan.

Those customers not only needed to trial films from the new Malaysia factory — they’ve approved it and have placed orders.

But they have also delayed new orders as they run down their existing stocks, because they don’t need to wait so long for delivery now that products are no longer coming from the shuttered Australian factory.

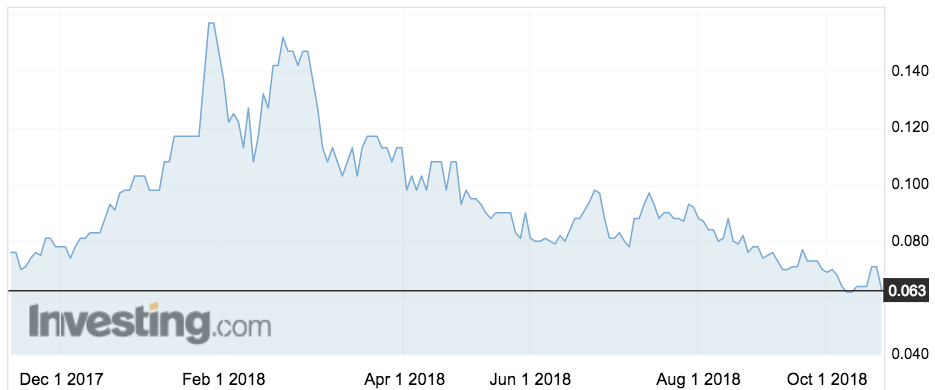

Secos shares remained flat at 63c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.