Room for one more? CBA launches new BNPL platform as competition intensifies

The BNPL sector is getting crowded in Australia. Picture Getty Images

Australia’s buy-now-pay-later (BNPL) industry is getting more crowded, with new platforms seemingly being launched almost every other week.

On Wednesday, the Commonwealth Bank (ASX:CBA) launched its new in-house BNPL platform, Step Pay, which will be offered alongside its other BNPL product, Klarna.

Step Pay splits repayments into four instalments for purchases between $100 and $1,000. It charges a late payment fee of $10, and can only be used with the CommBank app.

Of the Big Four banks, CBA has by far been the most successful when it comes to competing in the BNPL market.

In its full year results released last week, the bank valued its 5% stake in Klarna at $2.7 billion, a more than five-fold increase from the $506m valuation it reported in June 2020.

Interestingly CBA’s share price rose by almost 50% during that period.

But the competition has only just begun for the bank.

In response to the blockbuster deal between US giant Square and Afterpay (ASX:APT) a week earlier, CBA slashed its merchant fees on the Klarna platform – a move seen as an eventual race to the bottom in an increasingly cut-throat environment.

Square’s entrance into the BNPL scene is seen by some as throwing fuel to flame, with analysts saying that it could accelerate a stampede into the industry.

Will large players dominate?

As competition intensifies however, customer and merchant acquisition will become harder and more costly for the industry.

Because of that, some believe the BNPL sector will eventually be dominated by bigger, non-pure players such as banks, credit card issuers, or even payment companies who already have a large customer base.

These bigger players would be able to leverage their networks and payments systems to acquire new BNPL customers at a cheaper cost.

And that’s exactly what CBA and Square are banking on, offering BNPL services to millions of their already existing customers.

Paypal will no doubt leverage its 9 million customer base in Australia for its recently launched “Pay in 4” platform, while Citibank will be offering its new BNPL platform to millions of its Mastercard customers.

Will the other three big banks also join the BNPL fray?

Westpac already has a partnership deal with Afterpay, after selling its stake in Zip (ASX:Z1P) for a $48m profit.

But the bank said the deal is now under review, following Afterpay’s deal with Square.

National Australia Bank (ASX:NAB) refuses to gone all in, preferring instead to launch an interest-free credit card called StraightUp to attract millennial consumers.

ANZ Bank (ASX:ANZ) meanwhile, has been the most sceptical, with CEO Shayne Elliot saying that he isn’t at all keen on the BNPL hype.

Regardless, there is no denying the industry has changed the Australian consumer payments landscape, which was facilitated by mobile technology, innovative businesses and ironically, COVID-19.

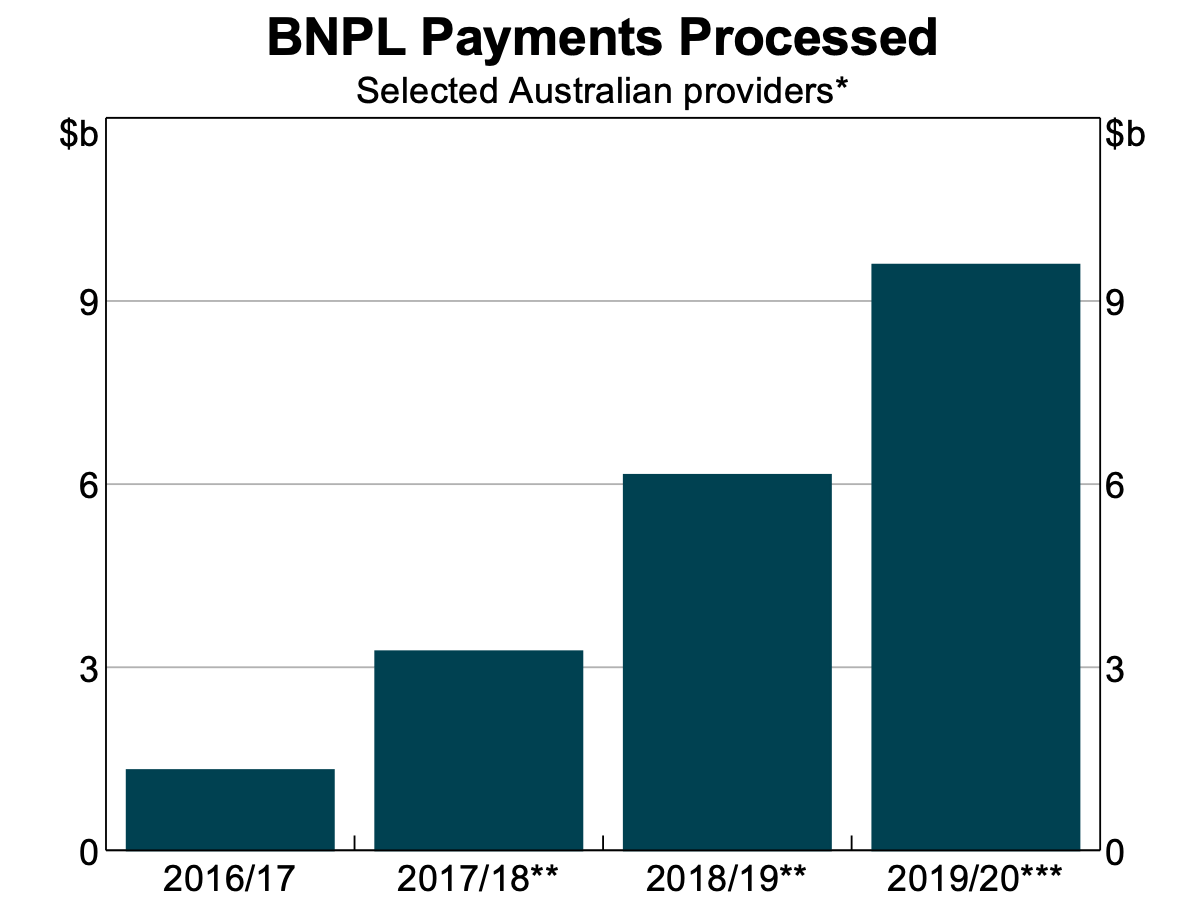

According to the latest RBA data, payments processed under BNPL terms have almost quadrupled since the industry first started in 2016.

Consolidation ahead?

With giants entering the industry, there are now question marks over whether the smaller BNPL players could survive.

“Afterpay will survive, Zip will survive and the rest will end up in a Hunger Games-style race to the death,” payment consultant Brad Kelly told Business Insider Australia.

Other analysts believe that coming regulations would be the final death knell for some of these smaller players.

Some have also suggested that Square’s decision to snap up Afterpay was a validation for the industry, which could open the floodgates to M&A activities in the sector.

Morningstar equity analyst Shaun Ler said: “I do expect this acquisition to fast track the consolidation process. Afterpay is going to get so powerful that its competitors won’t be able to keep up.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.