RocketDNA CEO explains why ‘drone-in-a-box’ is a game-changer for the company and drones industry

The ‘drone in the box’ is changing the game for the drones market. Picture Getty

- The ‘drone in the box’ is changing the game for the drones market

- RocketDNA’s CEO Christopher Clark explains big opportunities that lie ahead

- Are there other drone stocks on the ASX?

By 2030, the commercial drone market is projected to reach almost US$60 billion, driven by a steady Compound Annual Growth Rate (CAGR) of 7%.

Drones have rapidly become essential tools for businesses, and while some applications like aerial deliveries are still in their infancy, other uses have exploded globally.

In mining for example, drones are being used extensively to survey large tracts of land, capture aerial images, and collect data from areas where traditional methods may not be feasible.

The CEO of drones company RocketDNA (ASX:RKT) (formerly Delta Drones ), Christopher Clark, said that while people have seen drones before, most never really understood how they could be applied in business.

“That was always the hardest thing, I guess, to try to get investors’ heads across that you can make real, serious money with drones,” Clark told Stockhead.

Clark said the drones market is now developing through what he calls ‘a second wave of technological advancement’, which has led to the ‘drone in the box’ phenomenon.

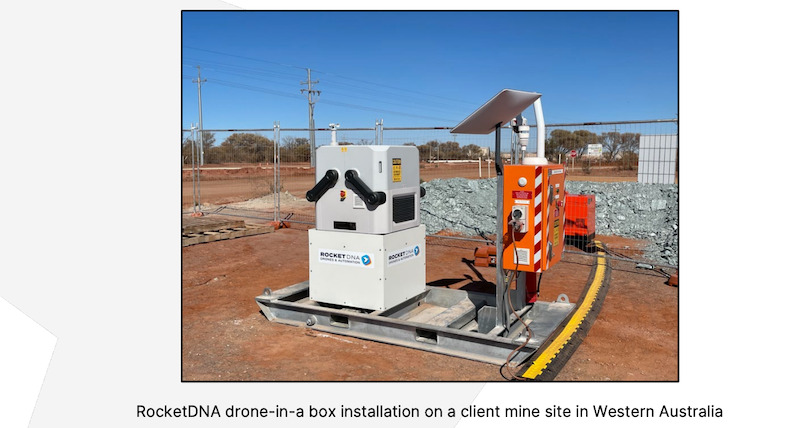

Drone-in-a-box is an emerging form of autonomous unmanned aerial vehicle (UAV) technology.

While traditional drones consist of both a non-manned aircraft and some form of ground-based controller, drone-in-a-box systems deploy autonomously from a box that also functions as a landing pad and charging base.

“In other words, drones up to now have been operated on a one-to-one scale. You deploy one drone out there to capture data, but you also need one remote pilot to fly it,” explained Clark.

BHP for example, probably has about 450 active drone pilots, and Rio has somewhere around 500 pilots.

“So the limiting factor has always been that one-to-one ratio, but now the drone-in-a-box can eliminate those manual tasks, and essentially what used to take days can now now happen in a couple of hours.

“These drones can be activated remotely; not only that, you can have one operator who can control multiple pieces of equipment at a time.

“So that gives us incredible scale in which to be able to do data capture, because now we’re going from a from a one-to-one, to one-to-five ratio,” explained Clark.

RocketDNA set to scale after getting approvals

Clark explained that drone technology is developing at a much faster rate than manned aircraft, which is still operating with the same technology from 20 years ago.

Satellite technology on the other hand, despite its rapid improvements in recent times, is still limited by the weather and most products also lean towards government and military customers.

“So we see this really big gap in the market, and the space that drones can fill,” said Clark, adding that unlike airplanes and satellites, drones can operate under the clouds at a lot more frequency on demand.

“But the caveat is that drones come with a lot of regulatory approval. So while the technologies are there, you’ve got to combine this with the regulatory and the safety that’s needed to get the data capture.”

A couple of weeks ago, RKT received a South African Civil Aviation Authority (SACAA) approval which made its drones the first to receive approval for Remote UAS Docking Station Operations in the country.

This follows a similar Australian CASA (Civil Aviation Safety Authority) approval in August.

Clark said these approvals were obtained after an incredibly long and hard process, but what they have provided is the opportunity for RocketDNA to do a land grab on the market.

“First you get the licensing of the company before you can apply for Extended Visual Line of Sight (EVLOS) and plan for Beyond Visual Line of Sight (BVLOS),” said Clark.

“On top of that, you then apply for remote operations, which is about how you can assimilate a pilot on site using using technology and sensors.

“So we’ve put a lot of our know-how from manned aviation into how we operate these drones.”

Clark added that these approvals are like a little bible of everything that can go wrong, ie; how the drone should work and all the risks that have to be taken care of during a flight.

“These approvals allow us to scale our business, and we can now look to set up remote operating centres.”

Big opportunities ahead

With operations in Australia, South Africa, Ghana, Namibia and Israel, RocketDNA focuses on the mining, agriculture and critical asset industries.

The company’s drones have surveyed more than 15,000km2 of land in these countries, with a customer base that includes names like Pilbara Minerals, Newmont, AngloAmerican, and AngloGold Ashanti.

Clark said the recent use of artificial intelligence (AI) has been exciting for the business, allowing the data capture to zoom in on specific requests.

“With AI, our customers can now ask a very specific question, such as detecting a water leak, a heat spot or corrosion,” said Clark.

“These drones actually act as an insurance policy, where they’re programmed and scheduled to fly every day. They’re actively scanning and looking for what you wanted to detect, and only when it detects it, would you then receive an alert or trigger a real world problem.

“So it allows companies to have a lot more capacity to to focus on other tasks while we continue to look at the problem areas,” Clark said.

Although mining is still RocketDNA’s biggest segment, one area that could provide RocketDNA with big opportunities down the line is critical assets infrastructure.

At the moment for example, all the infrastructure on transmission lines in Queensland are maintained or replaced on what’s called an interval policy.

This means that every 10, 20, 40 and 60 years, engineers determine whether particular assets like insulators or substations need to be replaced.

But now that interest rates are high and debt isn’t so cheap anymore, the government is under pressure to maintain this work.

“So what the government is doing now, instead of having a hard replacement policy of when these assets get replaced, they’re doing more frequent monitoring to detect things like heat spots and corrosion,” said Clark.

“And these are the projects that really excite us, as they could open up a whole new commercial opportunities for RocketDNA.”

Other drone stocks on the ASX

| Code | Name | Price | % Mth Change | % 6-Mth Change | % 12-Mth Change | Market Cap |

|---|---|---|---|---|---|---|

| RKT | Rocketdna Ltd. | 0.01 | 21.74 | 16.67 | 7.69 | $7,474,497 |

| MOB | Mobilicom Ltd | 0.01 | -40.00 | -25.00 | -45.45 | $8,623,399 |

| DRO | Droneshield Limited | 0.30 | -7.81 | 5.36 | 68.57 | $173,136,565 |

| 3DP | Pointerra Limited | 0.09 | -23.33 | 8.24 | -61.67 | $65,485,655 |

| EOS | Electro Optic Sys. | 1.08 | 2.38 | 123.96 | 93.69 | $184,078,706 |

| OEC | Orbital Corp Limited | 0.12 | -7.69 | -25.00 | -44.19 | $14,068,236 |

| 1CG | One Click Group Ltd | 0.02 | -5.00 | 72.73 | -52.50 | $11,071,768 |

| SOR | Strategic Elements | 0.10 | -2.44 | -9.09 | -41.18 | $42,458,677 |

| XTE | Xtek Limited | 0.30 | -21.33 | -35.87 | -26.25 | $30,019,702 |

| ELS | Elsight Ltd | 0.39 | 35.09 | 37.50 | 4.05 | $57,873,039 |

| CDA | Codan Limited | 7.97 | 2.31 | 48.97 | 28.55 | $1,443,276,259 |

Droneshield said the market for its counter-drone technology, which did not exist 10 years ago, is rapidly growing market with a $US10 billion potential, driven by rising international tensions.

DRO’s detection and counter-drone products are designed to bolster the security of a location and support security personnel in addressing the increasing and diverse range of UAS threats.

The company has a number of key partnerships including with the Australian Department of Defence, US Department of Homeland Security, US Army and Air Forces.

In the first half, Droneshield reported record contracts and rapidly growing cash receipts. The company also said it was sitting on a record $62 million contracted backlog, and pipeline of over $200 million.

Aerospace company Orbital is a world leader in the manufacture of integrated engine systems for tactical unmanned aerial vehicles or UAVs, such as its ScanEagle 3 model.

The company also manufacturers aero engines for Boeing from its Perth-based and US facilities, and is developing a hybrid propulsion system for a vertical take-off and landing UAV with defence technology company Northrop Grumman.

In June, Orbital signed a new contract worth $1.1m to manufacture and supply its proprietary unmanned aerial vehicle heavy fuel engine systems to a new customer.

Under the contract, Orbital will deliver the engines in the second half of the 2024 financial year to a defence agency organisation, Finance International PL, for integration into the latter’s tactical UAV.

Elsight has developed communication technology for real-time data, video and audio transmission over cellular networks and sees significant opportunities around drones.

Halo is the company’s drone communication technology that allows unmanned aircraft to fly beyond the visual line of sight that had undergone testing in California.

Last week, Elsight’s Halo-enabled Airobotics Optimus-1EX drone was granted Type Certification by the US Federal Aviation Administration (FAA).

The drone has become the first and only non-air carrier drone for autonomous security and data capture that has been granted that certification.

Xtek operates through two separate divisions including ballistics and technology.

In the Tech segment, Xtyek develops Unmanned Aerial Vehicle (UAV) and Unmanned Ground Vehicle (UGV), advanced detection systems, optical payloads, state-of-the-art 3D mapping and modelling software, and tactical situation awareness software for the defence industry.

Over the past year, Xtek says it has grown its pipeline of opportunities to +$375m, with multiple opportunities on foot for delivery in FY24 and beyond.

At Stockhead we tell it like it is. While Orbital Corporation is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.