Rising Chinese mega-tech stocks back in the Dog House, but finally out of Solitary?

Via Getty

Chinese tech is not back. But it is also not dead, disapeared or in house detention. These are improvements of a sort.

In Honkers, the Hang Seng Tech index was roiling on Thursday.

All of a sudden the once magnificat of global indices looked like it had shed several years and was bouncing around like a new born baby. It rose by 4% through the Thursday session and it’s now ahead by an audible exclamation of 9% since the close on Friday.

Among the best performers, Alibaba, Bilibili, Tencent and Kuaishou Tech found circa +7.5%. The earnings tracked the positivity which added an unexpected 3.5% burst of life across the Pacific where the Nasdaq Golden Dragon China Index found friends again in New York.

Back under house confinement

There was a time of course, in the not too distant past, when the Hang Seng Tech index was rising 4% before lunch on a bad day.

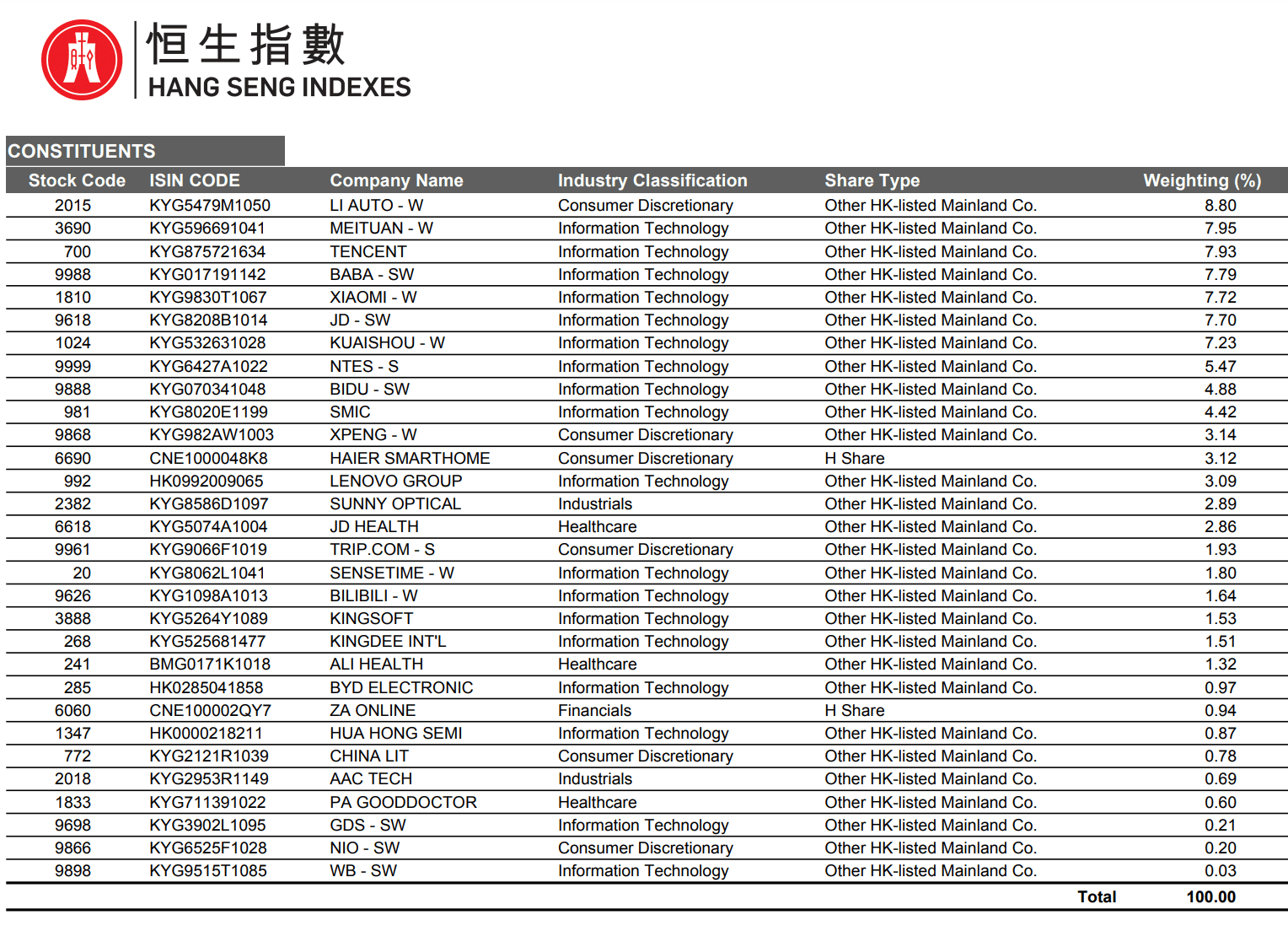

The Hang Seng TECH Index (HSTECH represents the 30 largest remaining technology companies listed in Hong Kong – and pretty much the mainland) that have ‘high business exposure to technology themes.’

A higher positive momentum intensity is being seen in the Hang Seng TECH Index which comprises China’s Big Tech firms that reintegrated back above its 50 and 200-day moving averages.

According to OANDA, reinforced by the narrowing of the premium of the US Treasury 2-year yield over China’s 2-year sovereign bond yield, “…a potential short-term downtrend phase is in progress for USD/CNH which triggers a positive feedback loop into the Hang Seng bench stock indices and China Big Tech equities.”

And one could add to this, that it appears there’s some pretty damn significant price action undoubtedly emerging in the relative momentum stakes for China’s long lambasted Mega Tech firms listed in the States where their American Depository Receipts* (ADRs representing shares issued by PRC companies and traded on the US stock exchanges) that have continued their outperformance over their US Monster Tech peers since last week, the first such turnaround since Donkey Kong.

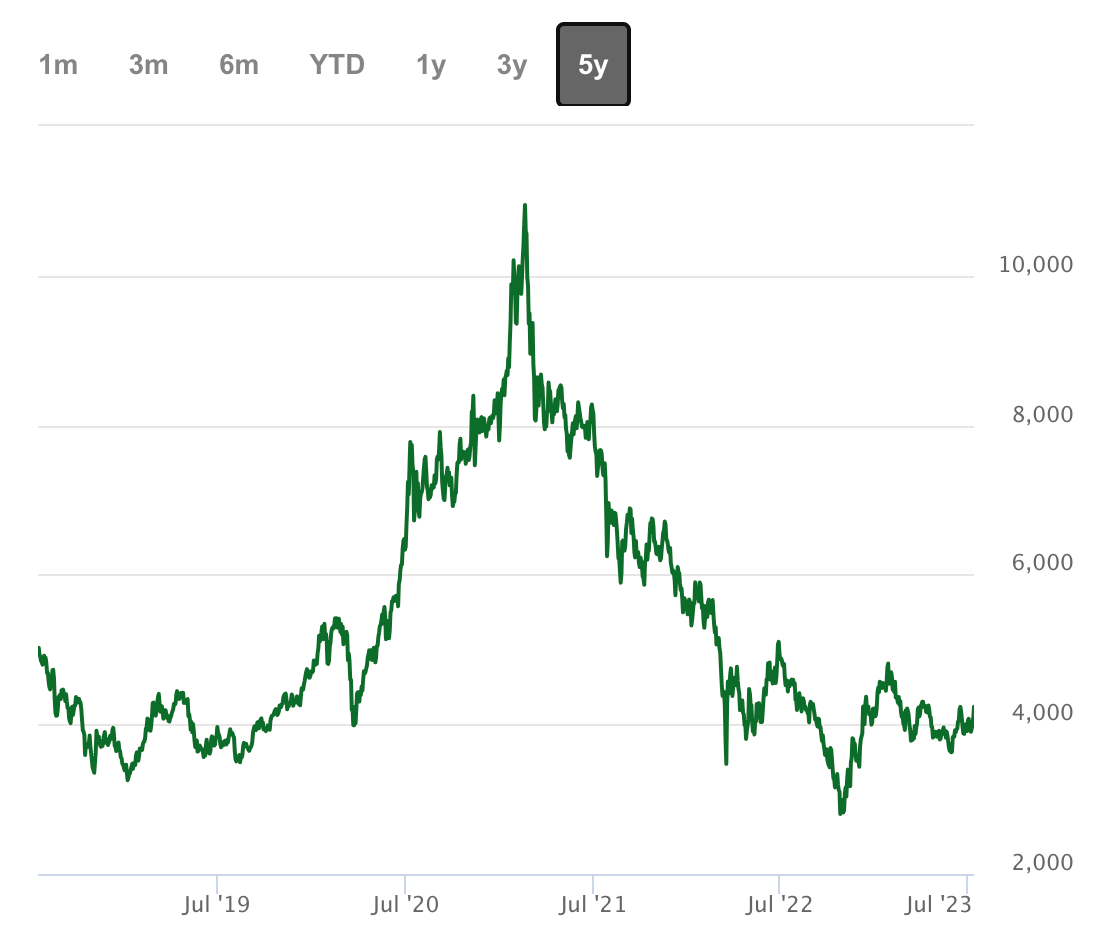

This is the HSTECH since inception:

China is sending its strongest signal yet that it supports the development of platform companies, putting an end to years of random regulatory brutality and even the occasional kidnapping for these once primal tech firms, just as a stuttering Beijing is waking up to its present economic growth predicament.

On Wednesday in Beijing new State Council frontman Premier Li Qiang generously ‘offered his support to senior tech executives in a meeting, while the country’s internet regulator on Thursday said it would push for innovation in generative artificial intelligence,’ according to a report in the South China Morning Post.

The country’s state planning agency man also slung some reassuring flattery at the big names who’ve made their way back into the bosom of the party, like Alibaba, Tencent and Meituan saying they were doing their bit for kicking sand at the White House chip sanctions by bolstering China’s semiconductor stocks.

The official pat on the back and squeeze of the cheek comes as traders read Ant Group’s nearly $1bn fine last week as maybe the last swift kick of a regulatory campaign three years in the making vs Alibaba founder and main naughty entrepreneuer, Jack Ma’s. It was his Ant Group, which copped the fine for basically getting too big for its boots.

On Wednesday the People’s Bank of China (PBoC) said the country’s widely used financial platform operators such as Ant and Tencent had pretty much bent the knee and ‘ironed out’ their rock n’roll behaviours.

The apparent end to the crackdown on major tech groups has lifted the New York-listed shares of Ant’s Mothership, Alibaba, which are now up 12% in the past week.

Pull yer Heads in: And one can see the moment they did…

A few days – four straight sessions of gains to be exact – does not cure the Hong Kong bourse of a venomous and trigger happy regulator, but it does suggest something is afoot. Confidence is a big word, but it certainly seems like no-one’s seen a big stick or a bruised tech giant on the island lately.

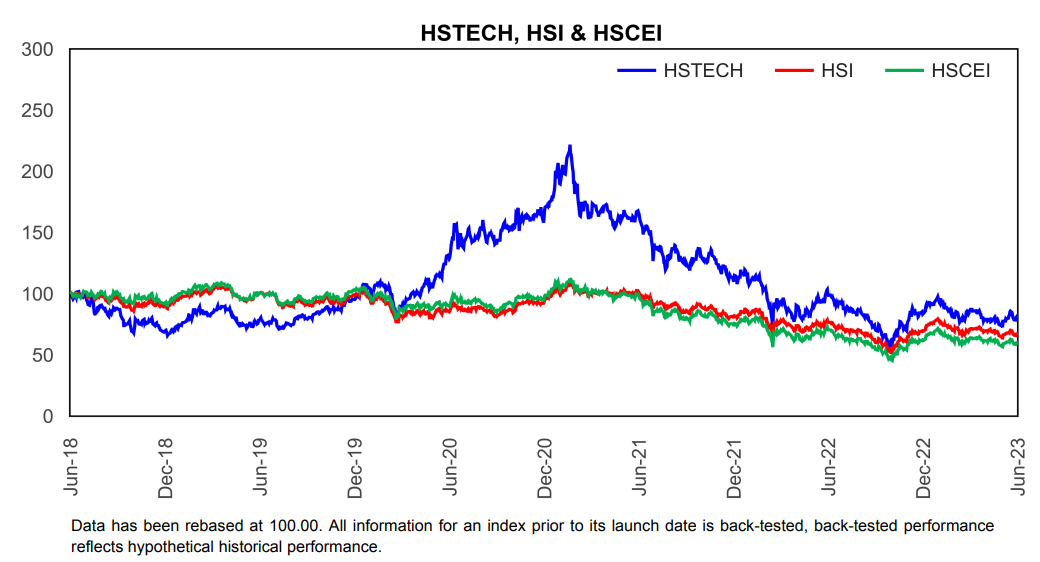

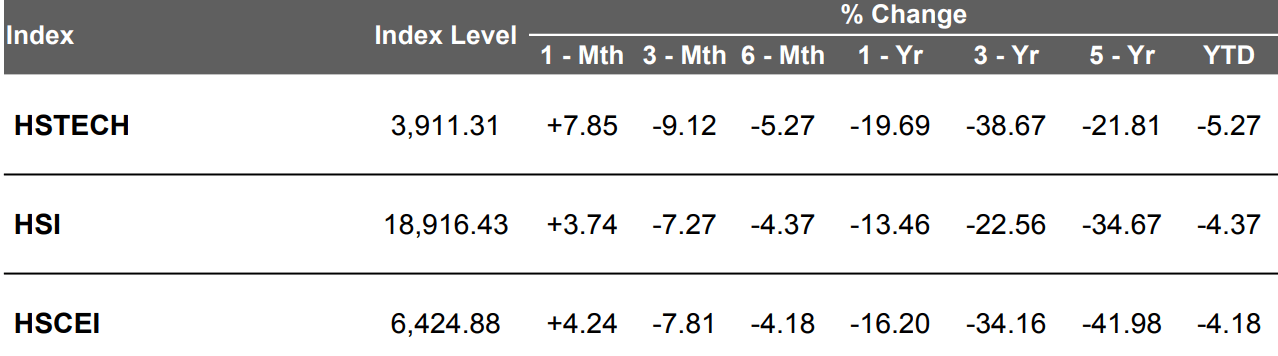

But the Hang Seng and its tech giants have ground to make up these last painful years:

The turnaround on Thursday followed some upbeat talk from Elon Musk on Chinese attention to AI, but more importantly after the new Premier Li Qiang on Wednesday suggested his officials would cultivate a chatty way of regularly schooling its Mega tech firms to “stay up on corporate difficulties and concerns, improve relevant policies and measures, and push for healthy and sustainable development of the platform economy in line with regulations”.

He wants to be sure everyone has the best chance to be good. That’s something actually.

Li’s kindly words came at a meet with the New Mandarin and some of China’s naughtiest and biggest major platform companies – Meituan, Alibaba and Douyin.

The kowtow sit down followed the other big news of the incredibly influential National Development and Reform Commission’s (NDRC) green light on new investment projects of this unique breed of Chinese whale which – it appears – are being released back into the open market ocean to fend for themselves again.

The big platform companies have been chastened and declawed of independent adventurous thinking these last years, but not because Xi Jinping doesn’t like what they do. Rather Beijing sees the sector – the new, utterly lotal and well-behaved sector – as essential to fuelling growth and creating jobs.

HSTECH: Who’s Who…

Alibaba, Tencent and Meituan have all received hefty fines and undergone heavy business restructuring since October 2020 amid Beijing’s regulatory crackdown.

Despite rising off the back of new found optimism, Alibaba shares still remain 70% lower from when Beijing snuffed out fintech spin-off Ant Group’s blockbuster public debut in 2020.

But the tide could finally be turning.

The stock is now up some up 3% YTD.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.