Praemium’s upbeat half-year results fail to impress, shares drop 19pc

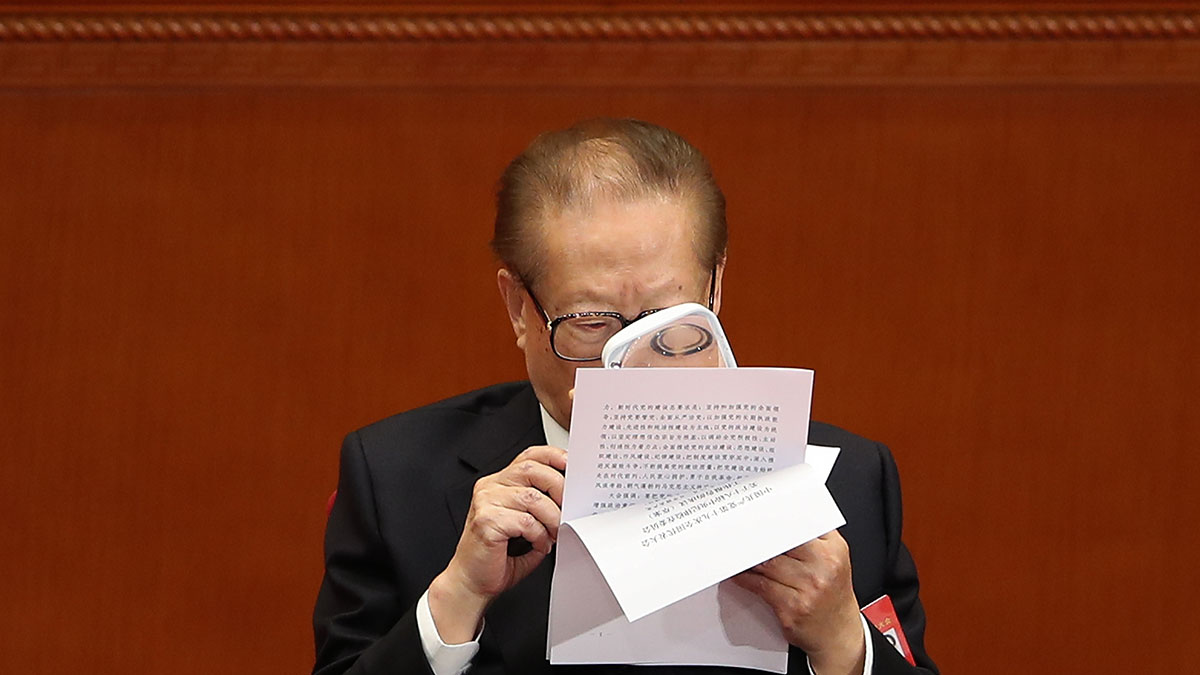

China's former president Jiang Zemin. Pic: Lintao Zhang

Shares in investment manager Praemium have fallen as much as 19 per cent this morning after investors weren’t sold on an upbeat half-year results announcement from the company.

Praemium (ASX:PPS) was sprouting continued “growth momentum” as underlying earnings before interest, tax, depreciation and amortisation hit record levels.

But profit fell 11 per cent on the previous half-year, down to $777,678.

The cashflow positive company increased its cash position to $11.3 million and boosted revenue by 7 per cent to $22.9 million.

The mixed results saw $3.2 million worth of shares trade hands by 11am on Monday, sending the buying price down 19 per cent to 56.5c, after closing Friday at 70c.

Highlights the company chose to focus on were record $5.1 million in underlying EBITDA, its recent major technology upgrade and a rebrand for its global investment platform — the company set its sights on the Middle East last year.

Michael Ohanessian, Praemium CEO, said his company was ready to compete in the “new paradigm” laid down after the release of the Hayne Royal Commission Report.

“What is now clear is that advisers will need to work harder to generate revenue given the increased compliance requirements,” he said.

“In this new paradigm, it will therefore be critical that they utilise technology to find efficiencies elsewhere.

“We make the complex simple with our superior corporate-actions capabilities, portfolio analytics and rebalancing engine. Now with a dramatically improved user experience, the efficiency gains are even higher.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.