Plenti to celebrate: Fintech lender chalks up $1.3 billion loan portfolio in record quarter

Pic: Getty Images

In a year of rapid growth for Plenti, the company continues to achieve significant milestones, with its loan portfolio now well past its $1 billion milestone.

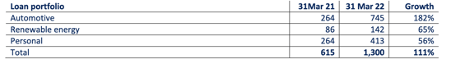

Fintech lender Plenti Group (ASX:PLT) has achieved $1.3 billion loan portfolio in a record-breaking Q4 FY22.

The company originally forecast reaching its $1 billion loan book target for Q4 FY22, which it achieved well ahead of forecast in November last year, after record loan originations across its three lending verticals – automotive, renewable energy and personal in Q3 FY22.

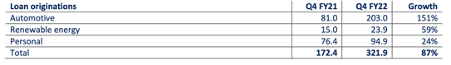

Among highlights from Q4 were record quarterly loan originations of $321.9 million, 87% above prior corresponding period (PCP)and 5% above the prior quarter, despite usual seasonal impacts.

Inaugural renewable energy and personal loan asset-backed securities (ABS) issued substantially reduced funding costs across $280 million of receivables.

Diverse and cost-effective funding

Plenti completed a $280 million ABS transaction in February, which substantially reduced funding costs on the underlying receivables and freed capacity in Plenti’s renewable energy and personal loan warehouse facility.

Pricing of the ABS was supported by $65 million of the notes being green-certified under the Climate Bonds Standard, and 76% of the notes being rated Aaa by Moody’s.

The transaction also reduced Plenti’s equity funding requirement for the underlying receivables, releasing capital back to the business to fund further loan portfolio growth.

Growing expectations of central bank rate increases meant Plenti experienced increases in funding costs on new loan originations during the quarter.

Higher funding costs on new loan originations have been partially mitigated through increases in borrower rates. Plenti expects borrower rates to continue to increase over coming months as the market adjusts to higher funding costs.

Plenti has also entered into a corporate debt facility agreement with an Australian funder to provide capital to support its ongoing business growth.

The facility limit is linked to the size of Plenti’s securitised loan portfolio, providing the ability to access more capital in-line with loan book growth and was initially drawn to $18 million.

Profitability upgrade

The upgraded profit guidance reflects the strength of Plenti’s loan portfolio growth and technology-led operating leverage that helps the business continue to take market share.

Record loan originations

January and February loan originations were robust although reflected usual seasonal impacts. A new monthly record of $124.6 million in loan originations was achieved in March, driven by record automotive and personal loan originations.

Renewable energy finance originations were impacted throughout the quarter by rain and flooding events in Queensland and New South Wales which restricted household solar and battery installations.

Plenti’s loan portfolio increased and was $1.3 billion as of March 31, 2022, which is 111% above PCP and 17% above prior quarter.

Exceptional credit performance maintained

Plenti achieved strong loan origination while maintaining its exceptional credit performance during the quarter. Credit performance is underpinned by its proprietary credit decisioning and pricing technology and supported by data it has derived from funding more than 100,000 loans since starting lending in 2014.

The weighted average Equifax credit score for new borrowers during the quarter was 847, above the portfolio weighted average score of 832 at the end of December 2021.

Annualised net losses for the quarter were low at approximately 42 basis points, reflecting the prime nature of Plenti’s borrowers. 90+ day arrears were 26 basis points at the end of the quarter.

Positioned for further growth

Plenti CEO Daniel Foggo said the company had delivered another outstanding quarter, which sets it up well for future growth.

“I am incredibly proud of the Plenti team for its relentless focus on delivering faster, fairer loans to our customers, while continuing to drive towards our mission of building Australia’s best lender,” he said.

“We are excited about the year ahead, with our team focused on leveraging our proprietary technology to execute our program of product innovation and efficiency initiatives, whilst continuing to profitably take market share in each of our three key lending verticals.”

This article was developed in collaboration with Plenti, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.