Plenti to admire as the non-bank lender delivers a strong Q1, taking its loan book to over $1.4 billion

Pic: Getty Images

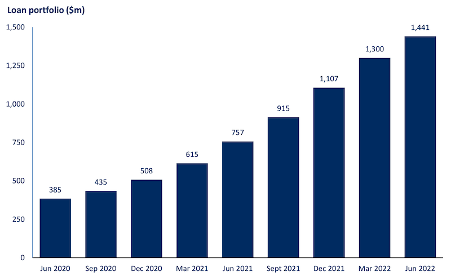

Plenti has delivered another strong quarter, taking its loan book to $1.44 billion while maintaining credit quality.

Fintech lender Plenti Group (ASX:PLT) has once again delivered a solid quarter, increasing its loan book to $1.44 billion in Q1 of FY23.

This represented a massive growth of 91% above the pcp, and 11% above the prior quarter.

Loan originations were $289 million, up 34% on the pcp, but 10% lower on the prior quarter.

Commenting on the decrease in QoQ originations, Plenti said that it prioritised increasing yields on new loan originations and business profitability over absolute loan origination volumes, as previously communicated to the market.

During Q1, Plenti secured $437 million in automotive loan asset-backed securities (ABS) transactions, which increased its total ABS issuance over the last year to over $1 billion.

This has now allowed the company to free capacity in each of its two automotive warehouse facilities.

Plenti has also maintained its strong credit performance over the quarter, keeping its 90+ day arrears at just 31 basis points.

Overall, the top line revenue came in at $30.5 million along with continued positive Cash NPAT.

“Plenti has delivered yet another strong quarter, driving substantial loan portfolio growth, further diversifying funding, and continuing to deliver Cash NPAT profitability,” said Daniel Foggo, Plenti’s CEO.

“The strength of our business model has allowed us to increase loan yields to offset changes to funding costs to deliver another quarter of positive Cash NPAT.

“Plenti continues to deliver technology and customer experiences to differentiate our offerings and achieve our mission of building Australia’s best lender.”

Auto loans approaching $1 billion

During the quarter, Plenti has managed to increase its loan book across all its three business segments.

The automotive segment’s loan book now stands at $838m, which represented a 136% growth on the pcp.

Personal loans grew by 49% above pcp to $451m, while renewables energy loans increased by 54% on pcp to $151 million.

Despite automotive loan originations increasing by 42% on pcp, they were lower than the prior quarter.

This is due to Plenti’s decision to move early on increasing its borrower rates to help offset higher funding costs on new loan originations.

Like other lenders, Plenti has experienced increases in funding costs on new loan originations, particularly this calendar year.

While margins were impacted for several months as the market adjusted, Plenti has now increased its borrower rates to largely offset these higher funding costs.

As the chart below shows, its net interest margin has increased in June reflecting that adjustment.

Meanwhile, renewable energy loan originations increased 15% on pcp and were broadly flat on the prior quarter, while personal lending increased 27% on pcp, up 9% on prior quarter.

Stable credit performance

During the quarter, Plenti has maintained its exceptional and stable credit performance, underpinned by its proprietary credit decisioning technology and supported by data it has derived from funding over 125,000 loans since it commenced lending in 2014.

Annualised net losses for the quarter were low at 57 basis points, reflecting the prime nature of its borrowers across each of the three loan verticals.

90+ day arrears were 31 basis points at the end of the quarter, supporting an expectation for Plenti’s strong credit performance to continue over coming months.

The weighted average Equifax credit score across the loan portfolio remained at a record 837 at the end of the quarter.

This article was developed in collaboration with Plenti Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.