Plenti delivers another record quarter as it nears $1 billion loan milestone and profitability

Plenti Group has just delivered yet another record quarter. Pic: Getty Images

Plenti has delivered yet another record quarter, and its CEO says it will be the first fintech to achieve a $1 billion loan book.

Fintech lender Plenti Group (ASX:PLT) has just delivered yet another record quarter.

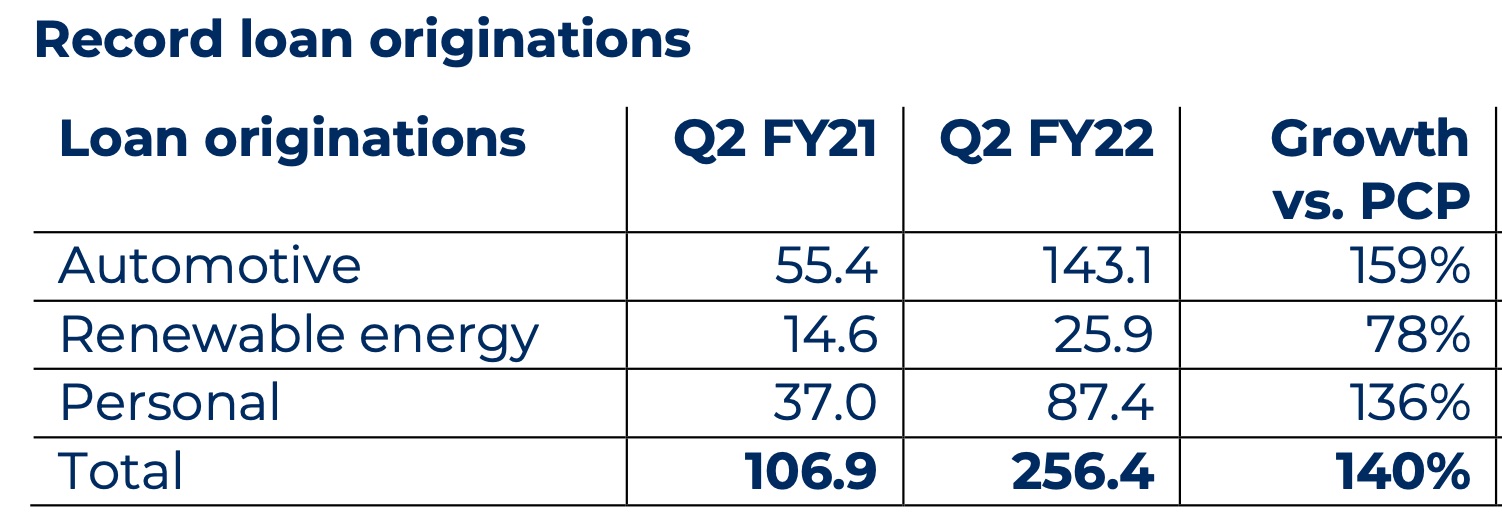

The company’s loan originations book grew by 140% to $256.4m in Q2, compared to the same quarter last year.

Loan originations in September were also at record levels at $95.5m, 159% above September 2020 figures.

This quarter has extended the company’s solid run, following record figures in the previous quarter where the loan book grew by 216%.

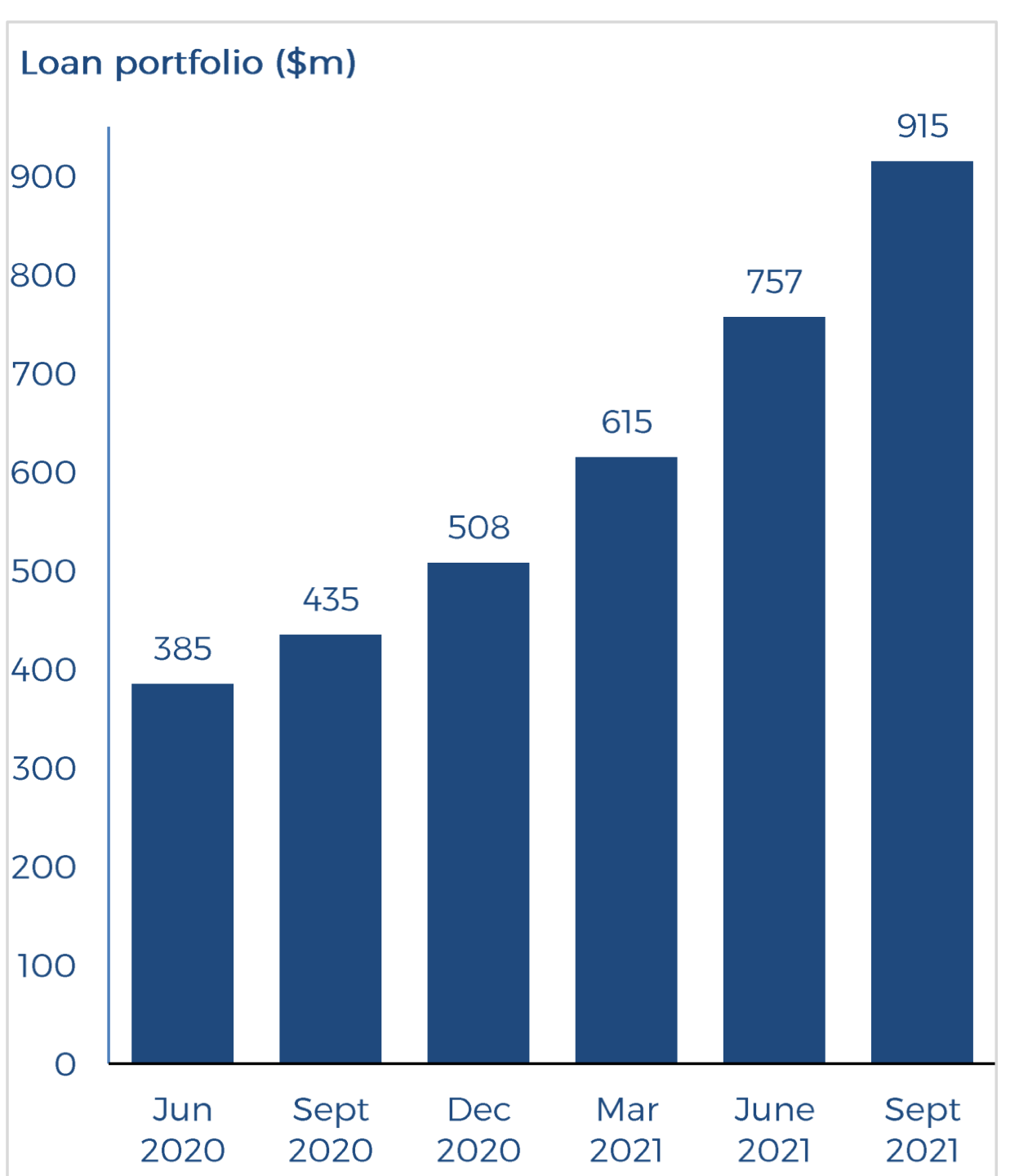

It’s been a story of rapid growth for Plenti, where loans have grown exponentially from just $385m in June 2020, to $915m today.

The business operates in three leading verticals – automotive lending, renewable energy, and personal loans.

All three segments achieved record growth during the quarter, with the automotive lending category being the outperformer once again.

Stockhead caught up with Plenti’s CEO, Daniel Foggo, to ask him about the latest results.

“Our growth is broad based. I think it’s really representative of us gaining market share,” Foggo said.

He said that large incumbents like banks are struggling to keep up with customer needs, and that has provided an opportunity for Plenti to displace them and take market share.

Positioned for further growth

Despite the record run, Foggo says that Plenti is still scratching the surface in terms of its market potential.

“We’re still at the start of the opportunity, and our market share is still only 2-3% in the automotive market,” he told Stockhead.

Loan origination growth versus the prior quarter was achieved in all states and territories except for the ACT, due to restrictions.

And what’s driving customers to the Plenti platform?

“The simplicity of our technology. Our user interface is easier and more intuitive – whether you’re a loan broker working with us, or a borrower coming directly to us for a loan,” Foggo said.

He said the Plenti platform offers better processing times, and a more customer-centric offering compared to other lenders. This has also enabled the company to better serve its loan brokers.

“It’s a good time to be in the market with a better offering, because people are looking for an alternative to those large incumbents that are exiting the market, or who just can’t serve their customers appropriately.”

Foggo also expects that growth will continue as people gradually re-emerge from lockdowns.

There’s a backlog of demand for new cars, and that car manufacturers are struggling to keep up with the pent-up demand, he said.

“So we see the opportunity for continued growth out of lockdowns over the coming months, as it’s going to be easier for people to go to a dealership and buy a car.”

In the personal loans segment, Foggo sees an accelerating trend in people buying more leisure goods.

“That might be jet skis, or a caravan, something that enhances their lives.”

Plenti, he said, is very well placed for the reopening as demand for credit is going to grow over the next quarter.

Path to profitability

The rapid growth in Plenti’s loan portfolio, which has more than doubled in just over a year, was backed by its inaugural asset-backed securities (ABS) funding of $306.3m, completed in August.

The ABS package was assessed by multinational credit ratings agency Moody’s, which applied a AAA rating to almost 90% (87.8%) of the underlying portfolio.

This has allowed the company to lock in debt funding with low rate costs – just 0.97% above the benchmark one-month Bank Bill Swap Rate (BBSW).

But the low funding cost also reflects Plenti’s exceptional credit performance.

During the last quarter, annualised net losses for the quarter were approximately 70 basis points, which is reflective of the prime attributes of its loan portfolio and strong underlying borrower characteristics.

Its 90+ day arrears were 26 basis points at the end of the quarter, down from 35 basis points at the end of June 2020.

The strong growth coupled with low-cost funding has accelerated the company’s targeted timeframes for achieving a $1 billion loan book, along with reaching cash NPAT profitability by December 2021.

“Our $915m loan book achieved at the end of the quarter gives us confidence around hitting a billion dollar loan book by the end of the year,” Foggo said.

Foggo says Plenti will be the first fintech consumer lender to achieve the billion dollar milestone.

The company also expects to achieve profitability within this quarter.

“That’s a really important milestone for our equity investors. We’ve been in the lending business for seven years, and to achieve profitability is a really exciting milestone.”

“And I think from an equity investor perspective, when you’ve got a high growth business with a lot of operational leverage, it could become a really interesting story.”

This article was developed in collaboration with Plenti, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.