Patience is a virtue for ASX small-caps looking to crack the multi-billion dollar global defence sector

(Getty Images)

For the select group of ASX stocks aligned with the defence industry, the commercial opportunities are large — but it requires a different way of doing business.

For obvious reasons, the sector operates within a strict regulatory framework. Higher security and the capital-intensive nature of some projects make scale-up opportunities harder than, say, B2B software companies.

But in terms of potential market size, the numbers involved are huge. And defence requirements also foster the application of some pretty cool tech.

Here are some quick examples of the hardware being built by ASX-listed companies; anti-drone weapons, lightweight battle armour and the housing for missile-decoy flares on fighter jets.

Stockhead‘s data team ran some numbers on defence-aligned stocks, and the year-to-date performance has been mixed.

But that’s perhaps to be expected in a sector where big contracts can take years to win, and smaller revenue streams still take plenty of groundwork to build out.

One company with plenty of industry experience is Quickstep (ASX: QHL), which makes carbon fibre parts used in planes, trains and medical devices.

Quickstep’s direct exposure to defence kicked off in earnest about a decade ago, when it won a long-term contract to make parts for the F35 joint strike fighter program; a global US-led construction project of more than 4,000 planes.

Thinking longer term

Speaking with Stockhead, Quickstep CEO Mark Burgess said many aspects of the defence industry are positive for business; contract lengths are usually multi-year, and barriers to entry are high.

As a components manufacturer, “it usually takes three-to-five years to get supplier accreditations, the right capital structure and the appropriate skills,” he said.

In addition to its work on the F35s, Quickstep also has a supply contract until 2024 to make wing components for the C130 Hercules planes manufactured by Lockheed Martin.

Despite that positive backdrop, investors are looking for more; QHL shares have traded in a range below 10 cents for the last two years. So what’s the key ingredient that investors are looking for?

“The question investors are asking is; you’ve got good positions on long-term contracts with certainty over volume of revenue, so can you make acceptable margins?”

In other words, the focus is on costs rather than revenue generation. It’s an area Burgess has focused on since joining Quickstep two years ago, and the company is coming off its maiden half-year profit.

“I think at our full-year results in four or five weeks, we’ll be able to demonstrate we’ve turned that corner on costs — which in turn flows through to net margins,” he said.

In addition, Burgess emphasised that Quickstep is taking a diversified approach, despite the lure of long-term defence contracts.

On the domestic front, the federal government has committed to defence spending equal to two per cent of GDP, as the Australian military takes on a more prominent role in the South Pacific.

“The next five years in defence in Australia are going to be really good to us – but we want to make sure that we take advantage of that period and diversify the portfolio so we have a sustainable business model,” he said.

“So the first half of our current five-year plan is heavily skewed towards defence and aerospace, but in the second you’ll start to see a bigger percentage of commercial contracts.”

USA or the highway

Quickstep’s diversified approach can be contrasted somewhat against XTEK Ltd (ASX: XTE), a defence equipment company with a more focused customer base centred around the military and police.

Stockhead spoke with XTEK managing director Philippe Odouard, who emphasised the importance of the US market to the company’s value proposition.

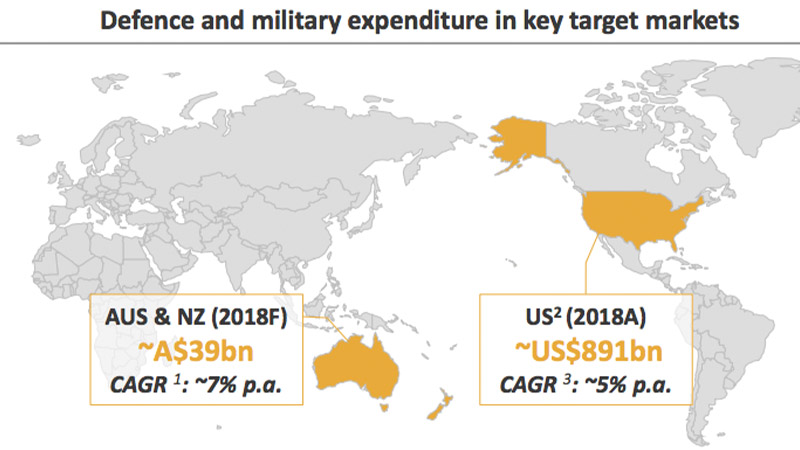

The chart below — from a recent XTEK investor presentation — is a useful reminder of the relative scale of US military spending.

At the same time, it’s a tough nut to crack — particularly for overseas contractors.

For example, ship-building company Austal (ASX: ASB) has seen its share price double this year after snagging a key supply agreement for a new class of US Navy ship. However, “the cost they had to put on the ground for years before they got there was enormous,” Odouard said.

To get a foothold in the market, XTEK recently acquired HighCom — a US-based protective equipment maker — in a $3.6m deal.

The strategic acquisition will help provide a distribution base for XTEK’s own armour products, including lightweight ballistic helmets.

“Getting access to the US market without having a presence on the ground is almost impossible,” Odouard says. The company’s first target market will be the USA’s 800,000 strong police force in the next 3-6 months, before exploring possible military contracts.

“To a large extent we’re more of an expert in the military market because we’ve done a lot of military work in Australia,” he said. But he added it’s a more convoluted system that Australia, where defence contracts are often signed off shortly after the budget is handed down.

“Over there it can take 18 months, with all the different committees and approvals. But if you know you’re way around it, it’s ok – we have a lot of expertise because we’ve been there a long time.”

Ultimately, Odouard said the tough regulatory environment was worth taking the time to work with.

“It’s a highly regulated sector and it has to be — we’re in the business of helping allied nations defend themselves,” he said.

“It’s a different way of doing business, but if you follow the rules and do it properly it’s as good as any other sector — and sometimes better.”

Here’s a summary of the 2019 performance of listed small caps serving the defence industry:

| Ticker | Name | Price ($) | Market Cap | 6m Total Return |

|---|---|---|---|---|

| DRO | DRONESHIELD LTD | 0.3 | $58,013,632.00 | 100% |

| EOS | ELECTRO OPTIC SYSTEMS | 4.1 | $389,220,704.00 | 65% |

| BCT | BLUECHIIP LTD | 0.105 | $52,716,224.00 | 43% |

| CDA | CODAN LTD | 4.01 | $713,327,040.00 | 28% |

| AJX | ALEXIUM INTERNATIONAL GROUP | 0.18 | $58,725,412.00 | 26% |

| MOB | MOBILICOM LTD/AUSTRALIA | 0.085 | $23,214,304.00 | 18% |

| QHL | QUICKSTEP HOLDINGS LTD | 0.079 | $56,114,332.00 | 11% |

| XTE | XTEK LTD | 0.47 | $21,218,420.00 | 3% |

| TTT | TITOMIC LTD | 2.03 | $254,431,728.00 | -5% |

| BIS | BISALLOY STEEL GROUP LTD | 1.025 | $46,094,516.00 | -6% |

| OEC | ORBITAL CORP LTD | 0.33 | $25,559,466.00 | -18% |

| BRN | BRAINCHIP HOLDINGS LTD | 0.054 | $73,091,504.00 | -33% |

| ELS | ELSIGHT LTD | 0.375 | $36,917,112.00 | -34% |

| UUV | UUV AQUABOTIX LTD | 0.006 | $2,435,625.50 | -87% |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.