Novatti delivers best quarter ever as it looks for other acquisition targets

Pic: Getty Images

Novatti is going from strength to strength as it records 11 straight quarters of record payment processing revenue.

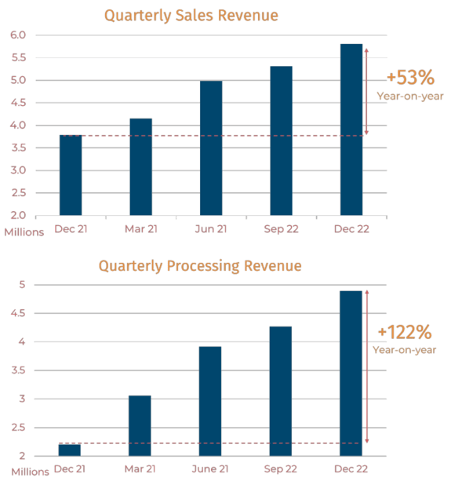

Multi-channel payments company Novatti (ASX:NOV) delivered its best quarter ever, notching a 53% year-on-year increase in Q2 FY22 sales revenue to $5.8m.

At the halfway point of FY22, Novatti has now bagged two straight quarters of record revenue as it continues to build on the momentum set across FY21.

The company has gone from strength to strength, following the previous quarter’s $5.3m revenue where it broke the $5m mark for the very first time.

In particular, the fintech recorded a 122% year-on-year growth in its core quarterly processing revenue to $4.9m, its 11th consecutive record quarter, growing from just $2.2m in the same period a year ago.

“These strong results highlight that Novatti’s long term strategy is delivering,” commented Novatti CEO, Peter Cook.

“Following many years of investment, Novatti has now established a business that has global scale. This scale is underpinned by a payments ecosystem that can be leveraged by businesses big and small to pay and be paid,” Cook added.

During the latest quarter, Novatti expanded its presence across the key market of southeast Asia after acquiring Malaysia-based fintech ATX .

The acquisition further extended Novatti’s reach into the rapidly growing payments demand in South East Asia, as ATX brings with it a network of 30,000 plus payments touch points.

The deal is revenue accretive for the financial year, as the company assesses other acquisition targets elsewhere.

Having started in Australia, Novatti now has operations across Asia, North America, and Europe, but Cook sees more regions to come as it continues on the acquisition trail.

“We see the opening of new markets and expansion of our presence in existing markets as being key to our growth strategy,” he said.

New and expanded markets

Novatti considers a key area of potential growth going forward is its acquiring business, which enables merchants, particularly those in e-commerce, to accept payment from consumers, including through credit cards, direct debits, and other mechanisms such as Alipay and WeChat Pay.

This business has a rapidly growing customer base, including a number of financial services from Novatti’s other business units who have sought the company for additional services.

The December quarter saw Novatti announce Principal Acquiring licenses from both Visa and Mastercard, adding to the strength of the business and expanding its reach within the Australasian market.

These new Visa and Mastercard licences could potentially result in increased margins, and the ability to bring through larger business opportunities.

Previously, the company had also secured partnerships with other global payment leaders including Apple Pay, Google Pay, Samsung Pay, and UnionPay, as well as collaborating with Afterpay on a prepaid Visa program in New Zealand.

Ambitions to enter the Australian banking market have also progressed, with the company working proactively with Australia’s banking regulator for the final approvals of its restricted banking licence, the first step towards its longer-term goal of securing a full banking licence.

Novatti closed a Series A funding round to fund this new banking business, which saw an investment of $10.5m being committed.

Elsewhere, discussions are continuing between Novatti and Ripple to launch services in new markets across South East Asia, following the launch of services in Thailand and the Philippines in 2021.

Outlook

Novatti says that for the second half of FY22, the company will continue to focus on delivering on its growth strategy with the aim of realising further growth for shareholders.

To bolster its management strength, the company has appointed Abigail Cheadle as Chair of the Company’s Audit and Risk Committee, effective in December last year.

This article was developed in collaboration with Novatti, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.