MyDeal shares rise after unveiling record financial results

Mydeal (ASX:MYD) just unveiled its FY21 results

Ecommerce outlet MyDeal (ASX:MYD) has this morning revealed just how big FY21 was in its annual results.

This was sparked mostly by the closures of stores but also the rapid shift to remote working as well as the drying up of the travel market – allowing people to redeploy money into home projects.

Nevertheless, some ecommerce companies have retreated as investors remain uncertain if the boom will last as well as the gradual growth of global giant Amazon.

MyDeal however saw a bump to its share price after its results.

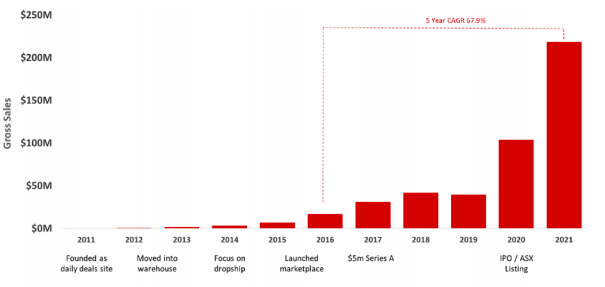

Gross sales increased by 111 per cent from FY20 to FY21, coming in at $218.1 million. Active customers increased too, surging 83.1 per cent to 894,225.

The company also said its latest growth represented 67.9 per cent Compound Annual Growth Rate (CAGR).

It has over 1,800 sellers on its platform with over 6 million products (measured by Stock Keeping Units or SKUs which are essentially barcodes).

MyDeal founder and CEO Sean Senvirtne credited the shift to ecommerce generally, but also the launch of his company’s app earlier this year, as contributing factors to the strong result.

“We have placed ourselves in an enviable position to harness the increased demand and ongoing transition to e-commerce,” he said.

“We remain focused on building and augmenting our proprietary technology platform which is proving to be a core scalable asset of the business and have invested in securing high calibre talent across all teams. The future of MyDeal is brighter than ever.”

Shares in MYD rose by as much as 20 per cent this morning but the stock is still below the $1 price it listed at last year.

MyDeal (ASX:MYD) share price chart

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.