Move over lithium as AI and Nvidia lead tech market rally boosting ASX ETFs

AI is proving a superhero among the tech giants in 2023. Pic: Getty Images

- Flow on effect of US tech giant Nvidia’s rally felt in ASX tech stocks

- Nvidia adds $200bn to its market cap in a single after hours session

- Aussie ETFs with exposure to Nvidia and big AI tech companies performing strongly YTD

Move over popular lithium, there’s another player in town – investors are hungry for exposure to artificial intelligence (AI).

A highly anticipated result from NASDAQ-listed AI company Nvidia this week saw one of the biggest companies in the world add almost US$200bn to its market cap in a single after hours session.

With a market cap of US$755.24 billion, upon release of its Q1 FY24 results after market close on Wednesday, the Nvidia share price spiked 26%. It’s up 113% YTD.

“It added more to its market capitalisation in a single after-hours trading session than the market capitalisations combined of three of Australia’s big four banks,” Global X investment analyst David Tuckwell told Stockhead.

“That is a stupendous rally in after hours trading and we haven’t really seen anything like it before.”

Nvidia’s result also boosted local tech stocks, which were up 2.42% at close yesterday, against the market benchmark’s 1.05% slump.

BetaShares senior investment strategist Cameron Gleeson said AI has been the theme of the most recent reporting season in the US. He said businesses are seeking to leverage AI while investors are looking for ways to add exposure to the long-term megatrend.

“Investors either rewarded or punished many companies based on how they were responding to the rise of generative artificial intelligence technologies, like ChatGPT,” he said.

“As a result, the hyper focus on the innovative technology has helped cement the reputation of household names, like Microsoft, Alphabet, Meta and Amazon, as quality names able to adapt their businesses in the face of a potential US recession.”

Powering the AI revolution

Gleeson said Nvidia has “carved out a reputation for providing the picks and shovels for the rise of AI and the market has rewarded them in kind”.

“Nvidia’s market leading AI chips are built to handle the massive processing power required to train and run artificial intelligence models,” he said.

“As a result, Nvidia upgraded its forward guidance by about 50% on the back of increased orders for their chips.”

Nvidia’s data centre group reported US$4.28bn in sales, up on expectations of $3.9bn and a 14% annual increase.

The company said performance was driven by demand for its graphics processing unit (GPU) chips from cloud vendors along with large consumer internet companies, which use Nvidia chips to train and deploy generative AI applications like ChatGPT.

The strong performance of Nvidia’s data centre group indicates increasing importance of AI chips for cloud providers and companies with large server operations.

Tuckwell said Nvidia’s microchips and premium graphics cards is where it has product power. Founded in 1993 to bring 3D graphics to the gaming market, the company now creates GPUs to power cryptocurrency mining, gaming as well as chip systems for robotics, electric vehicles and the list goes on.

Its A100 chip sells for US$10,000 and is considered “the workhorse” for AI professionals. It also sells the DGX A100, which is eight A100 GPUs working together.

The DGX A100 has a suggested price of $200,000, and it’s estimated that the ChatGPT model inside the search engine Bing, owned by Microsoft, may require eight GPUs to answer a question in less than a second.

For Bing to provide the service to all of its users, it’s estimated it would require more than 20,000 8-GPU servers, costing Microsoft US$4 billion.

“Nvidia is very much a glamour stock at the moment and popular because it has tentacles in pretty much all the sexy growth beds,” Tuckwell said.

“Its chips are used for Bitcoin and cryptocurrency mining, extensively for electric cars, video games, AI too of course, but pretty much every growth tech area, Nvidia has some kind of foot in it, so that’s what is going on with the rally.”

Slow burn megatrend

The level of interest in AI has continued to grow in Australia and abroad since the launch of OpenAI’s ChatGPT in November 2022.

Gleeson said businesses here and abroad, including Commonwealth Bank (ASX:CBA), are using transformational AI technology to improve efficiency across a range of tasks like data analysis, customer service and write software code.

“This trend is only expected to continue as the technology becomes more mainstream,” he said.

“Artificial intelligence has been a slow burn megatrend where the use case has always been well understood by businesses. The key change in recent months has been the market waking up to the potential of the technology.

“Arguably, some of the recent strong performance in artificial intelligence names can be attributed to the market catching up to its potential to reshape a number of industries and lower value tasks.”

The Nvidia and AI effect

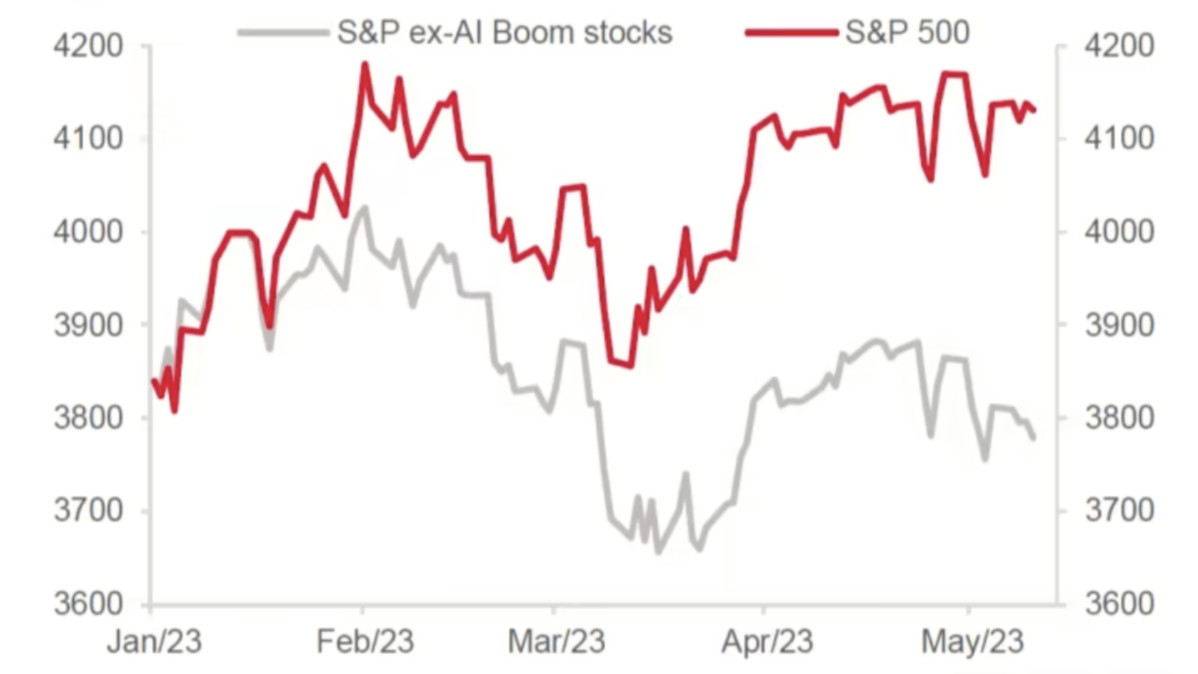

The rise of Nvidia and AI has driven nearly all returns of the S&P 500 in 2023 YTD.

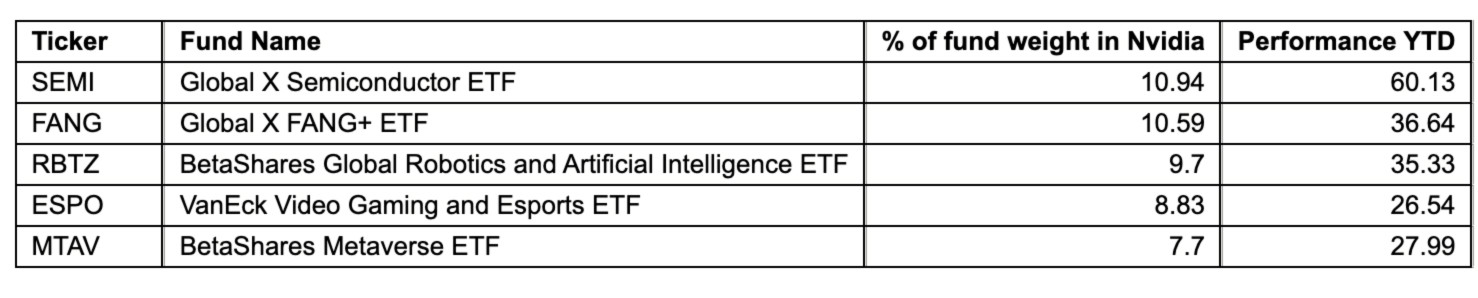

And for ASX ETFs with exposure to Nvidia, it has also been a good year.

“We’re seeing a lot of optimism around AI generally as a result of ChatGPT,” Tuckwell said.

“Where we’re seeing the most rally is in Nvidia obviously, like we’ve discussed, but also Microsoft and some of the other big tech names.

“Microsoft own a stake in ChatGPT now so that’s quite straightforward to explain.”

He said a lot of the AI capital expenditure occurring, like the R&D spend, is coming out of the big tech names.

“The market is anticipating more AI growth and as a result these big tech companies that have higher AI capex are seen as the winners.”

Using ETFs for AI exposure

Gleeson said the recent surge in the price of Nvidia highlights an important set of considerations for investors looking to add exposure to AI in their portfolio.

He said first of all, stock specific risk is an important consideration in sectors which are expected to play out over the long-term.

“For example, the current leaders in AI may not be able to maintain their positions over the long-term,” he said.

“An investor only needs to remember how Alphabet was punished by the market when Google’s Bard technology underperformed on its first outing.

“As a result, investors might want to look to a well-constructed basket of stocks to help reduce concentrated bets on specific AI names.”

Gleeson said second, investors should think global rather than local when looking at AI.

“Australia has a smattering of listed names in the artificial intelligence space, with leaders in artificial intelligence more likely to be found on the NASDAQ in the United States or the Nikkei in Japan,” he said.

Gleeson said an ETF will provide investors with this global exposure in a single trade.

He said finally AI will have second order impacts on a range of other industries, like global cybersecurity or cloud computing.

“For example, businesses and individuals will need to continue the online arms race underway as they seek to defend the next generation of AI-powered phishing attacks,” he said.

“While the sheer volume of data produced by AI systems will need to be stored by cloud providers.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.