Loyalty cryptocurrency play Mobecom lists on ASX at 50pc premium

Pic: Morsa Images / DigitalVision via Getty Images

What if the loyalty points from your airline, bank, or daily coffee order could be redeemed for rewards at other businesses such as a dry cleaner, restaurant or travel booking?

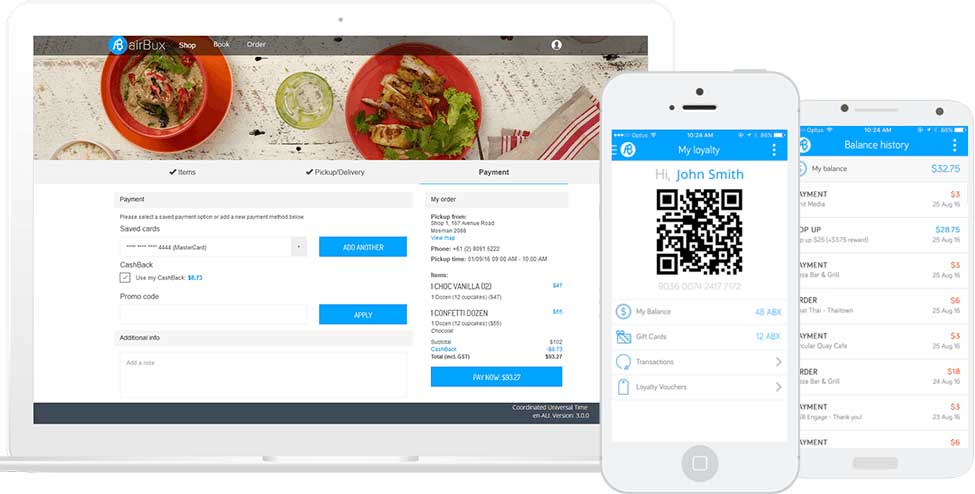

That’s the premise behind loyalty software developer Mobecom’s airBux, a digital currency that aims to provide a liquid marketplace for loyalty.

Mobecom (ASX:MBM) started trading at a premium on the ASX today after raising $5.1 million at 20c a share and completing a back-door listing through Waratah Resources.

Mobecom shares soared 50 per cent to 30c in Tuesday lunchtime trade — compared to an issue price of 20c.

“AirBux allows you to earn points (airBux) from multiple merchants and transfer them to a cloud-based cryptocurrency that you can redeem at any participating, eligible business,” chief executive Neil Joseph told Stockhead.

Customers sign up for the free app and make payments with credit cards or cash to accrue loyalty points in a digital “cryptocurrency” or reward called “airBux”.

Cryptocurrency refers to secure, digital currency designed to be secure and anonymous. There are many different types of cryptocurrency — of which BitCoin and Ethereum are the most famous.

A growing public familiarity with cryptocurrencies made this the perfect time to launch airBux, Mr Joseph said.

“The market is ready now and is open to new technologies. Most businesses already use a cloud-based Point of Sales so we can leverage the technology that is already in place.”

Full commercial launch of airBux

Mobecom is planning a full commercial launch of airBux in Singapore, South Africa and Australia in 2018 following a trial in Cairns earlier this year.

Mobecom plans to leverage their existing network and client base to reach out to new geographic locations.

The listing was backed by the Tulla Group who believe airBux can become a global standard.

“This is an agnostic global currency that will enable any of the larger points programs to switch their currency into airBux,” portfolio manager Kevin O’Hara said.

“People have come to understand that online currency and payments are here to stay and now merchants, banks and other parties are looking for ways to increase their market share.

Research from Visa’s 2017 Brand Loyalty Report suggests there are $US100 billion in global, unclaimed loyalty points in the US alone.

Mobecom’s airBux platform made loyalty points more valuable to customers because they could be redeemed for a variety of products and services.

“From a consumer’s point of view, it allows for liquidity – to take their airline points and go shopping for more than just a toaster.”

The platform generates revenue through monthly merchant subscription fees, coupon redemption fees, transaction fees and currency conversions.

This special report is brought to you by Mobecom.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.