Locality Planning Energy directors say they are placing their shares in escrow

Pic: Morsa Images / DigitalVision via Getty Images

Nothing says “I back my business” like directors putting their shares into voluntary escrow — a state of affairs Locality Planning Energy is proudly touting today.

In a market announcement (with a heading entirely in caps), the company (ASX:LPE) said the two founders CEO Damien Glanville and COO Ben Chester will voluntarily escrow a total of 800 million shares of their total 872.6 million for the next 12 months.

They separately own half of those shares.

Locality Planning Energy sells electricity and utility services to residential, commercial and retail customers and develops solar farms.

Escrow shares are unable to be traded for a certain period of time. Directors shares are escrowed for two years after an IPO and other major shareholders may agree to escrow their shares for a period of time as well.

“This escrow will place restrictions on 91.68 per cent of their total holdings leaving the two directors with 8.32 per cent or 36,299,756 shares of their individual holdings un-restricted,” the company said.

To date the directors have not sold any shares.

Shares owned by Mr Glanville and Mr Chester are part of the original packages they were issued at IPO as well as performance shares.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Each director holds a total of 17.38 per cent of the company’s issued capital with the four original vendors maintaining 58.76 per cent of the total issued capital.

“In our opinion the current market capitalisation and share price is materially below what we consider to be the true intrinsic value of the enterprise,” said Mr Glanville.

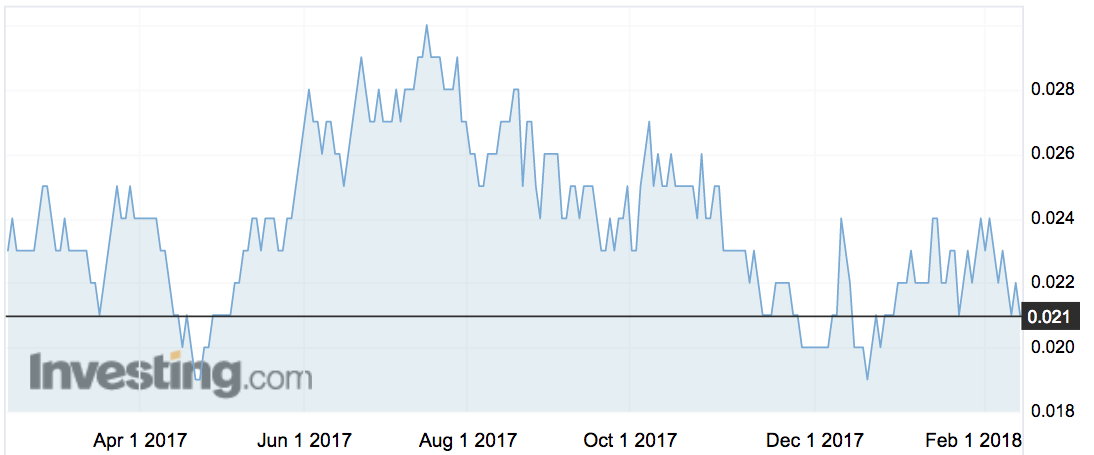

The shares were steady at 2.1c on Wednesday morning, valuing the company at $49 million.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.