High-tech video play Linius heads towards commercialisation, but no revenue yet

Investors in high-tech video outfit Linius Technologies watched revenue go from $46,000 to $2,860 in the December half.

But that’s merely an interest payment at an early stage tech play that just raised $10 million.

Linius (ASX:LNU) is still perfecting a commercialisation strategy for its “Video Virtualization Engine” (VVE) which tracks data within video files.

The technology can be used to combat video piracy or add interactive features such as customised ads.

The half-year loss of $4 million compared to a $2.5 million loss in the same period last year.

Linius had $3.5 million in cash at the end of 2017 (before raising $10 million this month), and a burn rate of $3.5 million for the six months.

“The directors are confident the group will be able to secure sufficient capital funds and the group has a demonstrated track record of raising capital as required,” the company said.

The $10 million cash injection will fund commercialisation in four areas (video search, anti-piracy, personalised ads and security), scale the use of virtual video globally through “software-as-a-service” deployments, continue R&D and pay for new hires.

Linius raised another $4.5 million in October to fund those same goals.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

In the six months to December, Linius spent $1 million on consultants, almost $1 million on software development, and $171,240 on employee expenses.

Director fees were $213,635.

The company says it has achieved six of 11 commercialisation goals.

It now has to deliver a cloud proof of concept, engage a global movie studio to do a mass content deal, make the IBM integration start paying for itself, deliver an anti-piracy solution for the movie studio it’s talking to (currently Warner Bros), and integrate VVE with major ad servers.

Stockhead is seeking comment from Linius.

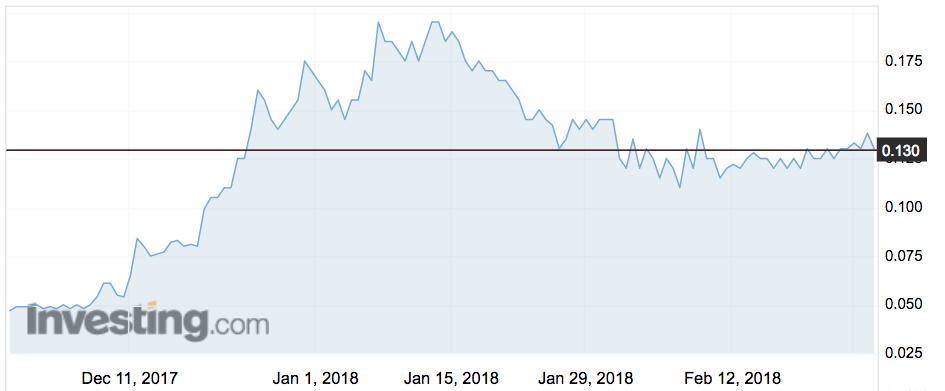

Linius closed flat on Tuesday at 13c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.