Leveraging Aussie mining genius to drive a battery circular economy

While still in its infancy the battery sector in Australia is growing and leveraging our mining expertise. Pic:Getty Images

- Australia has a growing battery recycling industry from ASX-listed companies to smaller start-ups

- Extracting battery minerals from raw materials and used batteries via hydro and pyro metallurgy

- Association for the Battery Recycling Industry believes it could become a core economic sector in Australia

As adoption of electric vehicles (EVs) and cleaner energy storage increases demand for battery metals such as lithium, nickel, cobalt and graphite will also increase.

But while electric vehicles are seen as the pathway towards zero emissions their growing uptake does pose some concerns. Most EVs and plug-in hybrid electric vehicles (PHEVs) use lithium-ion batteries (LiBs) , which have to be disposed after they are depleted.

Many of the metals used in LIB’s will leach into surface and groundwater, which could pollute the environment, once the batteries start to break down in landfill.

However, recycling could reduce the risk of disposed LiBs causing environmental damage while also ensuring supply of critical minerals and even reducing the need for as much mining.

Association for the Battery Recycling Industry (ABRI) CEO Katharine Hole told Stockhead the groundwork needs to happen immediately to deliver a battery circular economy in the global push for zero emissions.

She said Australia needs to ready at scale to recycle the projected 3,600% increase in lithium battery volumes over the next decade coming from EVs and energy storage systems.

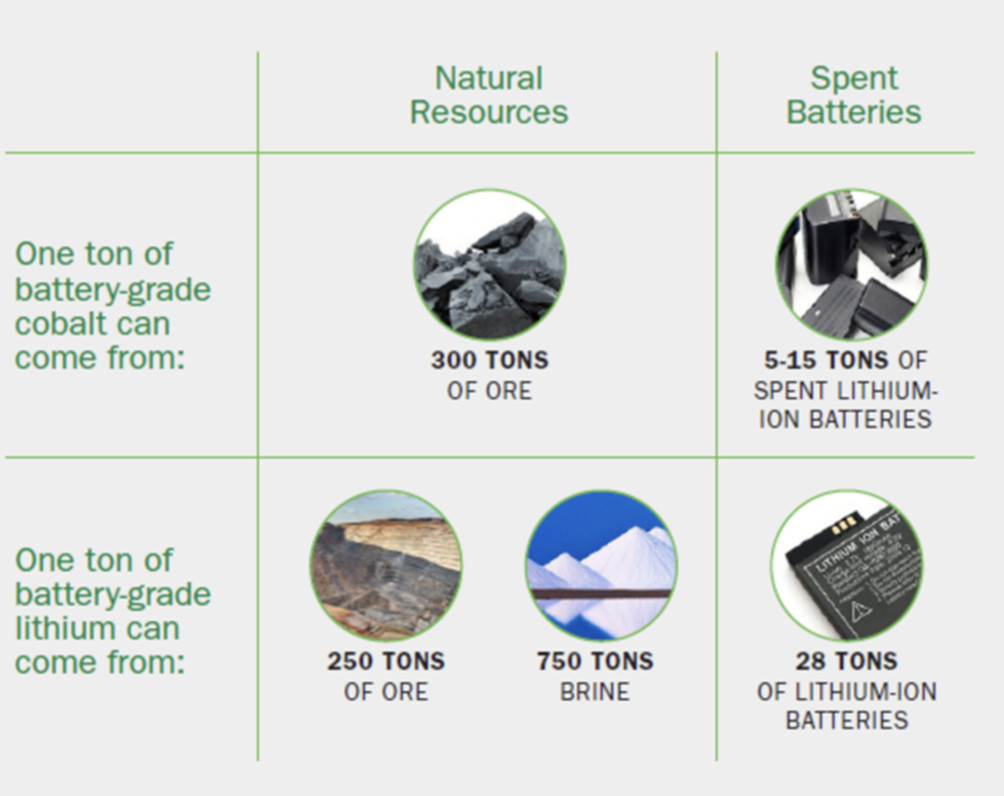

Materials produced from recycled lithium and nickel metal hydride batteries have 38% lower greenhouse emissions than virgin materials, whilst spent batteries require significantly less resources to obtain one tonne of battery grade cobalt or lithium.

Hole said Australia’s battery recycling sector is quietly leading the charge to:

- Establish itself as the leading downstream supplier of low emissions and sustainably produced minerals feedstock for battery manufacturing

- As an innovation hub and developer of technology to support battery recycling, reuse sustainability, safety and reverse logistics.

Hole said the CSIRO is projecting 5 million cars on the east of Australia (connected to the National Electricity Market) between 2030 and 2035.

She said earlier studies point to a projected 3,600% increase in lithium battery volumes over the next decade coming from EVs and energy storage systems.

“How the numbers actually evolve remains to be seen but the key message is the change is massive and the groundwork needs to happen immediately to be ready to deliver at scale a circular economy for all batteries,” she said.

Mining sector expertise put to use in battery recycling

Hole said extracting battery minerals from raw materials and used batteries uses the same processes hydrometallurgy and pyrometallurgy.

“That’s why Australia is seeing companies with mining sector expertise entering battery recycling and moving into battery chemicals manufacturing,” Hole said.

She said examples of companies moving away from minerals extraction and developing proprietary recycling technologies include Lithium Australia (ASX:LIT), Neometals (ASX:NMT) and Fortescue Future Industries, part of Fortescue Metals Group (ASX:FMG) .

“Lithium Australia has branched into lithium battery recycling through its subsidiary Envirostream and its VSPC subsidiary is taking black mass and converting it into lithium-iron phosphate battery cathodes. Lithium Australia has evolved into a technology company from an explorer,” she said.

“Neometals is recovering critical minerals from lithium batteries in Europe and has moved to commercialising technologies.

“In 2022, Fortescue Future Industries purchased UK company Williams Advanced Engineering, a leading provider of battery and electrification technologies. ”

READ: Beyond Gold and EVs – ASX companies spearheading the Aussie integrated battery economy

She said startup Aussie battery recycling startup Battery Pollution is focused on both the physical recycling of spent lithium batteries, but also the development of world class technology in relation to the recovery processes for cobalt, rare earths and other battery metals.

“This company has been established by LCC Asia Pacific founder, Nicholas Assef, whose investment banking practice focusses on the engineering, mining services and associated technical services sectors,” Hole said.

“He is also the founder of Halo Renewables, a developer of large scale solar farms in NSW.”

She said private company Magellan Power, based in Perth has long recognised the need to supply reliable power storage to mining companies.

“Magellan has been developing and assembling batteries to meet the harsh Australian conditions since 1991,” she said.

“This company is an example of the strengths of Australia’s existing battery manufacturing industry – small, innovative and able to deliver products for the Australian climate.”

Start-up Renewable Metals is bringing extensive chemical and metallurgical experience from the mining sector to develop a battery recycling process.

She said Renewable Metals is able to achieves more than 95% recovery of the valuable materials in lithium batteries including lithium, nickel, cobalt, copper, manganese and graphite, without creating black mass and saving 20-30% of the costs of standard recycling.

The company recently won the Supercharge Australia Innovation Award challenge.

Battery recycling popularity growth

Hole said the last 12 months has seen an explosion of interest in companies bringing technology expertise to solve the challenges of rapid growth in lithium battery demand.

“ABRI has seen growth in the number of companies moving into lithium battery recycling from three to 12 with most of these in the early start-up phase.”

She said this is being matched by companies entering battery chemical manufacturing and full product assembly moving towards local gigafactories.

“The recent Supercharge Australia Innovation Challenge Awards highlighted the breadth of R&D and start-up activity happening across the entire battery value chain in Australia,” she said.

Hole said it will be important for government initiatives such as the National Battery Strategy to drive this momentum forward.

“The Australian lithium battery recycling sector is in its infancy, only two listed companies and a number of fast running companies privately owned or focusing on early stage capital raisings,” she said.

“However, as demand for recycled minerals content grows, the industry will become a core economic sector.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.